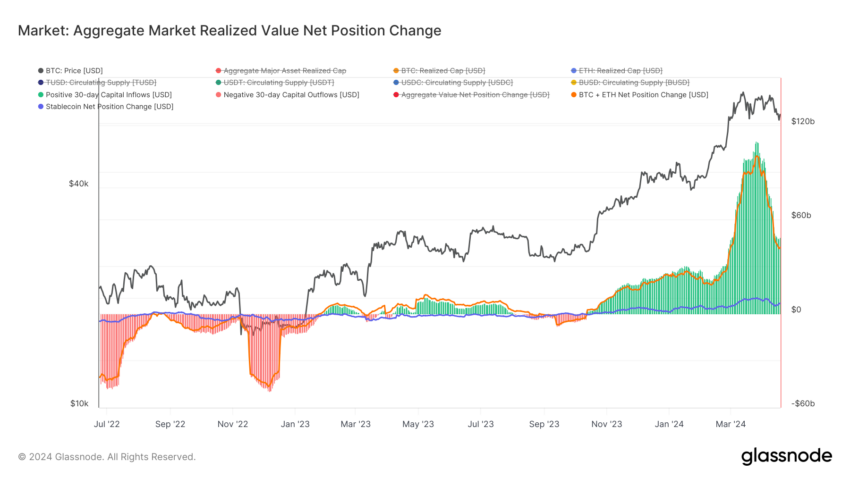

In an extraordinary display of market volatility, the cryptocurrency market saw a staggering $5.55 billion in long and short positions liquidated this April. This was primarily triggered by the mounting speculation around the Bitcoin halving event.

This tumultuous period serves as a fertile ground for crucial insights and strategic adaptations in investment practices.

Volatility Strikes Pre-Bitcoin Halving

Rossmarie Davila, a seasoned crypto financial advisor, gave BeInCrypto insights into the best practices for navigating these turbulent times.

When constructing an investment portfolio, she suggests having a clear objective for each asset on a short and long-term basis. Davila highlights the importance of a well-defined strategy as Bitcoin’s inherent volatility demands a nuanced approach.

Indeed, this year’s halving has already significantly influenced Bitcoin’s market, driving prices to an all-time peak of $73,737 in March. However, the subsequent weeks brought volatility, with Bitcoin experiencing a sharp 20% price correction and some altcoins plummeting by over 70%.

Given the high volatility, Davila strongly advises newcomers to the cryptocurrency market to proceed with caution.

“The best thing to do is not to panic and rush out to buy like crazy, because Bitcoin is volatile. I think a good advice is to allocate a fixed amount each month and buy at the average price, and in the meantime, see how you feel about these highly volatile investments. With a clear strategy, market noise should not cause me anxiety,” Davila told BeInCrypto.

Read more: Crypto Portfolio Management: A Beginner’s Guide

She also notes the psychological dynamics at play, particularly post-halving. The reduced Bitcoin supply invariably leads to price increases due to demand — classic supply and demand dynamics. If an investment portfolio aligns with expectations, it is recommendable to maintain one’s course.

Otherwise, Davila suggests investors should consider reallocating or increasing holdings after price corrections, but never during peak values. It is important to remember that the crypto market is influenced by many external factors and is difficult to predict with certainty. Still, following previous Bitcoin halvings, price typically stabilizes after an initial surge as capital flows into altcoins.

Managing Emotions and Expectations

Addressing the impact on investors, especially novices, Davila emphasizes the potential psychological strain. Reduction in Bitcoin supply can cause anxiety among newcomers, compounded by frequent and sensational news coverage. This fear of missing out can drive ill-considered decisions.

She points out that market sentiment, as gauged by the fear and greed index, currently indicates “greed,” suggesting an overvaluation and a potential forthcoming correction. Even with the halving and the debut of spot Bitcoin exchange-traded funds (ETFs), “the analytical approach should remain the same,” advises Davila.

Finally, She discusses operational tactics for different investment horizons. For speculative short-term holdings, for instance, she believes it is critical to utilize reputable platforms with significant daily trading volumes and user engagement. For long-term holdings, secure storage in cold wallets is advisable.

Read more: Top 11 Platforms To Trade the Cheapest Cryptocurrencies

As the conversation about cryptocurrencies continues to evolve, Davila sees Bitcoin’s utility in transactions and its broader acceptance as a legitimate financial asset only increasing, especially as regulatory landscapes adapt.

The post $5.55 Billion Crypto Liquidations in April: Financial Advisor Explains Lessons to Learn appeared first on BeInCrypto.