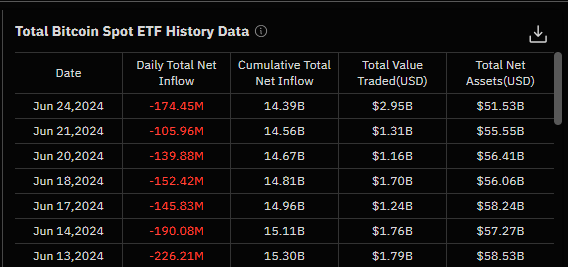

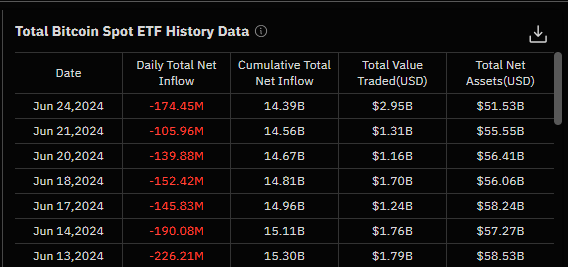

In the past seven trading days, spot Bitcoin (BTC) exchange-traded funds (ETFs) have witnessed significant outflows amounting to $1.13 billion.

This development has raised concerns among investors and traders about Bitcoin’s stability and future trajectory.

Behind the Spot Bitcoin ETF Outflows: Shifts in Market Sentiment and Dynamics

According to SoSo Value data, the spot Bitcoin ETFs have recorded outflows from June 13 until June 24. Grayscale Bitcoin Trust (GBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) are the biggest contributors to these significant outflows, with $90 million and $35 million outflows as of June 24, respectively.

Read more: What Is a Bitcoin ETF?

The crypto research firm 10x Research highlights that the current ETF selling contrasts sharply with the bullish buying seen in February and March, which was driven by perceived institutional adoption of Bitcoin. In today’s market, the bearish sentiment reflects ETF selling as institutions potentially exit the market, significantly impacting market confidence and trading behaviors.

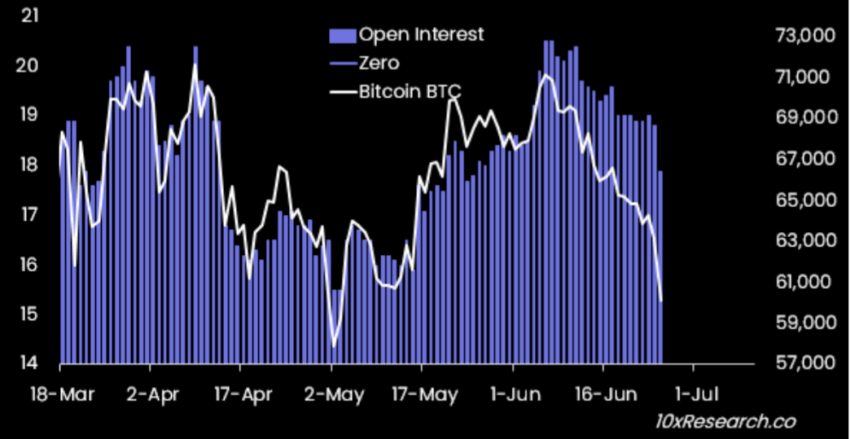

This shift is evident in the actions of many multi-strategy hedge funds. Previously long on Bitcoin ETFs and short on Chicago Mercantile Exchange (CME) Bitcoin futures, these funds are now unwinding their positions. This decision, driven by an annualized funding rate below 10%, is reflected in the decline of open interest in Bitcoin CME futures, matching the volume of sold Bitcoin spot ETFs.

Moreover, speculative trading activity in futures, driven by institutional buying through ETFs, has expanded the funding rate. Institutions adopted a delta-neutral strategy, buying ETFs and selling futures to lock in yields.

Arbitrage funds, which constitute 30-40% of the $14.2 billion Bitcoin ETF inflows, have traditionally leveraged a delta-neutral strategy by buying spot Bitcoin and selling futures. The current market conditions have prompted a reassessment of this strategy, reflecting a broader shift in institutional behavior and market sentiment.

Bitcoin ETF Buyers Flat as Market Faces Price Drop

Furthermore, 10x Research pointed out concerns about over-bullish sentiment regarding spot Ethereum ETFs, especially given the weak Bitcoin ETF inflows. This concern is amplified by the fact that the average Bitcoin ETF buyer is now flat, with an average entry price of $60,000-$61,000.

The continuous outflows from these ETFs coincide with Bitcoin’s current price movement. On June 24, Bitcoin’s price plummeted from $64,076 to $59,495, marking an approximately 7% decrease. According to 10x Research, several factors contributed to this sell-off, including distributions from Mt. Gox, sales by the German government, Bitcoin miners, ETFs, and OG wallets.

“Hypothetically, this adds up to $16-18 billion, similar to the year-to-date Bitcoin ETF inflows,” Markus Thielen from 10x Research noted.

10x Research has also identified multiple sell signals for Bitcoin. These signals include significant volatility and price range indicators predicting declines. These factors suggest deeper declines could occur before a potential rebound from lower levels.

However, 10x Research noted that Bitcoin is currently deeply oversold. Additionally, the Greed and Fear Index is at one of its lowest levels, often indicating market bottoms. This condition gives crypto influencers bullish sentiments, prompting them to advise buying the dip.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Despite the significant outflows from spot Bitcoin ETFs and the current BTC price situation, several institutional investors still show their bullishness toward the cryptocurrency. Earlier this week, corporates like MicroStrategy and Japanese firm Metaplanet announced significant Bitcoin purchases. Furthermore, spot Bitcoin ETFs in Hong Kong have seen an increase in Bitcoin amount, from 3,842 BTC on June 21 to $3,911 on June 24.

The post Spot Bitcoin ETFs Witness $1.13 Billion Outflows in Seven Days, Signaling Market Shifts appeared first on BeInCrypto.