The value of NEAR, a leading AI-related cryptocurrency, has dropped by 16% over the past seven days. As of now, NEAR is trading at $3.94.

With its bearish technical outlook, NEAR could potentially see an additional decline of up to 23% in the short term.

Near’s Downtrend is Strong

NEAR’s price has been declining steadily since August 24, trending below a descending trend line, which has led to a 25% drop in value. This trend line acts as a resistance level, signaling bearish market sentiment, and suggests that NEAR’s price may continue to decline unless it breaks above this line.

NEAR’s Aroon Down Line confirms that its current downtrend is strong. At press time, the indicator’s value is 85.71%.

The Aroon Down Line identifies an asset’s trend strength and direction and potential reversal points. When it approaches 100%, it suggests that the asset has reached its lowest price very recently.

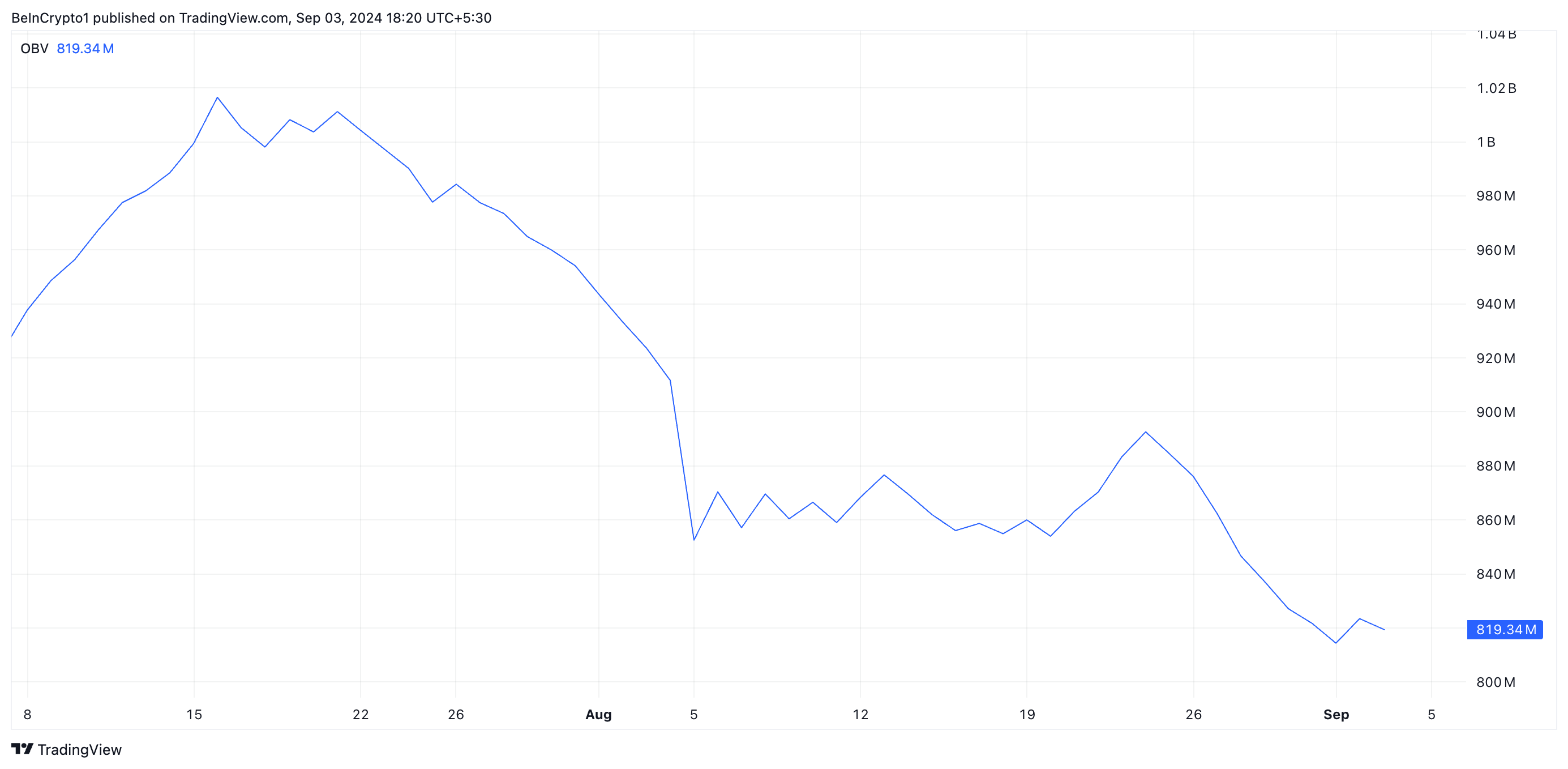

Further, NEAR’s On-Balance-Volume (OBV) is falling and has maintained that position since the price decline began on August 24. This indicator measures buying and selling pressure in an asset’s market.

When it falls, it signifies that the selling pressure is increasing relative to the buying pressure. NEAR’s price decline and decreasing OBV confirm the bearish trend.

Read more: What Is NEAR Protocol (NEAR)?

NEAR Price Prediction: A 23% Price Drop Is Possible

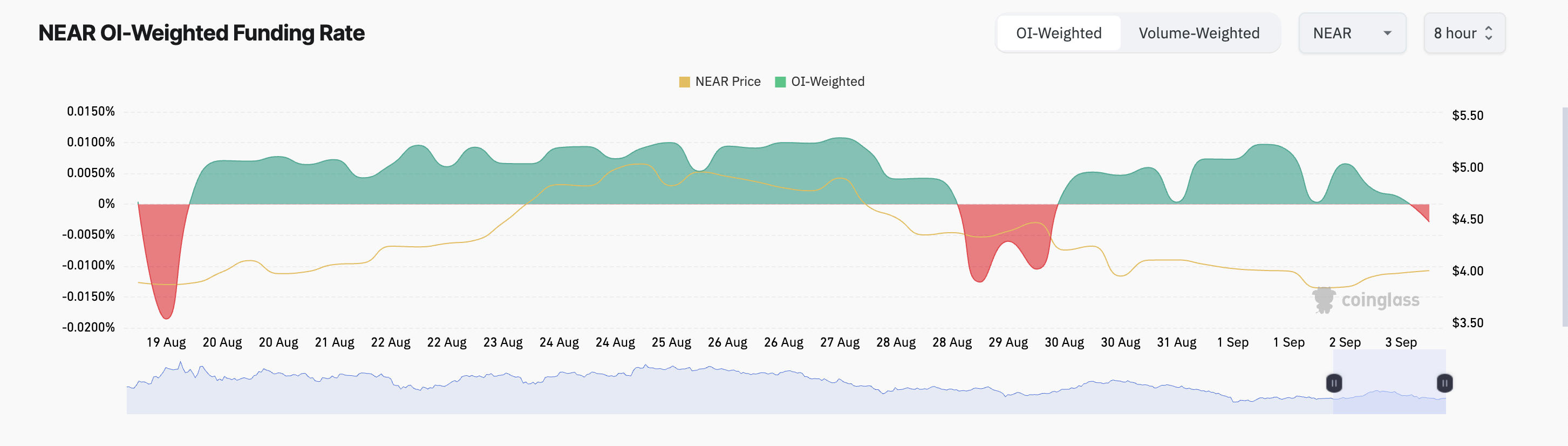

Since the downtrend began on August 24, NEAR’s futures traders have primarily opened long positions, as evidenced by its predominantly positive funding rate.

Funding rates in perpetual futures contracts help keep an asset’s contract price close to its spot price. Positive funding rates indicate higher demand for long positions, meaning more traders are buying the asset, expecting a price increase.

For NEAR’s long positions to succeed, the coin must reverse its current downtrend and start moving upward. If this resurgence in demand occurs, NEAR’s value could rise to $4.47.

Read more: Near Protocol (NEAR) Price Prediction for 2024

However, if it maintains its current course, NEAR’s price may drop by an additional 23%, thereby liquidating these long positions.

The post Near (NEAR) Targets Double-Digit Drop, Buying Pressure Craters appeared first on BeInCrypto.