Eight fund issuers are currently waiting for the U.S. Securities and Exchange Commission (SEC) to give its final approval for them to list and launch exchange-traded funds (ETFs) that will track the spot price of Ethereum (ETH).

There have been speculations on how much capital inflows the launch of these products would bring into cryptocurrency funds.

Ethereum Spot ETFs Will See up to $5 Billion of Inflows

In a new report, cryptocurrency exchange Gemini opined that these new funds could attract $3-5 billion in net inflows within just the first six months of trading. This positive outlook follows the successful launch of Bitcoin spot ETFs earlier this year.

The projected net inflows could translate to a total of $13-15 billion in assets under management for spot Ethereum ETFs within the first six months of trading.

This mirrors projections from financial services provider Citi, previously reported by BeinCrypto. Citi noted that net inflows into spot Bitcoin ETFs surpassed $13 billion between their launch on January 4 and May 20.

The bank stated that using similar market-cap-adjusted flows, the launch of spot Ether ETFs could attract between $3.8 billion and $4.5 billion within the same period and raise the coin’s price by 23-28%.

Read More: How to Invest in Ethereum ETFs?

According to Gemini, this inflow is achievable for many reasons, one of which is that Ether offers a good option for investors seeking diversification within the crypto space. This is due to its ever-growing network activity, measured by daily active addresses and transaction fees.

Also, the shift in the coin’s supply dynamics could make it even more attractive to investors. Following the change in Ethereum’s consensus mechanism from a Proof-of-Work (PoW) to a Proof-of-Stake network, there has been a steady decline in its total supply compared to Bitcoin.

“Net inflows below 20% or $3 billion would be a disappointment, given spot BTC ETFs had $15 billion net inflows in approximately the first six months. Net inflows exceeding $5 billion, or one-third of those into spot BTC ETFs, would be a strong showing, while anything close to 50% or $7.5 billion would be a significant upside surprise,” Gemini said.

ETH Price Prediction: Demand For the Altcoin Remains Low

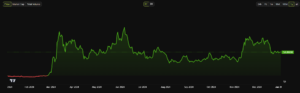

At press time, ETH exchanged hands at $3,446. It has faced resistance at the $3600 price level since the middle of June, causing its price to drop by 9% in the last month.

Readings from its performance on a one-day chart show that the demand for ETH is still low. For example, its Relative Strength Index (RSI) currently lies below the 50-neutral spot at 47.38 at press time.

This indicator measures an asset’s overbought and oversold market conditions. At its current value, ETH’s RSI shows a decline in buying momentum.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

If this trend persists, the coin’s price may plummet to $3,407.

However, if buying pressure gains, ETH’s value may rise to $3,515 and trend toward resistance.

The post $5 Billion in Ethereum ETFs Inflows Could Propel Prices Above $4,000 appeared first on BeInCrypto.