In May, the crypto industry saw significant events related to regulatory clarity in the US. President Joe Biden’s administration has dramatically shifted its crypto stance within a month. Initially resistant to crypto, the administration recently took several pro-crypto actions, signaling a significant policy change.

This article explores the events and motivations behind this surprising transition, including political pressures and legislative developments.

Passage of Crypto-Focused Bills

On May 16, the US Senate voted to pass H.J. Res 109, a resolution to overturn the Securities and Exchange Commission’s (SEC) controversial Staff Accounting Bulletin No. 121 (SAB 121). Introduced in March 2022, SAB 121 requires financial institutions to list customers’ digital assets on their balance sheets.

Critics argue this mandate creates substantial operational and financial burdens for firms handling cryptocurrencies. It also potentially exposes customers’ assets to risks in bankruptcy situations.

Despite Congress passing the resolution, it did not secure enough votes to be veto-proof. Before the passage, Biden has vowed to veto it. His administration argues that overturning SAB 121 would weaken the SEC’s ability to protect investors and the financial system from crypto-related risks.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

On May 22, the US House of Representatives passed the Financial Innovation and Technology for the 21st Century Act (FIT21). Introduced in July 2023, the bill aims to define the roles of the SEC and the Commodity Futures Trading Commission (CFTC) in overseeing cryptocurrencies.

It also establishes guidelines for various aspects of the crypto market, including token issuance, trading, and custody. The bill was approved with bipartisan support in a 279-136 vote, with 71 Democrats joining 208 Republicans in favor.

The White House again opposed the bill, citing consumer and investor protection concerns. While the administration acknowledges the need for a regulatory framework for digital assets, they believe FIT21 requires additional safeguards. However, President Joe Biden’s statement did not mention a veto threat, unlike his response to H.J. Res. 109.

SEC Chair Gary Gensler also stated his opposition to FIT21. Gensler argues the bill undermines classifying crypto assets as investment contracts. This change would remove these assets from the SEC’s oversight, making it harder to protect investors.

Following the passage of H.J. Res. 109 and FIT21, the crypto industry saw the US House of Representatives pass the CBDC Anti-Surveillance State Act on May 23. This bill aims to amend the Federal Reserve Act to prevent central bank digital currency (CBDC) from being used for monetary policy or direct consumer services.

The bill’s debate saw sparse attendance. Republican proponents emphasized the risk of CBDC misuse, while Democrats focused on innovation, the dollar’s global standing, and flaws in the bill’s drafting.

During the delivery, Chairman Patrick McHenry highlighted instances where governments, such as the Chinese Communist Party (CCP), have used CBDCs to monitor citizens’ spending behaviors. This surveillance implements a social credit system that either rewards or penalizes individuals based on their actions. McHenry asserted this form of financial surveillance is unacceptable in the US.

Majority Whip Tom Emmer introduced the bill in 2023, which gained 165 Republican cosponsors and passed with a 216-192 vote. Now heading to the Senate, this passage marks the third time the US House has passed crypto-focused bills in May.

A 180 in Spot Ethereum ETFs

Amid the legislative backdrop, the crypto industry saw a notable shift in focus toward exchange-traded funds (ETFs), particularly with Ethereum (ETH) at the center of attention.

Grayscale withdrew its 19b-4 filings for its futures Ethereum ETF on May 7. The sudden withdrawal raised speculation among industry experts and the crypto community. James Seyffart, an ETF analyst at Bloomberg Intelligence, suggested the filing might have been a strategic move.

At that time, Seyffart and his fellow ETF analyst, Eric Balchunas, still had very low odds of the spot Ethereum ETF approval by the SEC. They kept slashing their odds until they became “none to minimum.”

However, on May 20, they suddenly increased their odds of spot Ethereum ETF approval from 25% to 75%. This followed the SEC reportedly requesting asset managers wanting to list spot Ethereum ETFs to update 19b-4 filings ahead of the deadline. Balchunas admitted he heard chatter that the SEC could be doing a 180, but they maintained a cautious approach by capping the odds at 75% until they saw the filing updates.

Following the increased odds, the potential spot Ethereum ETF issuers gradually amended their 19b-4 filings with the SEC. All these asset managers excluded staking provisions by explicitly stating that “neither the Trust, nor the Sponsor, nor the Custodian, nor any other person associated with the Trust will, directly or indirectly, engage” in staking-related activities.

Additionally, three Republican and two Democratic senators wrote a letter to Gensler, urging the approval of spot Ethereum ETFs. Finally, on May 23, the SEC approved the revised 19b-4 filings of nine asset managers.

Following this preliminary approval, some asset managers, including BlackRock and VanEck, updated their S-1 filings to remove staking aspects. These moves fueled confidence among analysts that these ETFs could launch soon, probably sometime in July.

Political Pressures and the Election

In early May, Trump held an exclusive event with the NFT community, publicly declaring he would accept crypto campaign donations for the first time. He also pledged a more welcoming approach to the crypto industry, criticizing current US regulatory measures as “hostility.” Moreover, he urged those who favor crypto to vote for him.

Trump has expressed his comfort with crypto several times and reportedly explored Bitcoin’s use case to help address the US national debt of $35 trillion. He has also promised to pardon Ross Ulbricht, the darknet marketplace Silk Road operator if re-elected.

“If you vote for me, on day one, I will commute Ross Ulbricht’s sentence to time served. He’s already served 11 years, and we’re going to get him home,” Trump promised.

Trump also pledged to “support the right to self-custody to the nation’s 50 million crypto holders.” This statement is particularly interesting because Biden’s administration has been enforcing actions against self-custodial and privacy-focused platforms. These include MetaMask, Samourai Wallet, and Tornado Cash.

On May 29, the Department of Treasury Secretary for Terrorism and Financial Intelligence, Brian Nelson, addressed the Financial Crimes Enforcement Network’s (FinCEN’s) 2023 proposal. This proposal seeks to classify mixers as a “primary money laundering concern” and requires virtual asset service providers (VASPs) to report any crypto transactions involving mixing to the agency. He stated that the department is not attempting to ban crypto mixing services.

“At the end of the day, this is not a ban on mixers. This is a proposed rule designed to drive transparency,” Nelson stated.

While Nelson expressed sympathy for crypto users’ desires for financial privacy, he suggested that most mixers are not created to enhance privacy. Instead, they are made to skirt anti-money laundering (AML) and know-your-customer (KYC) reporting requirements. This makes them “very attractive” to bad actors.

Trump’s bold moves came at a strategic time when Biden’s administration was long known for its stringent approach toward the crypto industry. Moreover, key industry figures have declared they will support a candidate favoring crypto.

Given this outlook, it is understandable that Biden’s campaign tried to gain votes from the crypto industry. Last week, Biden reportedly began engaging with crypto industry players as part of his re-election campaign. Starting over two weeks ago, the re-election team contacted several crypto experts, including those previously distanced by Biden.

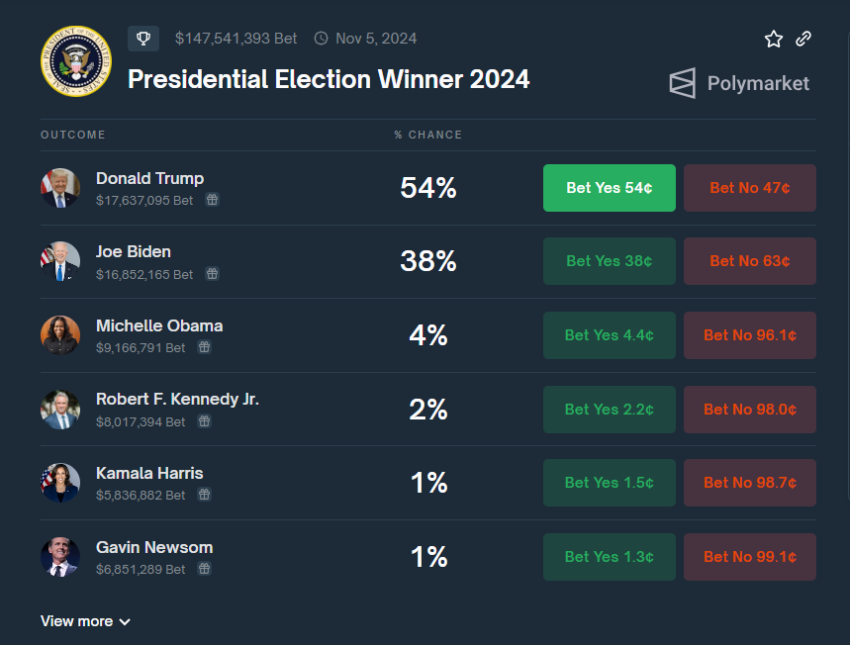

Trump’s chances have increased substantially over the past months following a series of pro-crypto actions and statements. Data from the crypto-based prediction platform Polymarket shows that Trump has a 54% chance of winning the upcoming election. This percentage starkly contrasts with Biden’s, who only has a 38% chance.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

On a broader scale, according to an NPR/PBS/Marist poll, Biden is losing support among key demographics. Young voters under 45 prefer Biden over Trump by just four points.

In a head-to-head matchup, Biden leads among Gen Z/Millennials by six points. However, the swing votes in Trump’s favor among the two groups, by six points among Gen Z/Millennials and among voters under 45, with third-party candidates in the mix, have an advantage of eight points.

This dramatic shift within the Biden administration reflects a complex interplay of regulatory, legislative, and political factors. As the administration navigates this evolving environment, the upcoming months will be crucial in shaping the future of crypto regulation in the US.

The post US President Joe Biden’s Administration Went from Anti-Crypto to Full Degen in One Month appeared first on BeInCrypto.