The fate of spot Ethereum (ETH) exchange-traded funds (ETFs) hangs in the balance as the US Securities and Exchange Commission (SEC) inches closer to its decision deadline in May. Leading voices in the industry anticipate rejection of these investment products.

Jan van Eck, CEO of the asset management firm VanEck, recently voiced his skepticism regarding the SEC’s likelihood of approving spot Ethereum ETFs.

VanEck Expects Rejection Despite Being the Early Applicant

During an interview with CNBC at the Paris Blockchain Week in France, Jan van Eck revealed that they were the first to file for Ethereum in the US, along with Cathy Wood, the CEO of Ark Invest. He also mentioned that both of them will probably be rejected in May.

“The way the legal process goes is the regulators will give you comments on your application, and that happened for weeks and weeks before the Bitcoin ETFs — and right now, pins are dropping as far as Ethereum is concerned,” van Eck explained.

Read more: How to Invest in Ethereum ETFs?

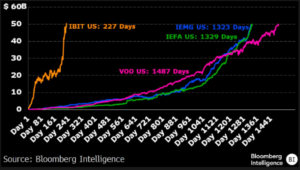

VanEck isn’t alone in its pessimism. Industry analysts like James Seyffart and Eric Balchunas of Bloomberg Intelligence echo the sentiment. Balchunas himself slashed his approval odds from 70% to just 35%.

JPMorgan, however, offers a glimmer of hope. Nikolaos Panigirtzoglou, JPMorgan’s Managing Director, suggested a delay beyond May could usher the SEC into a legal skirmish. This would be reminiscent of past confrontations with Grayscale. Panigirtzoglou posits that the SEC might not emerge victorious if litigation ensues.

The SEC’s stance on Ethereum remains a matter of debate. BlackRock CEO Larry Fink believes the SEC may greenlight an Ethereum ETF even if it considers ETH security, unlike Bitcoin.

Amidst these divergent views, Matt Hougan, Bitwise’s Chief Investment Officer, observes that the SEC appears to be dragging its feet on approving spot Ethereum ETFs. This delay tactic was evident when, in January 2024, the SEC postponed its decision on BlackRock’s iShares Ethereum Trust, followed by similar postponements for Hashdex and ARK 21Shares in March.

Read more: Ethereum ETF Explained: What It Is and How It Works

The SEC consistently cites the need for “sufficient time” to review these proposals in its postponement notices. Hence, this repetitive pattern suggests a reluctance to approve them.

Despite the uncertainty, asset managers remain determined. Industry heavyweights like BlackRock, Fidelity, VanEck, ARK 21Shares, Hashdex, Grayscale, and Franklin Templeton continue to pursue spot Ethereum ETFs.

The post VanEck CEO Anticipates Rejection for Spot Ethereum ETF, Despite Its Early Filing appeared first on BeInCrypto.