On Tuesday, Nvidia, the American manufacturer of graphics processing units (GPUs), surpassed technology giants Microsoft and Apple as the most valuable company.

This surge in Nvidia’s market capitalization has sparked a rally in AI-themed cryptocurrencies.

AI Tokens Rally as Nvidia Tops Tech Giants

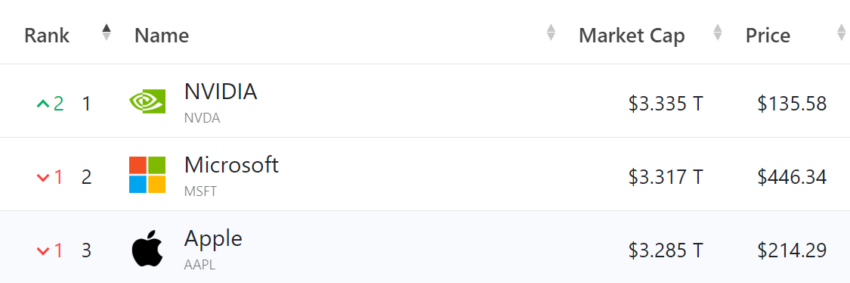

According to the latest data, Nvidia’s stock (NVDA) price is now $135.58, with a market capitalization of $3.33 trillion. Meanwhile, Microsoft and Apple have market capitalizations of $3.31 trillion and $3.28 trillion, respectively.

Read more: 9 Best Artificial Intelligence Stocks To Buy in 2024

The key driver of this growth is the demand for artificial intelligence (AI) products, which have become increasingly integral across various industries since 2023. Nvidia’s Q1 2024 earnings report shows that its data center category saw a 427% increase in revenue to $22.56 billion. This category includes AI chips and components for AI servers.

Nvidia’s success has also impacted the crypto market. Major AI-themed cryptocurrencies, including Fetch.AI (FET) and Render (RNDR), have substantially increased in the last 24 hours.

FET’s price has increased by 16.3%, now valued at $1.33. Meanwhile, RNDR has seen a 10.3% rise, currently trading at $7.75. Additionally, data from the on-chain analytic tool Santiment shows that RNDR has experienced a 33.33% increase in social volume changes during this period.

In the longer term, Nvidia’s influence on the AI and crypto sectors is expected to be profound. A report by asset manager Bitwise highlights how the AI boom has significantly impacted data centers, creating a shortage of AI chips and access to electricity.

Bitcoin miners, equipped with powerful chips and advanced cooling systems, provide the necessary infrastructure for AI companies. As a leading manufacturer of AI chips and GPUs for crypto mining, Nvidia can gain considerably from the increasing demand.

Greg Beard, CEO of Stronghold Digital Mining, noted that research analysts are sounding the alarm about the rising power demand driven by the expansion of AI data centers. He cites an April Goldman Sachs report stating that data center power demand, excluding crypto, is expected to grow by 160% in 2030 compared to 2023.

However, the infrastructure is insufficient to meet the demand. Moreover, Beard pointed out that the US electric industry hasn’t developed new baseload power infrastructure in almost twenty years.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

“AI developers are well-capitalized and in a hurry to build but face serious barriers to accessing power. The most obvious access to this power is existing Bitcoin mining sites already connected to increasingly valuable power sources. The only way for AI developers to attempt to overcome the resource gap and solve their future energy needs is to develop new sites and repurpose existing ones–like Bitcoin miners,” Beard told BeInCrypto.

The post Nvidia Tops Microsoft, Apple in Market Cap; AI Crypto Tokens Fetch.AI and Render Rally appeared first on BeInCrypto.