Several Bitcoin (BTC) addresses with large holdings have recently woken up after being dormant for years. This sudden spike has raised eyebrows, especially after Bitcoin’s price recently increased.

Known for their strategic moves, these long-term holders, also known as Bitcoin whales, could affect the coin’s short-term trajectory. In this analysis, BeInCrypto explains what this movement could mean for investors anticipating a major rally for BTC.

Old Bitcoin Wallets Are on the Move

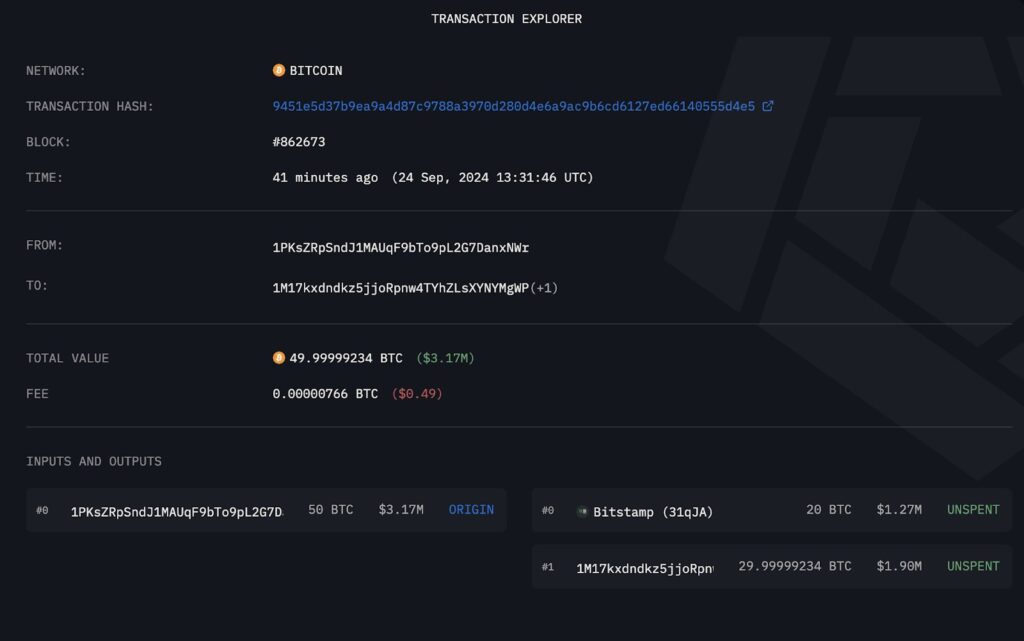

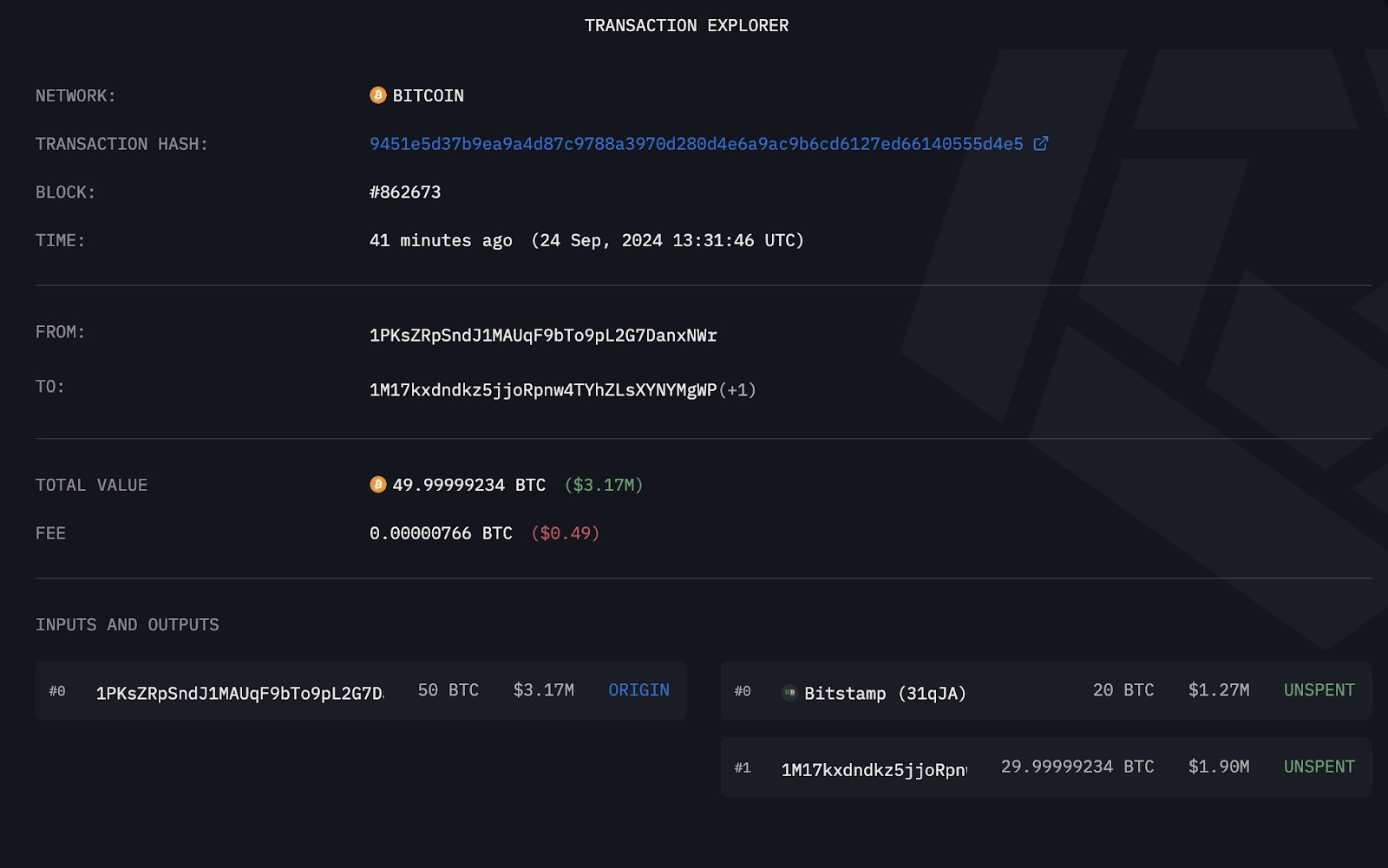

On Monday, September 24, blockchain firm Arkham Intelligence reported that a 13-year-old Bitcoin whale transferred 20 BTC, valued at $1.27 million, to Bitstamp. According to our findings, the whale holds 50 BTC and last made a transaction four years ago.

The movement of the coins to the Bitstamp exchange might raise concerns. This is because most exchange inflows from previously dormant wallets indicate that the investors are willing to sell. Depending on the volume, transactions like this can cause downward pressure on the price.

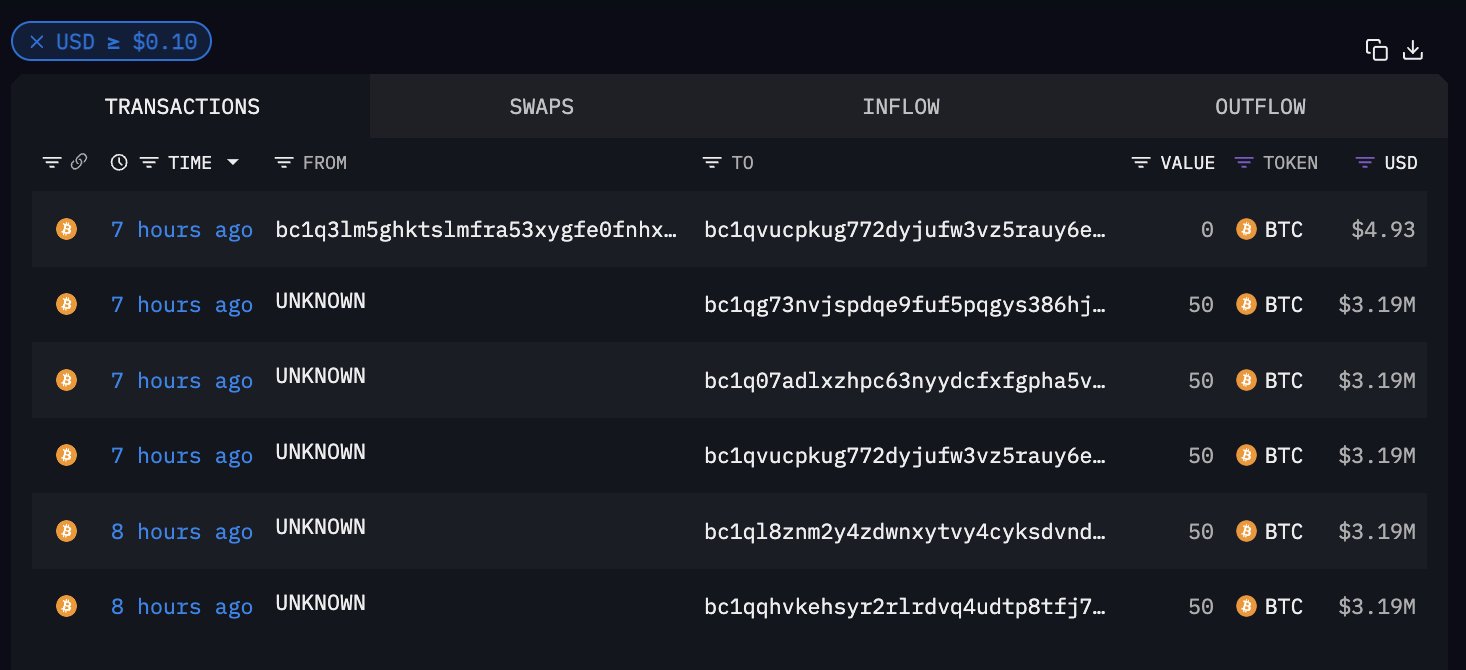

However, this whale is not the only one that has woken up recently. On the same day, another Bitcoin whale, who has been holding 1,215 BTC since 2009, moved 5 coins to Kraken.

Besides these two, another dormant address from the same year had woken up and transferred 250 BTC from the stash in the wallet on September 20.

These transactions bring the total number of coins moved by idle wallets to 275 BTC in five days. With Bitcoin’s price trading at $63,725, this means that the value moved is about $17.52 million.

Read more: Who Owns the Most Bitcoin in 2024?

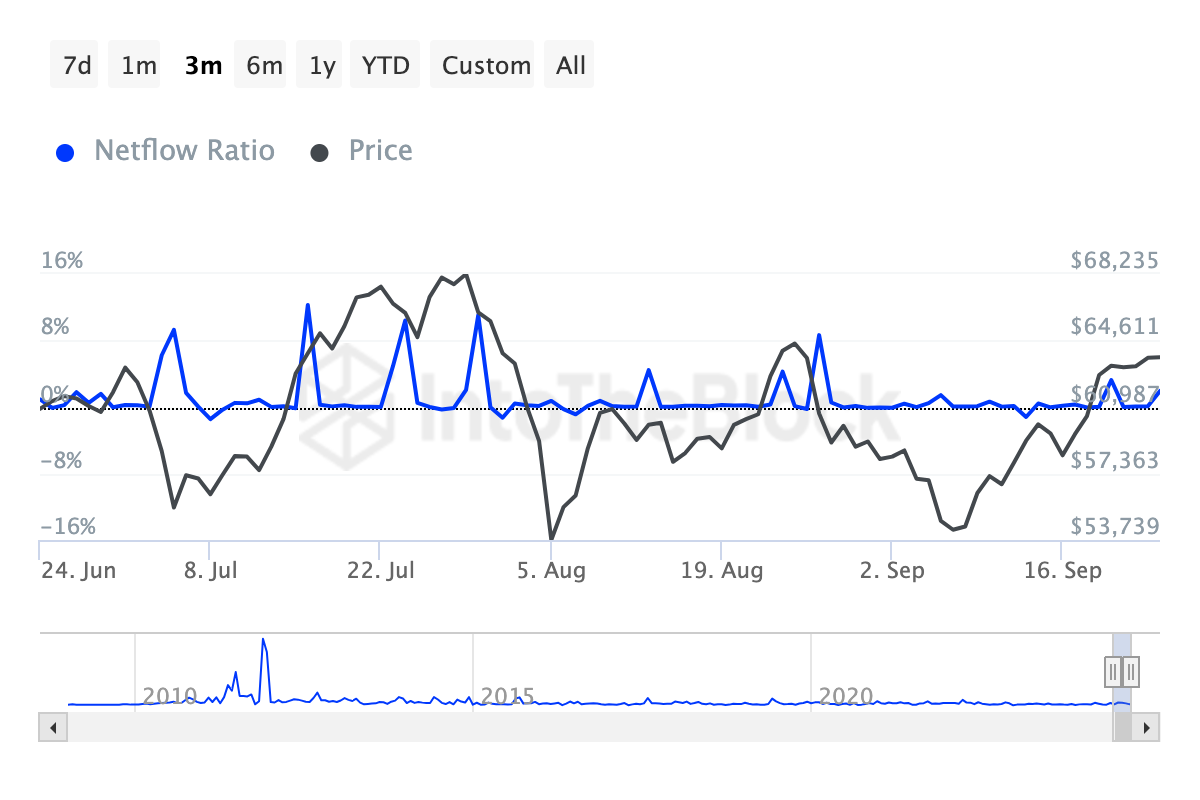

Despite the transactions, the Large Holders’ Netflow to Exchange Netflow Ratio shows a notable decrease over the last seven days. This netflow is the difference between the number of coins sent into exchanges by Bitcoin whales subtracted from those withdrawn.

High values of this metric foreshadow price decreases as selling pressure intensifies. However, a negative ratio, as it is currently, could be seen as a period of accumulation and could precede a notable BTC pump. Therefore, as it stands, BTC might not experience notable downward pressure.

BTC Price Prediction: $68,000 Next

On the daily chart, Bitcoin’s price has broken above the descending channel that formed between March and mid-September. As seen below, the support at $54,008 was vital in helping BTC avoid a decrease below $50,000. Also, the support at $60,296 ensured that the breakout was successful.

Furthermore, the Moving Average Convergence Divergence (MACD) is positive. As a technical oscillator used to identify trends, the positive MACD reading indicates that the momentum around Bitcoin is bullish.

Read more: How To Get Paid in Bitcoin (BTC): Everything You Need To Know

If this remains the same, Bitcoin’s price could move to $68,225. On the other hand, BTC might fail to reach this target if Bitcoin whales begin to distribute their coins in massive numbers. Should that happen, Bitcoin’s price could drop to $60,296.

The post Dormant Bitcoin Whales Move Over $17.5 Million in BTC: Price Impact appeared first on BeInCrypto.

:max_bytes(150000):strip_icc()/Bitcoin-7c580bcd389d4aef8f5a7bdb42cd26bb.jpg)