Since it rallied to its year-to-date high of $60.42 on March 14, Avalanche’s (AVAX) value has declined. The token’s price has fallen by 35% in the last month alone. As of this writing, the altcoin trades at $24.70.

AVAX’s value decline has caused many holders to sit on unrealized losses.

Avalanche’s Holders Count Their Losses

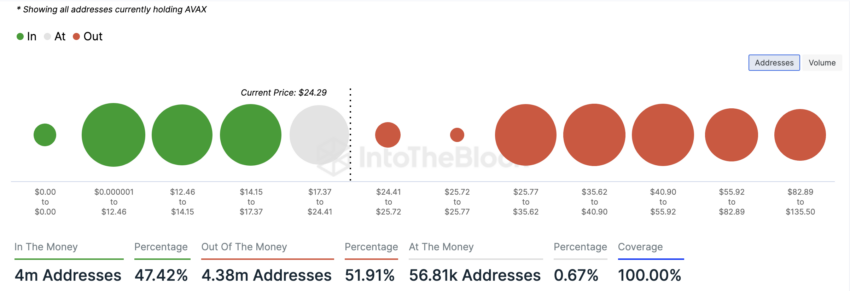

An assessment of Avalanche’s financial indicators shows that 4.38m addresses, which comprise 52% of all its token holders, are “out of the money.”

An address is considered out of the money when the current market price of a cryptocurrency falls below the average cost at which the address acquired its holdings.

On the other hand, 47.42% of all AVAX’s holders, made up of 4 million addresses, are “in the money.” These are addresses that currently hold the token at a higher price than the average cost at which they purchased their holdings.

Read More: How to Buy Avalanche (AVAX) and Everything You Need to Know

Most AVAX holders currently suffer losses because of the steady decline in its price. This week alone, AVAX has shed almost 20% of its value. Interestingly, this has occurred despite the surge in network activity on Avalanche in the past seven days.

During that period, the number of new addresses that completed at least one AVAX transaction daily increased by 88%, and the daily count of new addresses created to trade AVAX surged by 59%.

Notably, an increase in an asset’s daily active and new address count does not automatically mean that demand outpaces supply. If there is more selling pressure or if the new participants are selling an asset, its price can decline.

This is often the case when broader market sentiment is significantly negative. Two days ago, AVAX’s weighted sentiment plunged to its lowest level since December 2023.

AVAX Price Prediction: Price is Poised to Breach Support Level

AVAX’s price decline has caused it to trend within a descending channel in the last month. When a descending channel is formed, it is a bearish sign that confirms sustained selling pressure.

The upper line of this channel acts as resistance, while the lower line represents support. For AVAX, it has faced resistance at $46.91 and has found support at the $22.04 price level.

At press time, AVAX is trading at $24.82, close to the support level. If this level is breached, the bearish trend will continue, and the token’s price will fall further.

The dots that makeup AVAX’s Parabolic SAR indicator rests above its price, confirming the possibility of this happening.

This indicator identifies an asset’s trend directions and potential price reversal points. When its dots are above an asset’s price, the market is declining. Traders interpret it as a bearish sign that confirms that an asset’s price is falling and may continue to do so.

If AVAX maintains its downtrend, its value may dip to $23.57.

However, if the current trend reverses and buying activity spikes, the token’s value may rise to $26.92.

The post Avalanche (AVAX) Plummets to December 2023 Lows, Over 50% of Holders in Loss appeared first on BeInCrypto.