Celestia (TIA) is prone to further correction after consistently forming red candlesticks over the past few days. The saving grace is that investors are not too keen on saving the altcoin either.

The most likely outcome for TIA is a five-month low since it follows the cues set by Bitcoin, which dropped below $60,000.

Celestia Investors Save Their Money

Celestia’s price decline resulted from the crypto market noting a bearish couple of days in the previous month. However, the broader impact has been on the traders who have opted to withdraw from the asset for now.

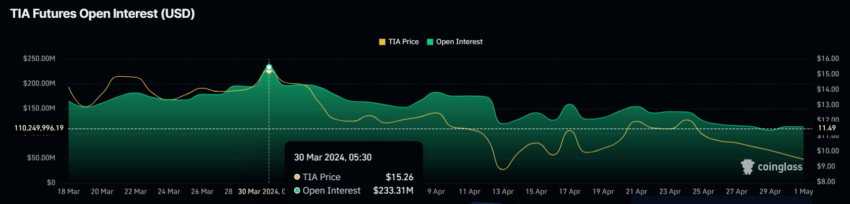

This is noted in the decline in the Open Interest (OI), which in the past month has been reduced by 50%. At the start of March, a total of $233 million worth of shorts and long contracts were opened in the market. This has since come down to $113 million, less than half of the original OI.

This shows that the investors only focus on profitable actions, which could take a while.

The reason behind this delay is the correlation that TIA shares with Bitcoin. A high correlation of 0.96 exhibits a tethered price action of both assets, with TIA following BTC’s cues. Currently, the world’s largest cryptocurrency is witnessing a bearish outlook, with Bitcoin’s price trading below $60,000.

Further decline in BTC is anticipated, and the condition of Celestia’s price is also the same. Thus, the altcoin could observe some drawdown in the coming days.

TIA Price Prediction: Drop to $7

Celestia’s price is testing the support marked at $9.2, which could fail to hold, resulting in a price correction to the next area of support at $8.3. But if this level breaks, it would validate the bearish thesis, causing the TIA price to correct further and hit $7.

Read More: Top 10 Aspiring Crypto Coins for 2024

However, if the $8.3 support floor holds strong enough to prevent a decline, TIA could bounce back. Reclaiming the $10 would wipe out half the losses noted and invalidate the bearish thesis.

The post Celestia (TIA) Price Targets $7 as Investors Pull Back appeared first on BeInCrypto.