As technology reshapes finance, the New York Stock Exchange (NYSE) is pondering a revolutionary move, enabling 24/7 stock trading.

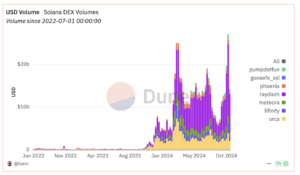

This development mirrors shifts in investment expectations, largely influenced by the nonstop nature of crypto markets.

NYSE Conducts Survey to Discuss Allowing 24/7 Stock Trading

The NYSE has launched a survey through its data analytics team. This survey gathers market stakeholders’ views on trading major stocks like Nvidia (NVDA) or Apple (AAPL) round-the-clock.

This interest in round-the-clock trading stems from changes in retail investor activity sparked by the coronavirus pandemic. Retail trading platforms like Robinhood and Interactive Brokers already offer 24-hour weekday trading. They facilitate this through internal matching or via dark pools such as Blue Ocean, which often involve transactions with Asian markets during their daytime hours.

Read more: How to Buy and Sell Crypto on Robinhood: A Step-by-Step Guide

Unlike these existing setups, an official 24/7 exchange would mark a significant evolution. Such an exchange would be under strict regulatory oversight by the Securities and Exchange Commission (SEC), ensuring transparency and security. Moreover, it would integrate all trades into the official “tape,” influencing opening prices in the regular trading sessions.

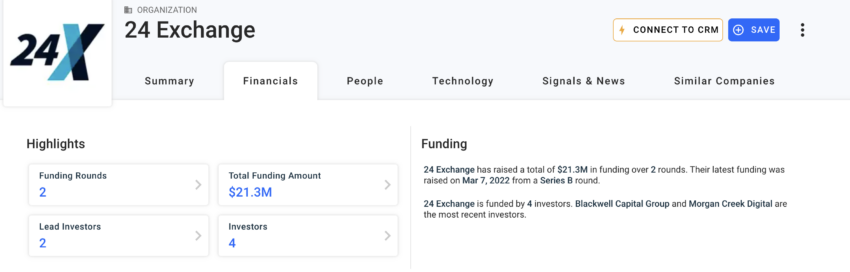

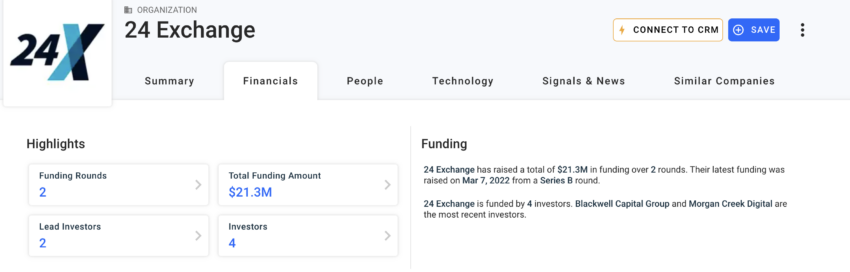

Amidst this backdrop, the startup 24 Exchange (24X) is emerging as a significant player. Initially launched as a crypto trading platform, 24X announced in June 2023 that it would cease its crypto spot products due to falling market demand.

Pivoting from its original focus, the company now aims to facilitate 24/7 equity trading, led by CEO Dmitri Galinov. He believes the demand for nonstop crypto trading will extend to major equities.

This strategic shift is supported by substantial investments, including more than $14 million raised in 2021 in a funding round led by Steve Cohen’s Point72 Ventures. Then, in March 2022, 24X raised $7 million through a Series B round led by Morgan Creek Digital.

Transitioning to a 24/7 trading model poses several challenges, including liquidity concerns and settlement risks. Currently, overnight trades are limited to “limit” orders, where trades execute if specific price conditions are met; otherwise, they expire by morning.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2024

“I’m in favour of letting the market decide. If it succeeds, we’re all better off and if it doesn’t, well, the exchange’s investors lost,” James Angel, a finance professor at Georgetown University, told FT.

Despite these complexities, cautious optimism surrounds the potential shift. Aligning stock trading hours more closely with global markets and the continuous operation of crypto could significantly enhance investor engagement.

The post New York Stock Exchange Considers 24/7 Trading to Match Crypto Markets appeared first on BeInCrypto.