Chainlink (LINK) price exhibits bearish signals, but considering the broader market cues as well as LINK holders’ behavior, a different route is the likely outcome.

This could lead to a recovery for LINK, and at the same time, it could also result in a confirmation of potential consolidation.

Chainlink Investors Go Bullish

Chainlink’s price has been under $15 for the entirety of this month, and its recent attempt at breaching $14.5 resistance failed. However, the same sentiment does not resonate with investors who continue to remain optimistic about a rise.

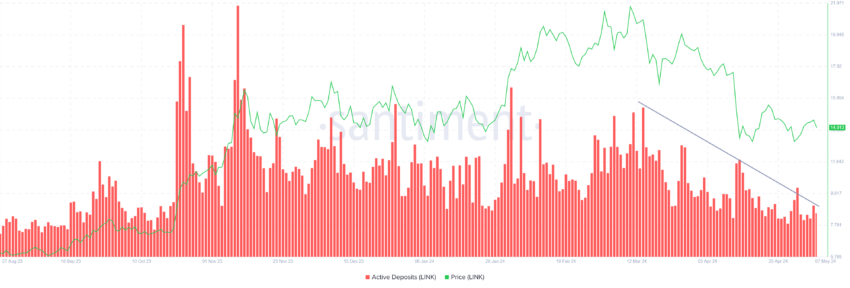

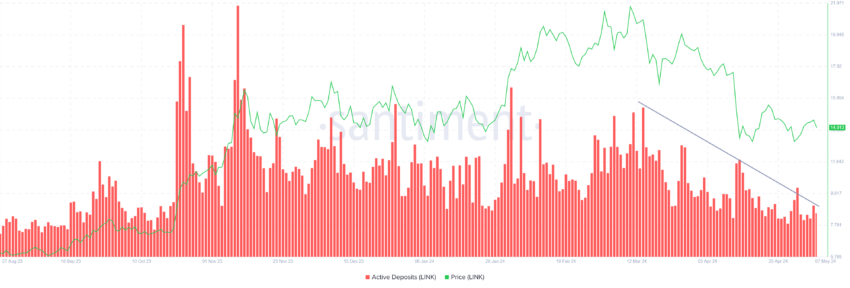

This is evident in the decline in active deposits over the past two months. Active deposits refer to the movement of tokens from investors’ wallets to the exchange’s wallet. This represents the potential for selling.

Declines in this metric are thus a bullish signal as it means LINK holders are choosing to HODL their assets.

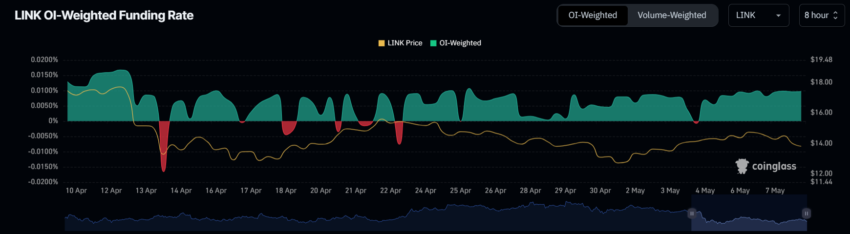

In addition, traders are also pining for a rise in the price, given the funding rate has steadily increased. The funding rate reflects the cost of holding a position in perpetual futures contracts, balancing the market by incentivizing traders to align with the prevailing market sentiment through periodic payments or receipts.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

This shows that traders are betting on a potential increase in Chainlink’s price, which could translate into a recovery.

LINK Price Prediction: A Dip Before a Rise

Chainlink’s price is expected first to note a decline in the coming days. This is because the altcoin would then be able to bounce back from the support of $13.10, enabling a potential 17% increase. This could lead to the altcoin reclaiming the $15 support level, given it is presently trading at $13.8.

In the past, this support floor has also been tested multiple times, usually resulting in a surge in price. The above-mentioned factors are also indicating optimism, which is key to a rally.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, if Chainlinlk’s price ends up falling through the support in the first seven months, the bullish thesis would be invalidated. This could lead to a drawdown below $13.

The post This is How Chainlink (LINK) Could Note a Rise Despite Corrections appeared first on BeInCrypto.