Keefe, Bruyette & Woods (KBW) indicated that Robinhood, known for its cautious approach to cryptocurrency offerings, stands a strong chance of prevailing in a potential legal skirmish with the US Securities and Exchange Commission (SEC).

The cryptocurrency exchange received a Wells Notice from the SEC, which was unexpected given its conservative strategy in digital asset listings.

KBW Predicts Victory for Robinhood in SEC Lawsuit

KBW highlighted that Robinhood supports only 15 cryptos in the US. This is in stark contrast to competitors who offer over two hundred.

According to KBW analysts, including Kyle Voigt, there is no anticipated change to Robinhood’s operations soon. They see Robinhood as likely to challenge the SEC’s claims successfully in court. The firm’s strict listing standards could give it an edge over its peers in legal disputes.

“We expect no change to HOOD’s current US crypto operations or asset listings – and expect the SEC to bring forward a suit within the coming months,” Voigt wrote.

The financial analysis further mentioned that cryptocurrency trading constitutes 12% of Robinhood’s total revenue. It speculated that the SEC might target a specific subset of cryptos available on Robinhood’s platform.

From a revenue perspective, the worst-case scenario would involve the SEC classifying Ethereum as a security. This asset represents approximately 25% of Robinhood’s cryptocurrency trades.

Read more: Coinbase vs. Robinhood: Which Is the Best Crypto Platform?

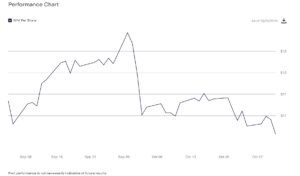

Despite this issue’s uncertainty, Robinhood’s stock slightly increased to around $18. KBW maintains a “market perform” rating on Robinhood with a $20 price target as the trading platform is anticipated to announce its highest quarterly earnings in almost three years. A recovery in stock markets and cryptocurrency trading bolstered such performance.

Earlier in the year, expectations of global interest rate reductions propelled US stocks and Bitcoin to new heights. It drew more traders to the markets and increased the brokerage’s transaction-based income.

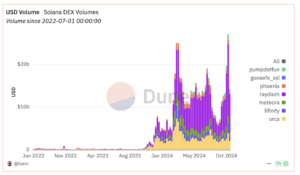

“In the core business, we saw a significant rebound in volumes this quarter across equities, options and crypto with total volumes up nearly 20% in Q1 through February reported metrics,” J.P. Morgan analysts said.

Moreover, KBW concluded that clarity on the outcome of any legal proceedings against Robinhood by the SEC would likely not be available until late 2025, paralleling the ongoing regulatory challenges faced by other firms like Coinbase.

The post Robinhood Will Likely Win in SEC Legal Battle: KBW Report appeared first on BeInCrypto.