BTC

Bitcoin soared again this week with a break through the $40,000 barrier to trade around $42,500 on Monday.

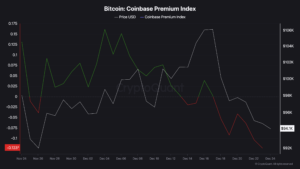

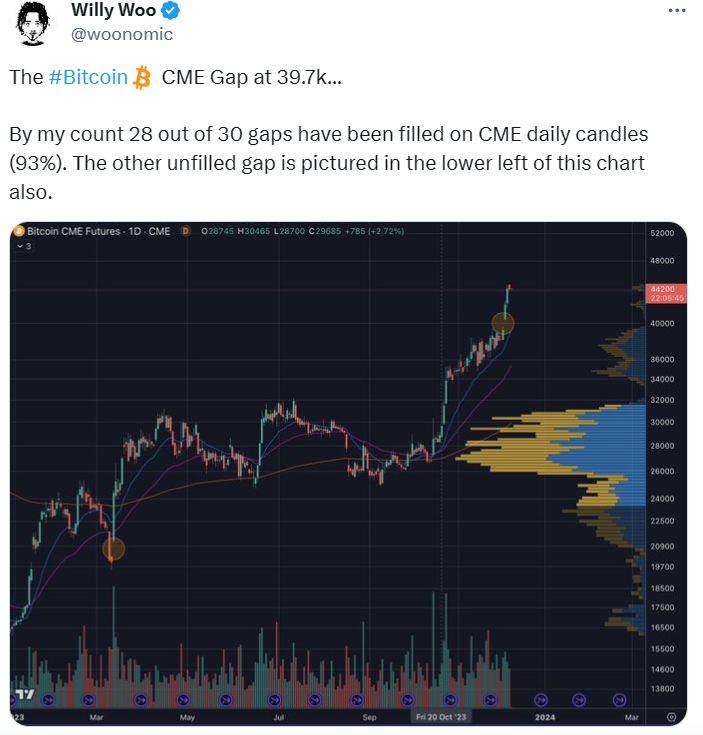

With the recent rally, Bitcoin now tests the 50% Fibonacci retracement from the all-time highs. Meanwhile, Bitcoin analyst Willy Woo on X noted a recent gap in the futures price.

Gaps occur when BTC futures open on Sunday as they do not trade over the weekend, with the analysts saying,

By my count 28 out of 30 gaps have been filled on CME daily candles (93%).

That could see the price return to that level and was close ahead of the Monday session. But he also noted that another unfilled gap remains around $20,000.

However, analysts are bullish and looking ahead to the Bitcoin halving next year, which may create Darwinism among miners, according to CoinDesk.

The reward for creating new coins will be cut in half and large miners could look to secure newer and more-efficient mining machines. But they might also look to buy up smaller miners as they figure out how to survive and benefit from declining commissions.

U.S.-listed company Marathon Digital said it had $800 million in cash and bitcoin, which will allow it to “capitalize on strategic opportunities, including industry consolidation” ahead of the halving.

Bitcoin now has a market capitalization of around $825 billion, but investors can look out for that price gap in the near term.

ADA

Cardano’s ADA token was a strong performer with a 62% gain over the last seven days.

Data from Santiment said that ADA has experienced a significant increase in investor interest.

Cardano has reached a price peak of $0.633, its highest level since June 2022. Trading volume is also at its busiest since that time, with a major increase in crowd interest. About 4% of all #crypto discussions are related to $ADA today.

The Cardano team remains dedicated to making it one of the most attractive in the blockchain world. Continued node improvements aim to enhance network efficiency and peer-to-peer connectivity, while the project has also moved toward artificial intelligence.

The project has launched a beta version of the Girolamo AI chatbot that generates content and interprets images.

The coin has also been showing heightened interest that is likely linked to institutional investors. X analyst Ali said:

In the last three months, there’s been a significant increase in $ADA transactions over $100,000, reaching new highs consistently. This surge points to growing interest in #ADA from institutional players and whales, which is usually a precursor to price spikes.

ADA surged to $0.60 this week but it could double again to the resistance level at $1.24. ADA hit a record high above $3.00 just before the crypto winter set in.

BTT

BitTorrent (BTT) was the best-performing token of the week with a huge 185% gain.

The price of BitTorrent went parabolic after founder Justin Sun, said the Tron platform had reached 200 million users.

Data from DeFi Llama also showed that Tron is the second-biggest chain in the DeFi industry with more than $8.1 billion in total value locked (TVL). This puts the platform above other BNB, Polygon, and Optimism.

One issue for the Tron DeFi platform is that it is dominated by JustLend, a lending platform with over $6.5 billion in assets. The other leading players in the ecosystem are JustStables and SUN with $1.19 billion and $368 million in assets, respectively.

Tron is also a dominant player in the stablecoin industry with over $48 billion worth of stablecoins, with the majority of the holdings being in Tether. More than 34 million users in Tron are holders of the USDT coins. Sun still sees room for the platform as crypto looks toward institutional adoption.

BTT soared after investors saw that total miners on the chain jumped to over 7.25 million last week, while total storage contracts rose to 131 million.

The coin could continue higher as investors now look for altcoins with value.

AVAX

Avalanche saw its AVAX token up 50% over the week as investors eye the next mem coin to pump.

Meme Kombat is finally arriving after a presale that has exceeded $2.7 million in ten weeks.

Avalanche is targeting two of crypto’s most promising sectors in real-world assets (RWAs) and gaming. Crypto Analyst Unit Network recently talked about RWAs on the platform and a projection from Bernstein that $3 trillion of RWAs will be tokenized in the next five years. Avalanche could be one of the leaders in serving that huge market.

The gaming market is also projected to reach $1.4 trillion by 2030 with two big drivers in place for AVAX.

Meme Kombat is a new token that allows betting on AI-generated battles between meme coin characters. Thanks to its advanced AI augmentation, users can watch the battles in Meme Kombat’s battle arena.

The project also offers utility with a staking mechanism, which currently provides a 307% APY. The team has allocated 30% of the token’s total supply to staking and battle rewards and another 10% to community rewards.