Chainlink’s (LINK) financial trajectory is turning heads, as its Cross Chain Interoperability Protocol (CCIP) revenue has soared by 180% in two months.

This surge, driven by the escalating adoption of its multichain bridging platform, positions LINK for a potential climb to the $200 mark.

Is Chainlink (LINK) Price Poised for 10X Surge?

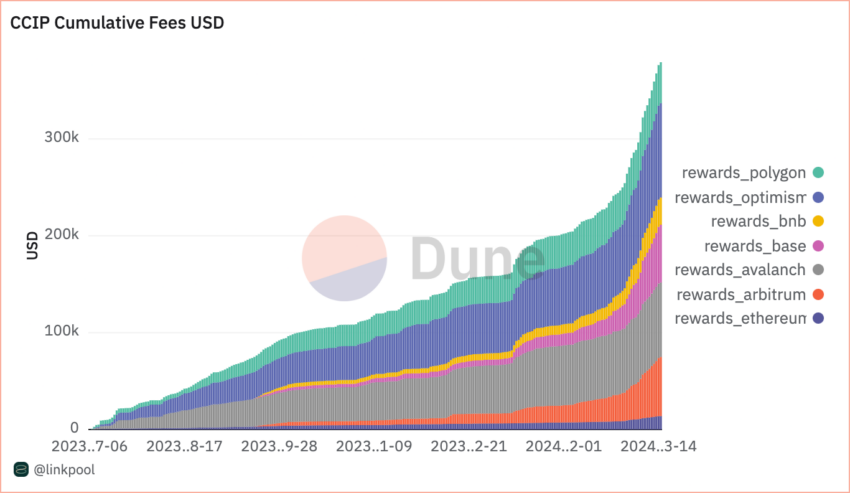

In a financial upturn, CCIP’s fee revenue leaped from approximately $61,728 in January to an impressive $174,000 in the first half of March. Dune Analytics reports that since its launch in July 2023, the protocol’s total revenue has hit $380,818.

Analyzing fee contributions, the Ethereum layer-2 protocol Arbitrum leads at 28%, closely followed by the Base at 24%. Consequently, Chainlink’s strategic moves have paid off, enhancing its financial and operational footprint.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

Community ambassador “ChainLinkGod” highlighted that CCIP fees are designed to cover transaction gas costs and pay service providers. Furthermore, Chainlink’s strategic integrations have spiked adoption.

These include partnerships with the Metis layer-2 network, auditing entity Code4rena, stablecoin firm Circle, and a significant alliance with South Korean game developer Wemade.

Moreover, the collaboration with SWIFT in 2022 for a token transfer project underscored Chainlink’s expanding influence. The essence of CCIP is facilitating secure data access for smart contracts, ensuring reliable off-chain and blockchain connectivity through a decentralized Oracle network.

The price dynamics of Chainlink mirror its strong market presence, peaking at $22.86 on March 11, a two-year high. Currently, LINK tests the $18.26 support level, derived from an inverse head and shoulder pattern on the weekly chart. If it holds above this support, a gradual rise to its May 2021 high of $53 is plausible.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

However, the community outlook is even more bullish. Analyst Satoshi Flipper predicts a massive uptake of CCIP, which could catapult LINK to the $200 region. This represents a significant increase from current levels, underscoring CCIP’s revenue growth as a catalyst for Chainlink’s potential price surge.

“You’re completely ignoring the massive adoption CCIP is undergoing right now. Chainlink is the most important tech in this entire space,” Satoshi Flipper said.

The post How Chainlink Is Banking on Interoperability appeared first on BeInCrypto.