The fusion of artificial intelligence (AI) and blockchain technology draws substantial interest and investment from venture capitalists.

The first quarter of 2024 has seen a notable influx of funding into startups developing innovative AI-blockchain solutions. This signals a resurgence of confidence in the crypto market following the introduction of Bitcoin exchange-traded funds (ETFs) in January.

Millions Flow Into AI Tokens

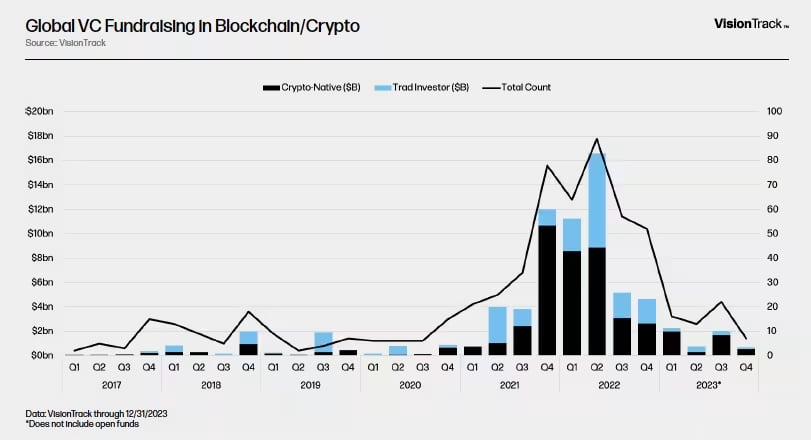

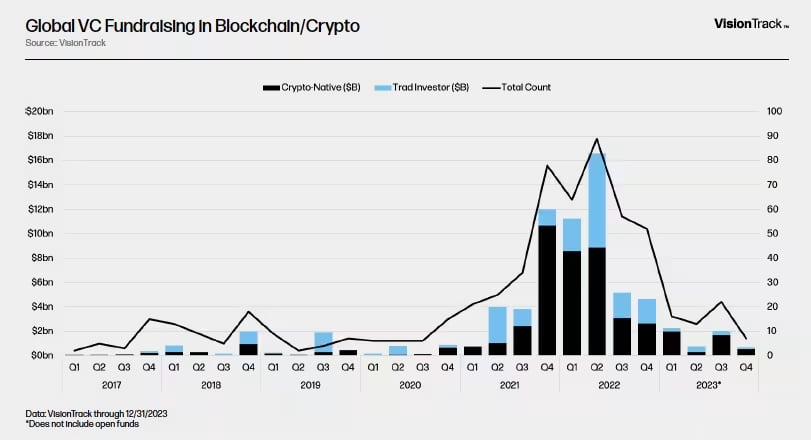

The recent trend reflects a significant recovery from the downturn experienced in 2023. At the time, venture capital in the crypto and blockchain sector declined to $5.75 billion across 58 funds. According to Galaxy Digital, this was a stark contrast to 2022’s record-breaking $37.7 billion across 262 funds.

The last quarter of 2023 marked a pivotal moment with a 2.5% increase in venture funding, reaching $1.9 billion. This was the first growth in crypto startup investments since early 2022.

This rejuvenated interest is largely attributed to developing solutions integrating AI with blockchain technologies. Therefore, building products that cater to institutional investors new to the crypto market. Startups such as Utila, Synnax, Sahara, the TON Foundation, UXLINK, and TEN have successfully secured funding, showcasing the wide array of applications and potential of AI-blockchain integrations.

Read more: Venture Capitalists Explain How to Pitch Your Crypto Project to Raise Capital

Utila, an enterprise-focused wallet provider, recently announced an $11.5 million seed funding round. It attracted investors with its self-custody wallet platform that supports a multitude of chains. The platform has already seen over $3 billion in transactions, demonstrating significant traction among institutional investors.

Similarly, Synnax raised $1 million in pre-seed funding for its credit intelligence platform. It aims to establish a transparent and unbiased credit rating standard for the digital asset industry. This initiative reflects the growing demand for more reliable and decentralized financial services.

Sahara’s $6 million seed funding round, led by Polychain Capital and joined by other notable investors, will bolster its efforts to develop a decentralized AI network. This network facilitates the creation of Knowledge Agents (KAs) capable of autonomously analyzing data. This is a breakthrough in making AI more accessible and applicable across various sectors.

Moreover, the investment in AI tokens is gaining momentum, as evidenced by Mirana Ventures’ $8 million purchase of Toncoin and the growing market cap of AI coins, now estimated at around $26.52 billion. This surge is driven by the diverse use cases of AI in the crypto market, from decentralized AI marketplaces to AI-powered portfolio management and beyond.

AI Cryptos to Keep an Eye On

Amid this resurgence, certain AI tokens have caught the eye of savvy investors and analysts alike. Crypto analyst Rekt Fencer highlighted the rise of AI in the crypto market, reflecting a diverse range of projects leveraging AI technology to pioneer innovations within the industry.

According to Fencer, the combined market cap of AI coins is a testament to their growing significance and potential.

“AI’s rise in the crypto market is unstoppable. Many AI crypto projects are emerging, utilizing AI technology to innovate and transform the industry. As AI and blockchain infrastructure continue to develop, it is only a matter of time before they intersect and AI starts interacting with blockchains directly. Moreover, the Nvidia GTC (GPU Technology Conference) serves as a key driver for AI tokens, attracting top industry figures,” Fencer explained.

He also has spotlighted several AI projects that exemplify the potential within this space. Fencer advised investors not to “overlook this trend” and to “seize the opportunity it presents.”

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

Sleepless AI emerges as a blockchain-based virtual companion game supported by industry giant Binance. It offers an engaging platform where users interact with AI-driven characters, blending entertainment with cutting-edge technology. With a market cap of $282.7 million, Sleepless AI’s success points to the potential of AI in creating immersive user experiences.

Transitioning from gaming to infrastructure, Oraichain stands out as a blockchain ecosystem for decentralized AI, aiming to provide a secure and transparent foundation for AI applications. This approach to decentralized AI services has captivated investors, as evidenced by its market cap of $271.6 million. Oraichain’s role in enabling the deployment of AI services with enhanced security highlights the versatility of AI blockchain integrations.

Similarly, AIOZ is redefining content delivery through its decentralized network that integrates AI computing, data storage, and Web3 video streaming. Known for its DePIN narrative, AIOZ addresses efficiency and cost challenges in media consumption, boasting a significant market cap of $935.2 million. This project exemplifies the transformative impact of combining AI with blockchain on traditional industries.

More Artificial Intelligence Coins

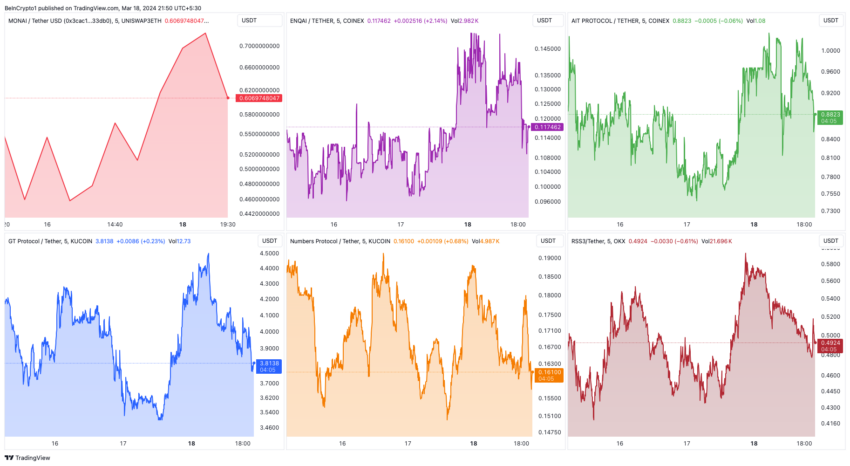

Rekt Fencer also mentioned Monai because it is designed to speed up research and clinical cooperation in medical imaging. The objective is to quicken the rate of innovation and clinical application. It creates a strong software infrastructure that supports nearly all aspects of medical imaging, from deep learning research to practical implementation. Its approach to generative AI technology and a market cap of $16.1 million reflects the project’s potential.

In the sector of ethical AI, enqAI (previously noiseGPT) aims to deliver uncensored, unbiased AI solutions. Focusing on transparency and fairness, enqAI tackles the issues of bias in AI, which resonates across the tech industry. With a market cap of $133.3 million, enqAI’s commitment to ethical AI development is gaining traction.

According to Fencer, AIT Protocol advances the conversation by emphasizing data annotation and the training of AI models within Web3 data infrastructure. Recognizing the importance of high-quality data in AI development, AIT Protocol’s solution, reflected in its $55.4 million market cap, is paving the way for sophisticated AI applications across various sectors.

Read more: 13 Best AI Crypto Trading Bots To Maximize Your Profits

Further blending AI with financial technology, GT Protocol offers AI-driven solutions for portfolio management, trading, and investments across CeFi, DeFi, and NFTs. Its platform showcases the potential of AI to revolutionize financial services, as evidenced by a market cap of $32.9 million.

Numbers Protocol addresses the pressing issue of content authenticity through a decentralized network that provides content verification. In an era marked by concerns over digital content’s integrity, Numbers Protocol’s blockchain-based solutions, supported by a $109.7 million market cap, offer a promising approach to ensuring trust in digital media.

Lastly, RSS3 aims to evolve the traditional RSS standard. It proposes a more dynamic and user-centric method for content syndication in the decentralized web. With a market cap of $299 million, RSS3’s efforts to innovate content distribution highlight the ongoing evolution of internet technologies.

These AI tokens represent a facet of the growing synergy between AI and blockchain technology. As venture capitalists continue to explore these innovative projects, the evolution of AI tokens could shape the future of technology and investment.

The post Venture Capitalists Pour Millions Into AI Tokens appeared first on BeInCrypto.