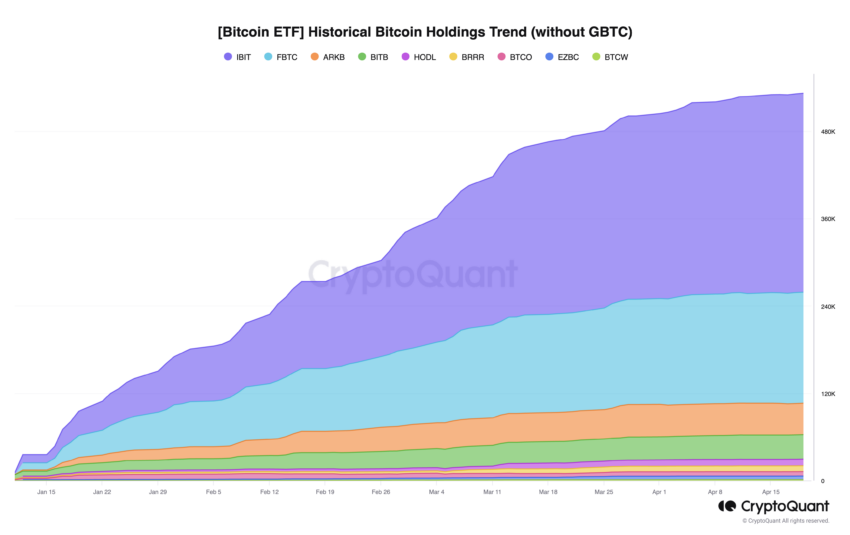

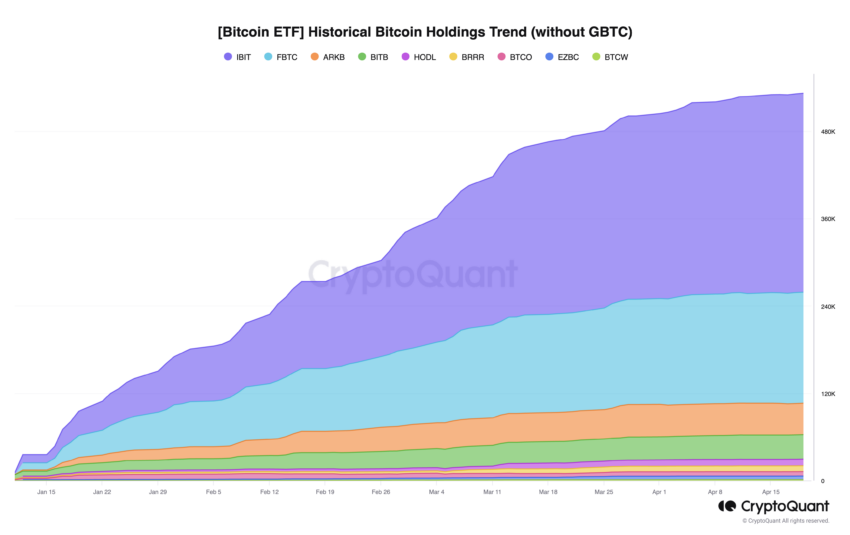

BlackRock’s iShares Bitcoin Trust (IBIT) stands out among other spot Bitcoin exchange-traded funds (ETFs). It nears a remarkable 70 consecutive days of investment inflows.

This persistent demand highlights a unique confidence among investors in the wake of Bitcoin’s latest halving.

BlackRock Bitcoin ETF Thrives for 70 Days

As the largest spot Bitcoin ETF in the United States by assets under management, IBIT showcased robust acquisition trends despite a general slowdown in the market. On April 19, the ETF recorded nearly $30 million in inflows, starkly contrasting the broader sector’s cautious stance.

The cryptocurrency market has been notably steady around the halving, with Bitcoin’s price action maintaining a level trajectory.

Despite stagnant price movements, institutional investors continue to show strong enthusiasm for Bitcoin ETFs. Together, these financial products have accumulated more than 532,342 BTC, valued at over $35.13 billion—a milestone that took gold ETFs several years to reach.

Notably, BlackRock’s IBIT alone has gathered 273,596 BTC, with a market value exceeding $18 billion.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, noted that despite the high number of transactions, the actual share of total holders remains minuscule. Reportedly, IBIT has about 60 holders, yet these holders represent just 0.4% of the total shares issued.

“This shows that most of the bites are nibbles but there are a LOT of fish. This in tune with the high daily # of trades as well and our thesis that this is gonna be used like hot sauce for 60/40 ppl, just gonna add a little bit,” Balchunas said.

Moreover, market analysts have noted that the Bitcoin halving, which reduced mining rewards from 6.25 BTC to 3.125 BTC, could potentially trigger a supply shock, given the high demand through ETFs. However, the expected surge in Bitcoin’s price post-halving has yet to materialize.

“Historically, Bitcoin price movements have been fairly muted around the halving itself, but there have been major price run-ups 9 to 12 months post-halving. This could be driven by miners earning less BTC to sell on the market, relative to the demand for Bitcoin coming from ETFs. As such, the halving has been a “buy after the news” event,” Ken Timsit, Managing Director at Cronos Labs, told BeInCrypto.

As the dust settles on the latest halving event, the true impact of sustained investment in ETFs like IBIT will be a key indicator of the cryptocurrency’s role in broader financial strategies.

The post BlackRock Bitcoin ETF Nears 70 Consecutive Days of Accumulation appeared first on BeInCrypto.