As July approaches, spot Ethereum ETFs, which received the US SEC partial green light on May 23, near their official launch. Many investors wonder if the price of Ethereum (ETH) will follow Bitcoin’s (BTC) reaction to its related financial instruments in January.

That answer, however, lies in the future, which may begin in a few days. While waiting, the on-chain analysis provides actionable insights that can predict if the altcoin is following a likely pattern.

The Altcoin Investors Are in High Spirits

Amendment of registration documents is one factor that has delayed the live trading of the spot Ethereum ETFs. However, in a recent interview, SEC Chair Gary Gensler confirmed that things were going smoothly.

Furthermore, a report from anonymous sources at the regulatory agency reveals that the products will launch on July 4.

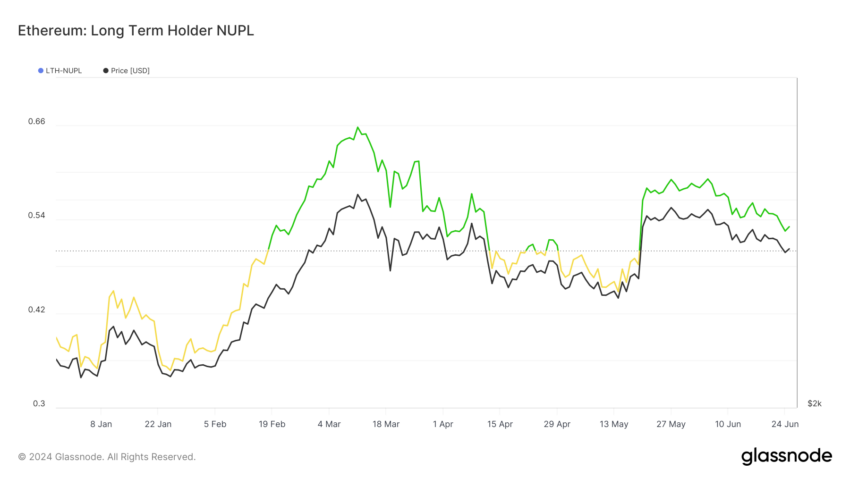

Following the development, BeInCrypto monitors holder behavior towards ETH. According to our findings, ETH holders display resolute confidence in the cryptocurrency. We discovered this after examining the LTH-NUPL provided by the analytic platform Glassnode.

The metric stands for Long Term Holder-Net Unrealized Profit/Loss. It measures the behavior of holders who have owned a cryptocurrency for over 155 days. As seen in the chart below, different colors exist for different sentiments.

Read more: Ethereum ETF Explained: What It Is and How It Works

While red indicates capitulation, orange means fear. Yellow indicates optimism, while blue suggests greed. Currently, Ethereum’s LTH-NUPL is in the belief (green) zone. When this happens, long-term investors are confident about a forthcoming price increase.

However, ETH has experienced a 12.75% decline in the last 30 days while it trades at $3,365. In situations like this, the broader sentiment is expected to be bearish. Thus, as perception tilts toward confidence, the much-anticipated development seems to be the reason. If sustained till launch day, it can propel higher demand for ETH.

Ethereum Is Taking Bitcoin Out of the Way

Meanwhile, perception alone cannot push the price. Therefore, we evaluate another indicator that can affect the altcoin’s price, which is the ETH/BTC ratio. This ratio tells whether Bitcoin is outperforming Ethereum or the other way around. Specifically, if the ETH/BTC ratio is high, it means that ETH is performing better than Bitcoin.

However, a low ratio implies that BTC is outperforming ETH. As of this writing, the ratio is 0.055—up 2.33% within the last seven days. This means that today, one ETH can purchase 0.055 BTC.

Should the ratio continue increasing, Bitcoin’s market dominance will decrease. As such, Ethereum can step up while its price may climb much higher. Considering Bitcoin’s performance, the price rose by 56.95% in less than two months after approval.

If ETH mirrors a similar move, the value of the cryptocurrency will be worth $5,308 before the end of the third quarter (Q3). Now, let’s examine the altcoin’s short-term potential.

ETH Price Prediction: It Is Not Priced In

According to the daily chart, the 20 (blue) and 50 (yellow) EMAs sit above Ethereum’s price. EMA stands for Exponential Moving Average. It is an indicator measuring trend direction over a given period.

When the EMA is below the price, it indicates that bulls are defending it. However, the indicator being above the price gives credence to the downside. If conditions remain the same, ETH may drop to $3,278. This position also shows that ETH is not yet priced in.

In simple terms, this means that the economic impact of the upcoming development has yet to be reflected in the current market price. Hence, it can be assumed that the value still has the potential to jump.

However, both EMAs are on the brink of reaching the same point. If this happens, ETH’s price will move sideways, potentially consolidating between $3,355 and $3,610. However, if the 20 EMA flips the 50 EMA (bullish crossover), the altcoin may key into the $3,866 resistance.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

In a highly bullish scenario, ETH may replicate its performance between February and March, reaching $4,059 before the end of July.

In addition, the value of inflows is one major concern that investors have. From comments online, a number of analysts are not sure if the Ethereum ETFs can pull the kind of volume Bitcoin did.

However, a previous prediction placed the inflows at $569 million monthly. Should Ethereum match this volume, a rally past the altcoin’s all-time high may happen within a short period.

But if the reception to the development is “all talk no action”, ETH’s price may nosedive, possibly reaching another 10% decline.

The post Will Ethereum ETF Debut Steer ETH Price Beyond $5,000? appeared first on BeInCrypto.