Token unlocks significantly impact cryptocurrency prices, volatility, and overall market dynamics. From massive airdrops to barely noticeable linear unlocks, changes in supply are crucial to monitor.

Vincent Maliepaard, Marketing Director at IntoTheBlock, shared an exclusive report with BeInCrypto, exploring the nuances of different types of token unlocks and their influence on asset prices.

Linear Unlocks: Gradual Market Impact

Token unlocks are a universal standard in crypto. Whether mining rewards or pre-sale unlocks, nearly every token features some form of unlock in its design. These events can be broadly categorized into linear and cliff unlocks, each with distinct characteristics and implications for investors.

Linear unlocks release tokens into circulation gradually over a specified period. This slow dilution process subtly influences the market. A well-known example is Bitcoin’s miner reward, which slowly increases the available BTC over time. However, Bitcoin’s linear unlocks are relatively small compared to its market cap size, thus limiting their price impact.

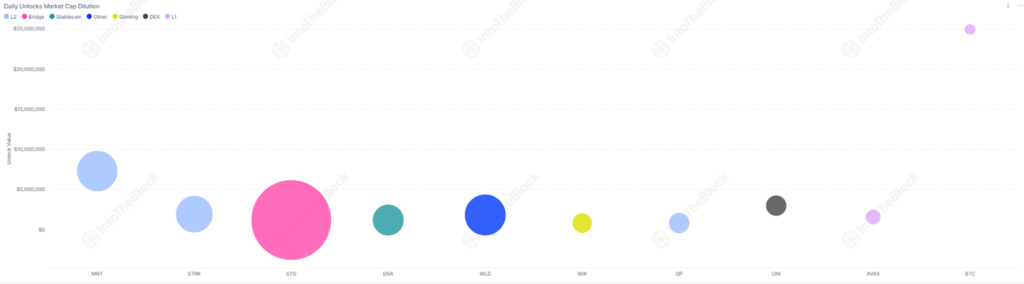

The size of linear unlocks can be assessed as a percentage of the supply or as a monetary figure. The most practical way is by comparing the size of the unlock to the token’s market cap.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens

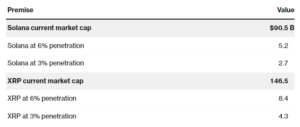

A chart from IntoTheBlock visually represents daily unlocks against market cap, highlighting their relative impact. Tokens with larger market caps, like Bitcoin (BTC) and Solana (SOL), see smaller relative dilution compared to smaller projects like Stargate (STG) and Worldcoin (WLD). This distinction is crucial because a larger daily market cap dilution can significantly and negatively impact long-term price development.

Cliff Unlocks: Sudden Price Shifts

Cliff unlocks involve releasing a large portion of tokens all at once, rather than gradually over time. This can lead to significant and sudden price movements as investors decide whether to hold or sell their newly unlocked tokens.

Several projects are set to experience substantial cliff unlocks:

- Wormhole (W): Unlocking 600 million tokens on August 3, representing 33.33% of its supply.

- Mode (MODE): Unlocking 185.3 million tokens on August 5, representing 14.25% of its supply.

- The Sandbox (SAND): Unlocking 205.6 million tokens on August 14, representing 9.07% of its supply.

A common question is whether token unlocks directly impact prices. While it makes sense to assume that a large supply release would decrease prices, this isn’t always the case. For example, despite a major unlock event in February, SAND price increased. This suggests that such events may be priced in before they occur.

Conversely, recent unlocks from AVAX and ARB were followed by downward movements. The broader market environment plays a crucial role here. Data indicates that while token unlocks do impact asset prices, the general market trend is more important in determining price direction.

Circulating Supply vs Total Supply

However, the type of unlock isn’t the only factor to consider. Another crucial aspect is the percentage of the total supply already available. When this percentage is very small, as with Worldcoin or Bittensor, market cap dilution can be significant.

For instance, if Worldcoin’s entire supply were circulating at the current token price, its market cap would be over $11 billion, ranking just behind TRON in total value. This demonstrates that long-term price appreciation possibilities for WLD are very limited.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Token unlocks, whether linear or cliff, play a crucial role in asset prices. Linear unlocks tend to diffuse market impact over time, while cliff unlocks can cause abrupt shifts. Closely monitoring unlock schedules allows investors to better understand growth potential and adjust their strategies accordingly.

The post Understanding Token Unlocks: How Supply Changes Affect Market Dynamics appeared first on BeInCrypto.