Ethereum’s (ETH) price is set to face the impact of not just its whales selling but dumping by all its investors.

The consequent impact on price could bring the second-generation cryptocurrency to multi-week lows.

Ethereum Investors Appear Skeptical

Ethereum’s price recently lost a key support level owing to the broader market cues and the rising pessimism among ETH holders. The biggest sign of this can be noted in the behavior of the whales.

Whales tend to have the most impact on an asset, given that they have the largest wallet. In the case of ETH, however, the whales do not appear very hopeful of profits. The addresses holding between 100,000 and 1 million ETH have sold close to 700 million ETH in the last two weeks.

The selling of this $2.32 billion worth of supply has brought down their total holdings to 20.26 million ETH. Since whales are known even during bear markets, their sudden selling does raise concern.

Read More: How to Invest in Ethereum ETFs?

Secondly, the sales among retail investors have also seemingly surged.

Upon observing the active addresses by profitability, it can be seen that about 25% of the users are in profit. The reason why they are conducting transactions on the network is most likely to book profits.

When this indicator is under 25%, the chances of selling by ETH hodlers are rather low. However, since the indicator is above the threshold, investors could attempt to secure whatever gains they can before the price falls further.

Thus, ETH may face the brunt of these investors’ selling.

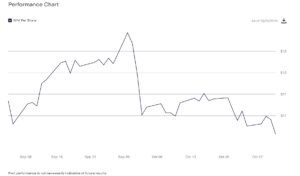

ETH Price Prediction: Prepare for a Bounce Back

Ethereum’s price is moving within a falling wedge, a technical pattern known for signaling a bullish reversal. This places the potential target for the altcoin far above $4,000. But even in a bullish market, this is not going to happen.

However, the bullish cues could counter the aforementioned bearish cues by presenting ETH with a period of consolidation. The sideways movement would keep the altcoin restricted under $3,500 but also prevent a drawdown.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

But if Ethereum’s price does fail the bullish pattern, a drawdown could send it to $3,000 or lower. This would invalidate any potential of a rally, extending investors’ losses.

The post Ethereum (ETH) Price Suffers as Key Investors Opt to Sell appeared first on BeInCrypto.