The anticipation surrounding Bitcoin’s upcoming halving has sparked a notable shift in investors’ sentiment. Goldman Sachs, for instance, is witnessing a surge in interest from its hedge-fund clients towards the crypto market.

This resurgence in enthusiasm is not limited to the speculative individual investor but extends to the sophisticated institutional investors.

Goldman Sachs Investors Want to Bet on Bitcoin

Max Minton, Goldman Sachs’ Asia Pacific Head of Digital Assets, said that the approval of Bitcoin exchange-traded funds (ETFs) has reignited the spark of interest among the firm’s clients. Many of them are either actively investing in the crypto market or exploring the potential to do so.

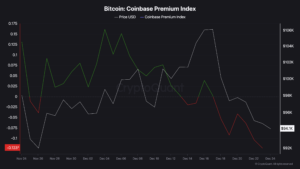

“It was a quieter year last year, but we’ve seen a pickup in interest from clients in onboarding, pipeline, and volume since the start of the year,” Minton said.

Goldman’s current clientele, mainly conventional hedge funds, generate the bulk of interest. Additionally, the institution is broadening its reach to encompass a diverse range of clients. These include asset managers, its own banking customers, and certain firms specializing in digital assets.

Minton mentioned that clients engage with cryptocurrency derivatives to make speculative predictions, enhance yields, and hedge. He also noted that products related to Bitcoin continue to attract the most attention from clients. However, the level of interest in products associated with Ethereum could shift based on the potential approval of Ethereum ETFs in the US.

The impetus for this renewed interest can also be attributed to the forthcoming Bitcoin halving. Scheduled for late April, this event will halve the reward for Bitcoin mining, prompting miners to upgrade to more efficient technology to maintain profitability. This quadrennial update is critical for sustaining the economic model of Bitcoin, with the reward decreasing to 3.125 BTC from the current 6.25.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

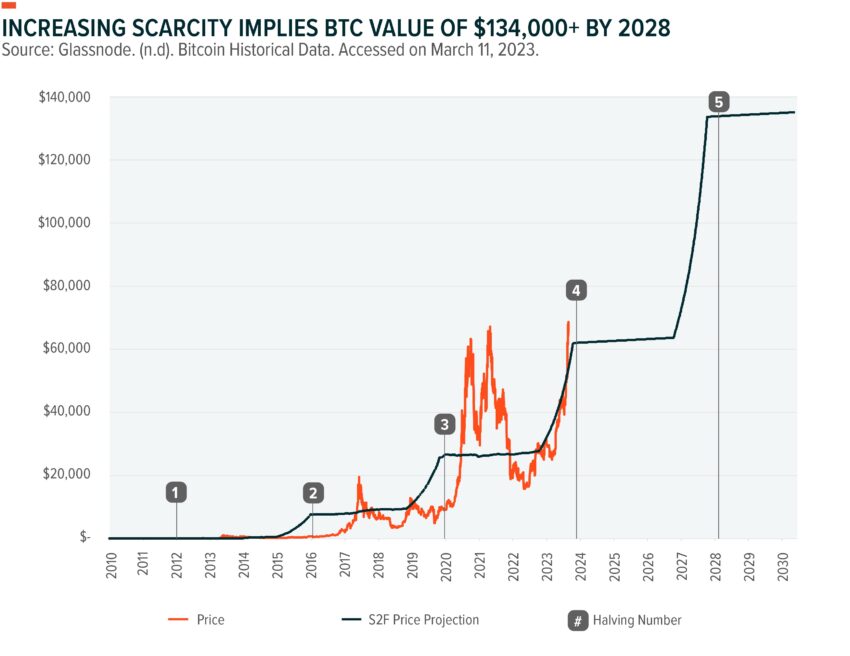

After the 2012 halving, the market capitalization of Bitcoin surged by more than 8,000%. In a similar vein, following the 2016 halving, Bitcoin’s value experienced a more than 1,400% increase. Meanwhile, it saw a rise of over 700% subsequent to the 2020 halving.

Although the stock-to-flow (S2F) model, typically applied to commodities like gold, has its flaws, it serves as one method for assessing Bitcoin’s value. This model has demonstrated a historical correlation with the price fluctuations of Bitcoin. As Bitcoin becomes increasingly scarce, experts project its value will climb from its current price.

“Bitcoin (BTC) is poised for another seismic shift with its next halving event likely in April 2024. Historically, there is a correlation between halving events and subsequent increases in BTC’s price. Based on a stock-to-flow model, BTC could increase to over $130,000 by 2028,” Pedro Palandrani, Researcher at Global X, wrote.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

From trading to blockchain innovation, Goldman Sachs’ engagement with the cryptocurrency market reflects a broader institutional acceptance of digital assets. As the halving approaches, the bank’s proactive stance on digital assets, coupled with its clients’ growing interest, represents a pivotal moment in the cryptocurrency market.

The post Goldman Sachs Clients Interested in Bitcoin as Halving Nears appeared first on BeInCrypto.