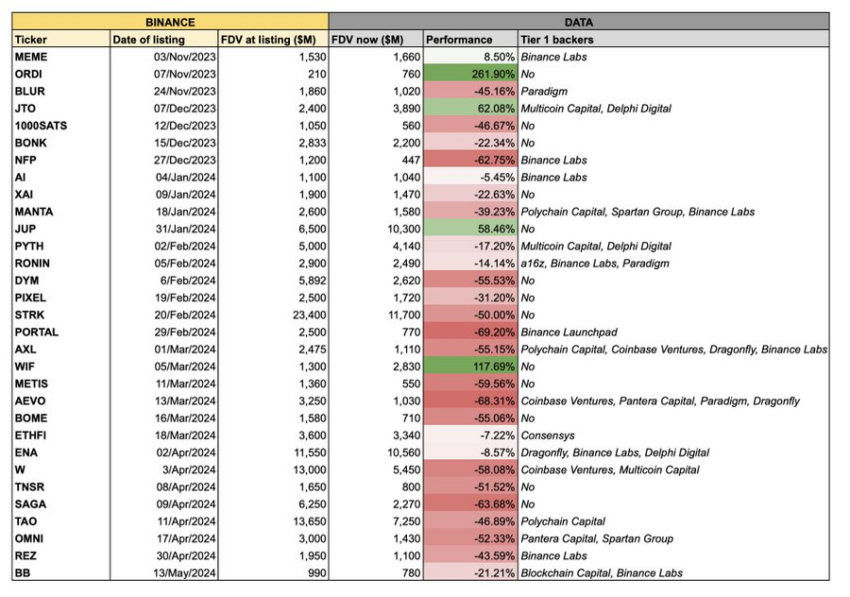

More than 80% of the tokens listed on Binance, the world’s largest crypto exchange by trading volume, have dropped in value since their listing over the past six months.

Crypto researcher Flow reported that many of Binance’s new listings are tokens supported by top-tier venture capital firms and introduced at high valuations.

Binance Listing Now Provides ‘Exit Liquidity’ For VCs

According to Flow, only 5 out of 31 selected tokens on Binance have seen price increases since their launch. These tokens—ORDI, JUP, WIF, JTO, and MEME—are primarily meme coins or projects without major venture capital backing.

Over the past six months, these tokens have surged individually by over 50%. Specifically, ORDI rose by approximately 262%, JTO increased by 62%, and JUP by 58%. WIF and MEME also saw gains of more than 117% and 8.5%, respectively.

Conversely, tokens backed by top VCs have performed poorly. Binance Labs’ NFP token, Pantera Capital-backed OMNI, and AEVO, supported by VCs including Coinbase, Paradigm, and Dragonfly, have plummeted by about 63%, 52%, and 68%, respectively.

“If you held a portfolio where you would invest an equal amount at each new Binance listing, you would be down over 18% in the past 6 months,” Flow stated.

Read more: Which Are the Best Altcoins To Invest in May 2024?

Flow furthered that many of these projects launch at high fully diluted values (FDVs). He said an average FDV for a Binance listing could exceed $4.2 billion, sometimes reaching as high as $11 billion with “no real users or a strong community behind” these projects.

Notably, Flow’s finding starkly contrasts last year’s analysis by crypto investor Ren & Heinrich, which found that token prices rose 73% in the first 30 days following their listing on Binance. At the time, Ren & Heinrich suggested that Binance’s emergence as the dominant global crypto exchange gave its token listings much more attention among industry players.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Market experts have explained that Binance’s dominance and high liquidity have made it attractive for insiders to exit their investments in these assets.

“More often than not, tokens launching on Binance are not investment vehicle anymore – all their upside potential are already taken away. Instead, they represent exit liquidity for insiders who capitalize on retail lack of access to quality early investment opportunities,” Flow explained.

The post Researcher: Binance Token Listing Now Serves as Exit Liquidity for Venture Capital Firms appeared first on BeInCrypto.