Coincheck is preparing to enter the Nasdaq stock market, marking a significant step for Japan’s crypto market.

This move comes through a merger with Thunder Bridge Capital Partners IV (Nasdaq: THCP), a particular purpose acquisition company (SPAC).

Coincheck to List on Nasdaq

For five years running, Coincheck has led in app downloads and boasts over 1.98 million verified accounts. The company’s push to Nasdaq started after partnering with Monex Group, enhancing its financial base and credibility. Coincheck announced the merger with Thunder Bridge IV in March 2022, targeting completion by the second or third quarter of 2024.

Now, the firm has filed for the Nasdaq listing, which is currently under review. This critical step moves Coincheck towards becoming a public holding company following Coinbase’s steps. Such approval hinges on the US Securities and Exchange Commission (SEC), other regulatory clearances, and Nasdaq’s agreement.

”Publishing the registration documents does not imply that the Securities and Exchange Commission (SEC) has approved the registration documents, or that the likelihood of listing has increased,” Coincheck wrote.

Read more: Best Crypto Exchanges With the Lowest Trading Fees

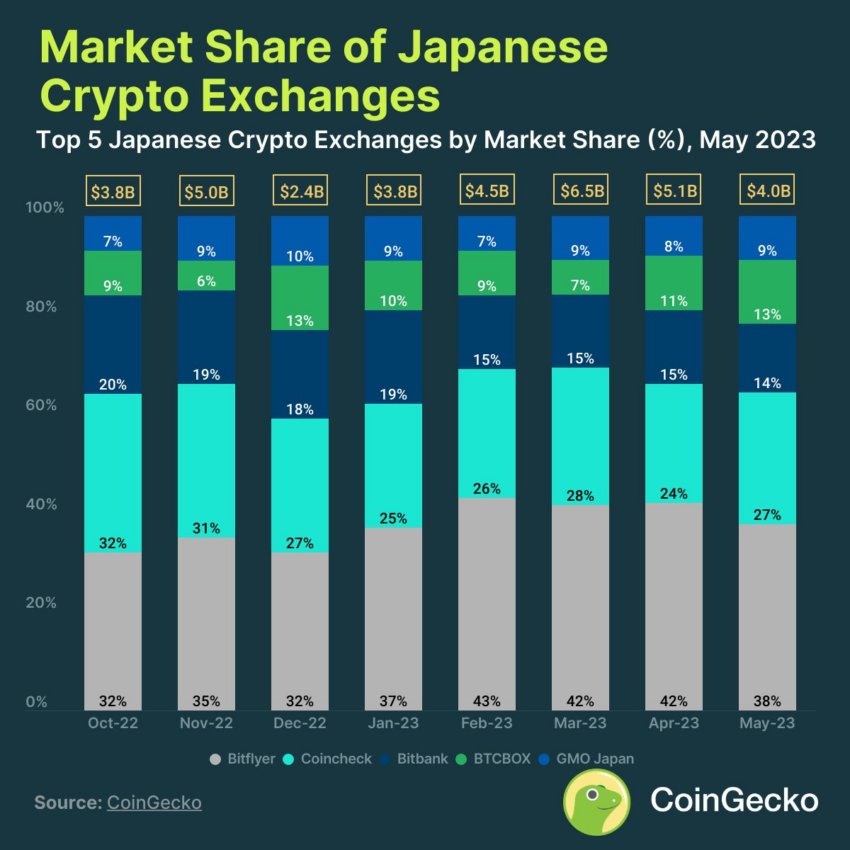

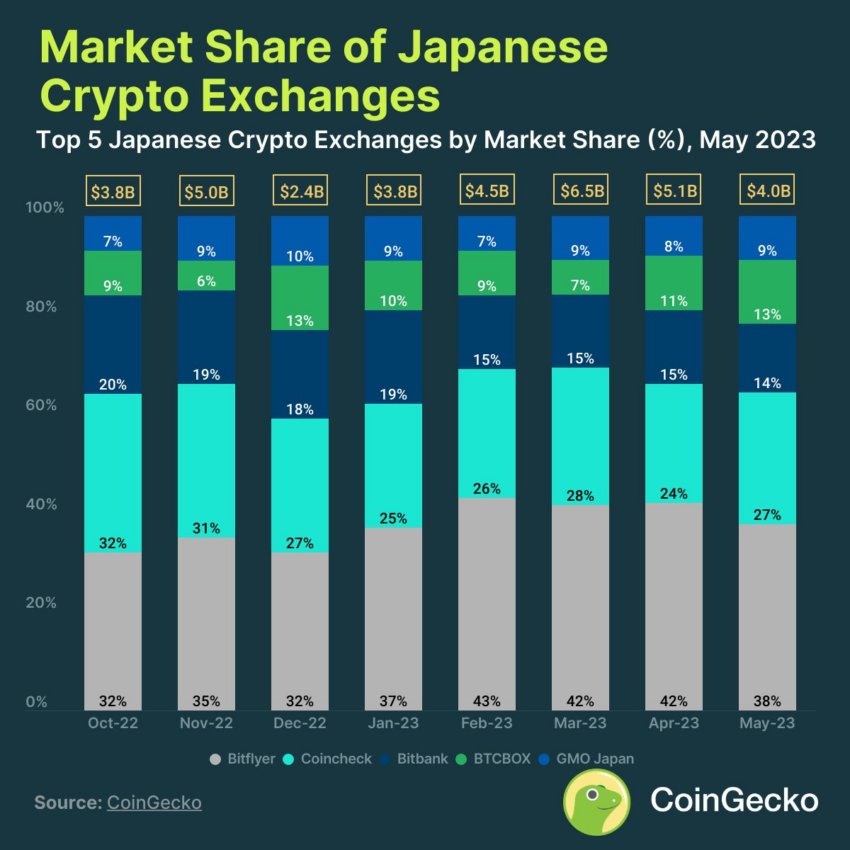

Coincheck maintains its position as one of the leading crypto exchanges in Japan. According to a CoinGecko report, the firm enjoyed a 27.2% market share with a spot trading volume of $1.1 billion in May 2023. With unprecedented scrutiny and interest, Coincheck’s upcoming Nasdaq listing signals a maturing market poised for deeper integration with traditional financial systems.

The post Japanese Crypto Exchange Coincheck Will List on Nasdaq appeared first on BeInCrypto.