Cardano blockchain founder Charles Hoskinson spoke against Central Bank Digital Currencies (CBDCs) while explaining the fundamental concept behind crypto.

Hoskinson made this statement in a May 11 social media post while expressing his views about the forthcoming US presidential elections.

Hoskinson Explains Why Crypto is Important

According to Hoskinson, the fundamental concept of cryptocurrency is to establish new social contracts. These contracts, he explained, would hold governments, corporations, and other authorities accountable to the people. He urged the industry to focus on advancing this purpose rather than engaging in arbitrary debates on taxes and regulations.

Hoskinson warned that those opposing the expansion of crypto might unwittingly endorse the concentration of power among the few. He cautioned that if the crypto industry fails to seize the opportunity, CBDCs could become the only viable alternative.

Consequently, these CBDCs would potentially escalate financial surveillance and citizen control, endangering user privacy and autonomy. Hoskinson furthered that governments might exploit CBDCs to manipulate information flows and hinder social mobility.

“Crypto gives us our voices, financial freedom, and shared humanity back. Any politician who wants to rob us of that is dangerous,” Hoskinson remarked.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

The Cardano founder’s view on CBDCs echoes concerns shared by privacy advocates who perceive them as potential tools for extensive government surveillance and economic manipulation. Renowned author Robert Kiyosaki, famous for “Rich Dad Poor Dad,” recently warned of central banks exploiting CBDCs to infringe upon individuals’ privacy.

“Please be careful. Banking crisis worsens. Threat of war grows. Cental banks will push for CBDC, Cental Bank Digital Currency, to SPY on us. I am buying more Bitcoin and silver coins,” Kiyosaki said.

Despite such apprehensions, proponents argue that CBDCs could enhance transactional efficiency and bolster defenses against fraud in digital transactions. Joachim Nagel, President of the Deutsche Bundesbank, highlighted the pressing need for central banks to reevaluate their business models and swiftly embrace CBDCs.

A CBDC is a blockchain-based iteration of government-issued currency. Compared to conventional banking infrastructure, it facilitates expedited settlement of fiat currency transactions for central banks, retail banks, and consumers.

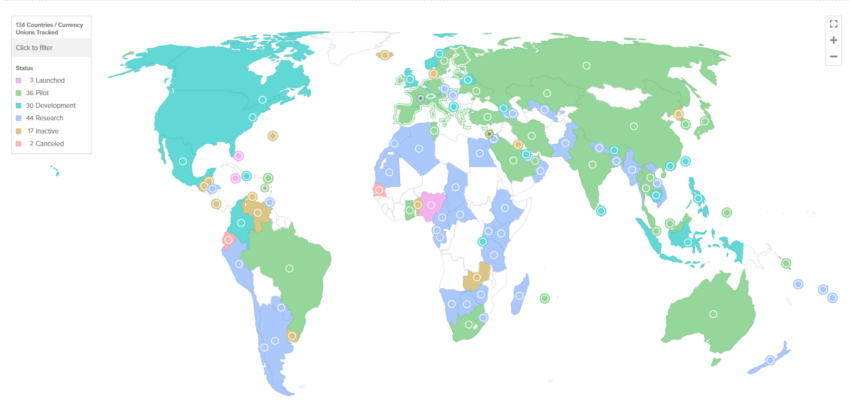

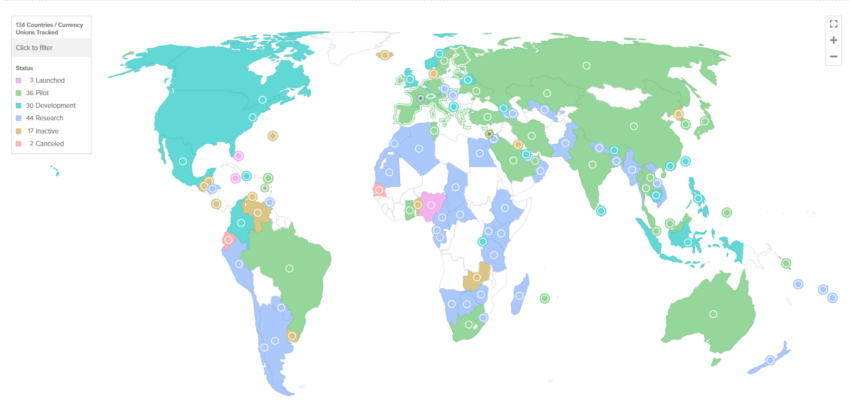

Notably, an overwhelming majority of nations and currency unions—134 in total, comprising 98% of global GDP—are contemplating CBDC implementation, a substantial surge from the 35 nations exploring it in May 2020. Presently, 68 countries are actively engaged in advanced stages of CBDC exploration, including development, pilot programs, or launch preparations.

Read more: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

“19 of the Group of 20 (G20) countries are now in the advanced stages of CBDC development. Of those, eleven countries are already in the pilot stage. This includes Brazil, Japan, India, Australia, South Korea, South Africa, Russia, and Turkey,” the Atlantic Council wrote.

The post Cardano Founder Charles Hoskinson Advocates for Crypto’s Social Contract Over CBDC appeared first on BeInCrypto.