Perpetual contracts have become crucial for traders who want exposure to cryptocurrency prices without owning the actual assets. dYdX excels in this area due to its decentralized infrastructure and user-friendly features.

In this article we’ll explore decentralized perpetual futures, their benefits and risks, and how dYdX Chain supports effective trading.

What are Decentralized Perpetual Futures?

Perpetual futures, often referred to as perpetual contracts, are a type of derivative that allows traders to speculate on the price of an underlying asset, such as Bitcoin or Ethereum, without an expiration date. Unlike traditional futures contracts, which have a set expiry, perpetual contracts can be held indefinitely, provided the trader maintains sufficient margin to avoid liquidation. This feature makes perpetual contracts particularly appealing for long-term speculative strategies and continuous hedging needs.

Decentralized perpetual futures take this concept a step further by leveraging blockchain technology to operate without a central authority. This decentralized approach offers enhanced transparency, reduced counterparty risk, and the ability for anyone with an internet connection to participate.

To make sure the price of perpetual contracts stays close to the underlying asset’s index price, trading platforms use a mechanism known as the funding rate. It involves periodic payments between long and short trades, determined by the funding rate, which is calculated based on market premiums and an interest rate component, averaged over one hour. These payments incentivize traders to maintain price alignment with the index. The rate updates hourly and is bound within predefined minimum and maximum limits, ensuring stability in trading positions.

How dYdX Facilitates Perpetual Contract Trading

Launched in 2018, dYdX has quickly become a leader in decentralized perpetual futures trading due to its advanced technology and cost-effectiveness. Backed by venture capital firms like Andreessen Horowitz, Paradigm, and Polychain, dYdX transitioned from Ethereum to the Cosmos ecosystem in 2023. This change improved scalability, decentralization, and throughput and introduced a fully decentralized order book system. The platform supports onboarding via various wallets or social logins without requiring KYC checks. With over $1-2 billion in daily transaction volume, dYdX Chain competes with major centralized exchanges, establishing itself as a key player in the market.

Here are some key features of dYdX Chain:

- Decentralization: dYdX Chain operates without a central authority, ensuring that all transactions are transparent and auditable. This minimizes the risk of fraud and manipulation.

- Leverage: Traders can leverage their positions, allowing for higher potential returns (and risks). dYdX Chain offers up to 20x leverage on perpetual contracts, making it a powerful tool for both speculative and hedging strategies.

- User-Friendly Interface: Despite its advanced features, dYdX maintains an intuitive interface, making it accessible to both novice and experienced traders.

- Low trading fees: Fees on dYdX Chain vary based on the type of trade and your trading volume over the past 30 days, ranging from 0.025% to 0.05% for taker orders. These fees are generally lower than those on centralized exchanges. Up to 90% of trading fees are instantly returned to your dYdX Chain address. Additionally, there is an ongoing incentive program that, subject to governance, will distribute $5 million in DYDX tokens to eligible traders.

Advantages of Perpetual Futures on dYdX

Continuous Trading Opportunities

The indefinite nature of perpetual contracts allows traders to maintain positions as long as they have sufficient collateral. This continuous exposure is beneficial for traders who want to capitalize on long-term trends without the need to roll over contracts periodically.

Leverage

Leverage is a significant draw for perpetual contract traders. By allowing traders to control large positions with relatively small amounts of capital, dYdX provides opportunities for amplified gains. However, it’s important to note that leverage also increases the potential for substantial losses.

Decentralization and Security

Operating on a decentralized platform like dYdX reduces the risk of counterparty default. Each validator runs an in-memory orderbook that is never committed to the blockchain (i.e. off-chain). Orders and cancellations are propagated through the validator network, ensuring they are received by all validators, and validators match orders together off-chain in real-time. The resulting trades are then committed on-chain each block by the validators.

Access to a Variety of Assets

dYdX Chain supports a wide range of assets for perpetual contracts, offering traders the flexibility to diversify their portfolios and explore various market opportunities. This variety enhances the ability to implement complex trading strategies and hedge different types of risk.

Improved Liquidity

High liquidity is crucial for minimizing slippage, ensuring that traders can enter and exit positions at desired prices. dYdX Chain features a fully decentralized, off-chain orderbook and matching engine operated by validators. This setup offers an institutional-grade trading experience with high liquidity and low slippage, unlike Automated Market Maker (AMM) models. It lowers barriers for users and market makers, promoting sustainable liquidity provision. When liquidity providers submit and match a trade, the settlement is deterministic, ensuring reliable and efficient execution.

Risks and Considerations

While the opportunities presented by perpetual contracts on dYdX Chain are substantial, there are risks and considerations that traders must be aware of.

High Leverage Risk

Leverage amplifies both potential gains and potential losses. A small adverse movement in the market can lead to significant losses, potentially resulting in the liquidation of the trader’s position. It is crucial for traders to manage their risk carefully and use leverage judiciously.

Market Volatility

Cryptocurrency markets are notoriously volatile. While this volatility can create opportunities for profit, it also increases the risk of sudden and severe price swings.Traders must prepare for the possibility of quick market movements and implement strategies to mitigate these risks.

Technical Risks

Despite the security of blockchain technology, technical risks remain. Smart contracts, while secure, are not immune to bugs and vulnerabilities. Additionally, the underlying technology of the blockchain can experience issues, such as network congestion or delays, which can affect trading.

Regulatory Risks

The regulatory environment for cryptocurrencies and decentralized finance is still evolving. Changes in regulations can impact the availability and legality of trading certain assets or using specific platforms. Traders need to stay informed about regulatory developments that could affect their trading activities.

Counterparty Risks in a Different Form

While dYdX eliminates traditional counterparty risk through decentralization, there is still the risk associated with the platform itself.. It is essential to understand these risks and monitor the security measures implemented by the platform.

Practical Guide to Trading Perpetual Contracts on dYdX

To successfully trade perpetual contracts on dYdX Chain, traders need to follow several key steps. Here’s a practical guide based on the resources and features provided by dYdX:

1. Setting Up an Account

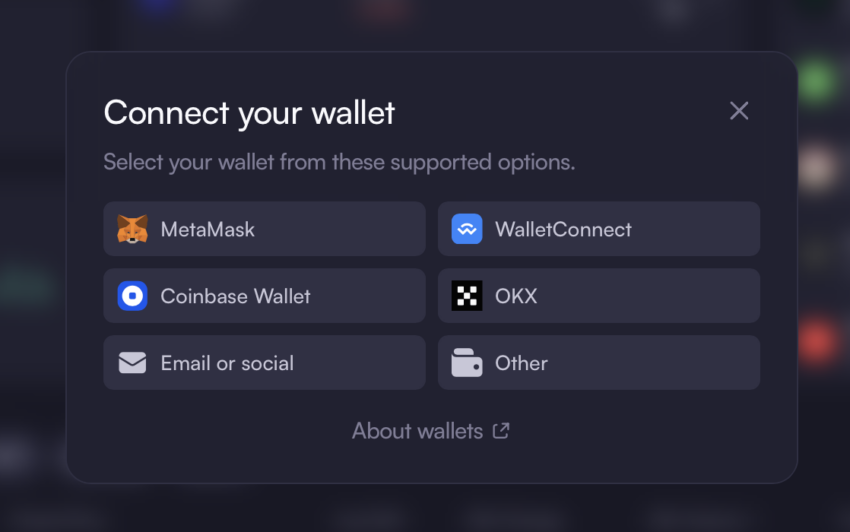

To trade futures on dYdX Chain, users need a compatible cryptocurrency wallet, e-mail, or socials (X or Discord). Popular wallet options for dYdX include MetaMask, Trust Wallet, and Ledger. Alternatively, users can set up a new wallet through Privy, which allows users to log in using existing email or social media accounts. This method eliminates the need to memorize a seed phrase.

2. Depositing Funds

Set up the account, then deposit funds. dYdX supports various cryptocurrencies for deposits, including USDC, which serves as the sole collateral for trading perpetual contracts.

3. Navigating the Trading Interface

The dYdX Chain trading interface is designed to be intuitive. Traders can easily navigate through different sections, including order books, trading pairs, and leverage options. The platform provides detailed charts and analytical tools to help traders make informed decisions.

4. Placing Orders

Traders can place various types of orders, including market orders, limit orders, and stop orders. Understanding these order types is crucial for effective trading. For instance, limit orders allow traders to specify the price at which they want to buy or sell, providing better control over trade execution.

5. Monitoring Positions and Risk Management

Effective risk management is essential in leveraged trading. dYdX provides tools for monitoring open positions, calculating margin requirements, and setting stop-loss orders to manage potential losses. Traders should regularly review their positions and adjust their strategies based on market conditions.

dYdX offers a compelling avenue for traders looking to engage with the cryptocurrency market in a flexible, leveraged, and decentralized manner. The platform’s advanced features, such as perpetual trading, and staking, provide a solid environment for both new and experienced traders. However, the opportunities presented by perpetual contracts come with risks, including market volatility, leverage-related dangers, technical vulnerabilities, and regulatory uncertainties.

For traders to maximize their success on dYdX Chain, it is essential to approach perpetual contract trading with a well-informed strategy, rigorous risk management practices, and a continuous awareness of the evolving market of decentralized finance. By doing so, traders can harness the potential of dYdX’s perpetual contracts while reducing the inherent risks associated with this innovative financial instrument.

The post Understanding Perpetual Contracts on dYdX: Opportunities and Risks appeared first on BeInCrypto.