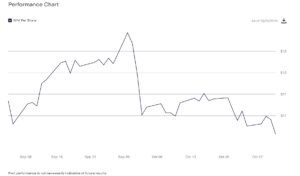

As BeInCrypto highlighted in a previous analysis when MATIC was trading at $0.74. The price action remains bullish since the support levels have not been broken to the downside.

By examining critical indicators such as the EMA 100, the Ichimoku Baseline, and the Ichimoku Cloud, we can discern the potential for a significant bullish breakout.

Polygon (MATIC) Technical Outlook

Let’s analyze the price movements of Polygon (MATIC) using the 1-day chart, focusing on the EMA 100, the Ichimoku Baseline, and the Ichimoku Cloud.

The EMA 100, represented by the blue line, is a significant resistance level.

Over the past two months, Polygon’s price has consistently traded below the EMA 100, depicted by the blue line. This sustained trading below the EMA 100 underscores a bearish trend. Notably, the last significant attempt to break above the EMA 100 occurred on April 9. However, this attempt was met with substantial selling pressure, further reinforcing the bearish sentiment.

The Ichimoku Baseline, illustrated by the red line, is a dynamic support level. The price has repeatedly approached but failed to sustain below this baseline, indicating consistent buying activity at these price levels.

The price has entered the Ichimoku Cloud. The lower boundary of the cloud, currently acting as support, appears to be a challenging level to break. The price’s entry into the cloud suggests an increase in volatility. A breakout within the cloud is expected to heighten this volatility further.

Additionally, the 0.618 Fibonacci retracement level within the cloud is a critical resistance point.

Polygon’s price has been testing this level, and a sustained breakout above the 0.618 Fibonacci level could propel it higher.

This breakout can push the price towards the upper boundary of the cloud and potentially higher resistance levels, such as the EMA 100 and the 0.5 Fibonacci retracement line, situated around the $0.78 to $0.80 range.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

Despite the prevailing bearish trend indicated by the EMA 100 and the Ichimoku Baseline, the recent entry into the Ichimoku Cloud introduces the potential for increased volatility and possible bullish movements.

Polygon Supply Shifting to Smart Contracts: A Positive Indicator

A smart contract is a self-executing contract with the terms of the agreement directly written into code. They run on blockchain networks like Ethereum and Polygon. When conditions specified in the code are met, the contract executes automatically.

The purple line represents the percentage of the total MATIC tokens currently locked in smart contracts. These contracts could be related to decentralized finance (DeFi) applications, staking, or other blockchain-based services.

Over the given period, the percentage of MATIC in smart contracts fluctuates. There was a dip at the start of the period, followed by a steady increase. Around mid-April, there is a significant jump in the percentage, suggesting a surge in smart contract activity on the Polygon network.

A higher percentage of MATIC in smart contracts indicates more active network use. This could mean more people use MATIC for DeFi, staking, or other applications, showcasing the token’s utility and demand.

Over the past two months, nearly 2% of the total supply has been allocated to smart contracts.

Fewer are available in the market when more tokens are locked in smart contracts. This can reduce supply and, depending on demand, potentially lead to an increase in price.

Strategic Recommendations

The bullish to neutral outlook could shift to bearish if the price exits the cloud to the downside and breaks below the baseline at $0.70. Placing stops in this region could be a prudent strategy.

A breakout within the cloud will likely increase positive volatility. Pay close attention to how the price behaves around the 0.618 Fibonacci retracement level. A sustained move above this level could indicate a shift in momentum.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

If the price breaks above the EMA 100, it would signal a potential bullish reversal. This level has been a strong resistance, which could lead to significant upside potential.

Over the past two months, nearly 2% of the total supply has been allocated to smart contracts. This increase in smart contract activity suggests more active network use, which could positively impact the price. Monitoring this metric can provide insights into the network’s health and potential demand for MATIC.

The post Polygon (MATIC) Breakout Likely: Strong Technical and Fundamental Indicators appeared first on BeInCrypto.