Bitcoin’s (BTC) price is known to drive the crypto market, but the king of cryptocurrencies tends to react to macro-financial conditions.

Since these conditions have been rather positive lately, it seems like BTC could have a shot at escaping consolidation and marking a new ATH.

Impact of the US Financial Markets

Bitcoin’s price has been reacting positively to the Federal Reserve’s recent shift in tone. Earlier this week, the inflation rate, measured by the Consumer Price Index (CPI), softened to 3.3% year over year.

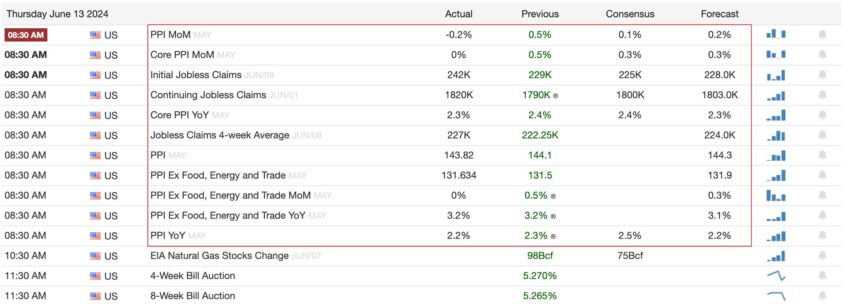

Soon after, the Federal Open Market Committee (FOMC) also announced that it would keep the interest rates unchanged at 5.25% to 5.50%. On Thursday, the Producer Price Index (PPI) also came in at 2.2% on a yearly basis, as per the forecasts and lower than April’s 2.3%.

The combined positive outlook has created favorable bullish conditions for Bitcoin’s price. The research team at Bitfinex also believes that BTC is looking at growth in the long term. Bitfinex analysts told BeInCrypto,

“Since the Fed decided to maintain current rates, Bitcoin might experience short-term volatility as the market adjusts to the news. However, the overall trend could remain positive, especially if the broader economic outlook continues to improve.”

Discussing about the potential impact on the ETF flows, the analysts stated,

“ETF flows may stabilize with a hold decision, as investors await clearer signals from the Fed’s future policy moves. Spot Bitcoin ETFs might see steady inflows, but the momentum could be less pronounced compared to a rate cut scenario. The launch of Ether ETFs could still attract significant interest, potentially leading to diversified investments across both Bitcoin and Ethereum ETFs.”

Thus, Bitfinex analysts believe that Bitcoin could consolidate around current levels or experience moderate gains as investors remain optimistic about future rate cuts later in the year.

BTC holders are also of this opinion, as their conviction seems to be making a comeback. The Mean Coin Age is observing an uptick again after noting a downtick in March and again in May.

Mean coin age is a metric that measures the average age of all coins in the network, indicating the average holding period of the cryptocurrency. It helps assess investor behavior and potential market trends by showing how long coins have remained in their current addresses.

Upticks in this metric suggest investors are HODLing, while downticks hint at the increased movement of tokens across the network.

Read More: Bitcoin Halving History: Everything You Need To Know

Thus, Bitcoin’s price could see some sideways movement before it initiates its recovery again.

BTC Price Prediction: Validating the Pattern

Bitcoin’s price, which was trading at $67,800 at the time of writing, has been consolidated under $71,000. Recent attempts at closing above it failed, and BTC dropped back down below $68,500, another crucial support floor.

However, looking at the macro timeframe, it can be noted that BTC is awaiting a breakout following a Wyckoff pattern. The Wyckoff pattern is a technical analysis method that describes the cyclical price behavior of financial markets. It consists of phases of accumulation, markup, distribution, and markdown, helping traders identify potential market trends and reversals.

Per this pattern, a rise beyond the all-time high of $73,736 is on the cards. However, as mentioned above, this would likely come after a period of consolidation.

Read More: Bitcoin (BTC) Price Prediction 2024/2025/2030

But if Bitcoin’s price breaks below the consolidation before this recovery, the bullish thesis will be invalidated. BTC could also lose the support of $67,000, sending the crypto asset to lows of $63,000 or lower.

The post Bitcoin (BTC) Price Prediction: Positive Macro Conditions Could Drive Rally appeared first on BeInCrypto.