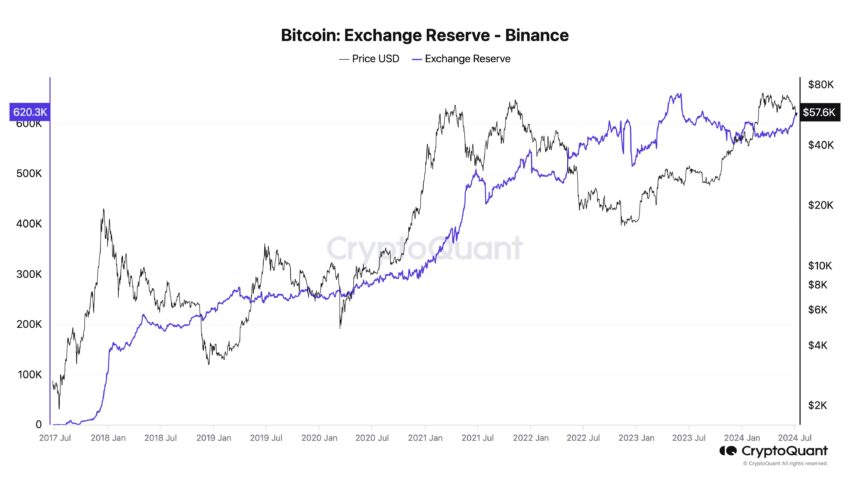

Binance continues to defend its heft as the largest crypto trading platform by trading volume metrics globally. As the exchange turns seven, reports indicate that its Bitcoin (BTC) holdings continue to grow.

Centralized exchanges such as Binance and Coinbase facilitate the buying, selling, and trading of cryptocurrencies, acting as intermediaries between buyers and sellers.

Binance’s Bitcoin Exchange Reserve Soars 10%

CryptoQuant founder and CEO Ki Young Ju reports that Binance Exchange’s Bitcoin holdings have increased by 10% since early 2024. The opposite happened for other exchanges, whose BTC holdings plummeted by 8%.

Read More: Binance Review 2024: Is It the Right Crypto Exchange for You?

The report comes as Binance announced its seventh anniversary on Wednesday with a new limited-time referral promotion. Eligible users will share up to 700 BNB in token vouchers.

“When the user (‘referrer’) successfully invites a new Binance user, the referrer will receive a 0.01 BNB token voucher and the new user will receive a 0.005 BNB token voucher.”

Despite these milestones, Binance recently faced regulatory woes with authorities from different jurisdictions. For instance, the US Securities and Exchange Commission (SEC), among others, clamped down against the trading platform for allegedly artificially inflating trading volumes.

“Through thirteen charges, we allege that Binance CEO Changpeng Zhao and Binance entities engaged in an extensive web of deception. Conflicts of interest, lack of disclosure, and calculated evasion of the law are some of the other crimes,” SEC Chair Gary Gensler wrote.

The financial regulator also called Binance out for diverting customer funds and failing to restrict US customers from its platform. It reportedly also misled investors about its market surveillance controls. Meanwhile, others cited violations, including enabling the trading of crypto tokens deemed securities.

Conversely, Coinbase, the largest US-based crypto exchange on trading volume metrics, is among exchanges whose Bitcoin holdings have dwindled. This is particularly interesting given that Coinbase has a competitive edge by being the custodian for most spot Bitcoin ETF (exchange-traded funds) issuers in the US. However, Tolou Capital Management founder Spencer Hakimian says Coinbase’s role among ETF issuers could be the problem.

“Many ETFs within the US likely hurting Coinbase’s target market. Less so for Binance,” Hakimian wrote.

Read More: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

The advent of spot ETFs in the US solidified Coinbase’s case, with its CEO Brian Armstrong trumpeting the exchange. Lawyer John E. Deaton, a prominent XRP advocate, echoed Armstrong. He acknowledged that “Coinbase will be a big winner” as the exchange stood at the center of the ETF campaign.

“Coinbase will be a big winner. I expect to see BlackRock and Vanguard buy more. By the way, 90% of Gary Gensler’s $120 million fortune is with Vanguard,” Deaton remarked.

The post Binance Marks Its Seventh Anniversary with 10% Bitcoin Holdings Growth appeared first on BeInCrypto.