Chainlink co-founder Sergey Nazarov predicts that tokenized real-world assets (RWAs) will soon be more valuable than cryptocurrencies. He points to the increasing involvement of traditional finance in decentralized finance, driven by a growing interest in tokenization.

Nazarov also noted that Chainlink is ready to take advantage of this shift in the blockchain space.

TradFi Interest in Tokenized RWAs To Alter Blockchain

Nazarov anticipates an interconnected world where decentralized finance (DeFi) and TradFi actively transact with each other. Acknowledging the growing interest in tokenized RWAs, he says TradFi would be DeFi’s largest customer.

Speaking at Token2049 in Singapore, Nazarov highlighted DeFi’s ability to generate yield and create reliable markets for RWAs. He urged the industry to prepare for this shift, noting that it’s already happening, driven by asset tokenization. According to Nazarov, blockchain technology is giving TradFi exactly what it needs.

Chainlink co-founder also highlighted how decentralized infrastructures like Chainlink and smart contracts are transforming the digital space by removing the need for traditional counterparty relationships. Instead of relying on human decision-making, automated code ensures outcomes, improving efficiency and reducing risks that traditional finance models often face.

Read more: Real World Asset (RWA) Backed Tokens Explained

Nazarov emphasized that this represents a major shift from the current TradFi model, where delays and risks stem from human intervention.

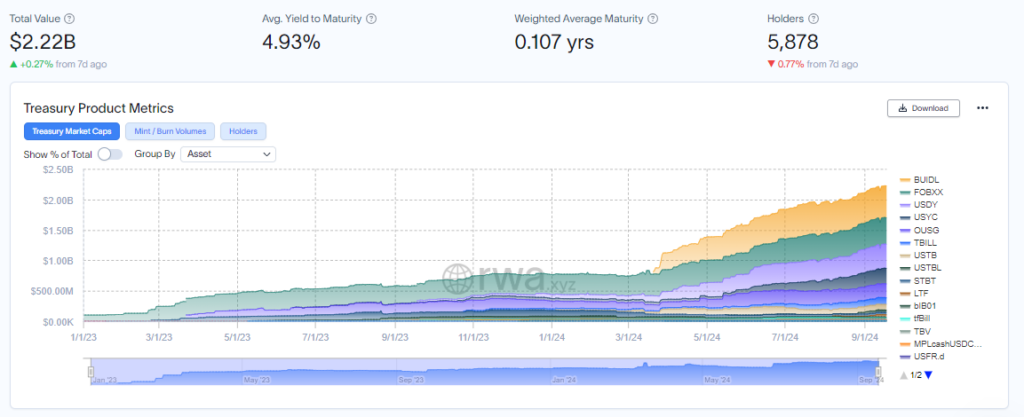

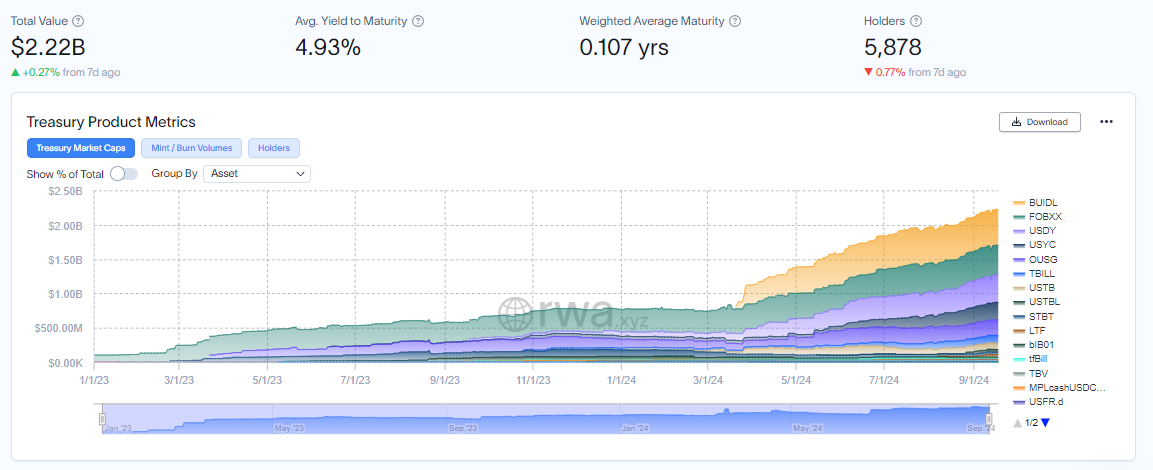

His remarks align with his statements from late August, when he predicted that tokenized real-world assets (RWAs) would surpass crypto in value by 2027, driven by institutional interest and TradFi integration. Currently, the RWA market is growing, with RWA.xyz data showing it is already a $2.22 billion industry.

This development comes as blockchain technology continues to tackle the infrastructure challenges faced by traditional finance, while also opening up new investment opportunities. Blockchain’s ability to streamline workflows and significantly improve settlement times is especially appealing — echoing what Sergey Nazarov explained about the efficiency and certainty that decentralized systems offer.

“TradFi needs all kinds of different data that allow those traditional finance smart contracts to function properly…the Net Asset Value (NAV) data of tokenized funds is an example of a dashboard live on production showing the proof of Reserves of one of the many ETF funds use to prove things about them,” Nazarov said.

Read more: What is Tokenization on Blockchain?

Notwithstanding, the road to a complete transition to digital infrastructure is marred with challenges. Among them are legal considerations, identity standards, and data privacy, which would demand careful evaluation with regulatory systems in mind.

Accordingly, TradFi and DeFi players and the broader financial services industry must work to build infrastructures capable of supporting broader tokenization adoption while ensuring security and compliance before Nazarov’s dream can become a reality.

The post Chainlinks’s Sergey Nazarov Says Tokenization Will Turn TradFi Into DeFi’s Top Customer appeared first on BeInCrypto.

:max_bytes(150000):strip_icc()/Bitcoin-7c580bcd389d4aef8f5a7bdb42cd26bb.jpg)