Amidst a vigorous crackdown on a $300 million Ponzi scheme, the US Securities and Exchange Commission (SEC) faces unexpected digital disruptions. These issues compound the challenges of addressing extensive financial fraud.

The SEC’s recent legal actions against individuals associated with CryptoFX LLC spotlight the gravity of these scams. This company is implicated in a scheme that mainly defrauded Latino investors.

SEC Takes Action Against Alleged Crypto Ponzi Scheme

In a sweeping move, 17 individuals from various states, including Texas and California, were charged. They allegedly promoted unregistered investments and operated without broker registration.

This expansion of the legal battle follows the 2022 case against CryptoFX’s leaders, Mauricio Chavez and Giorgio Benvenuto. They reportedly swindled over $12 million from investors.

Eric Werner of the SEC’s Fort Worth office revealed the investigation’s depth, which unearthed the broader scam. The fraud involved enticing investors with high crypto and foreign exchange trade returns. However, these promises were hollow, with funds diverted for personal use and to perpetuate the Ponzi scheme.

“In the end, the only thing that CryptoFX guaranteed was a trail of thousands upon thousands of victims stretching across 10 states and two foreign countries,” SEC enforcement head Gurbir Grewal said.

The SEC’s resolve to dismantle this fraudulent operation is evident. Consequently, several defendants have settled, paying significant sums without admitting guilt.

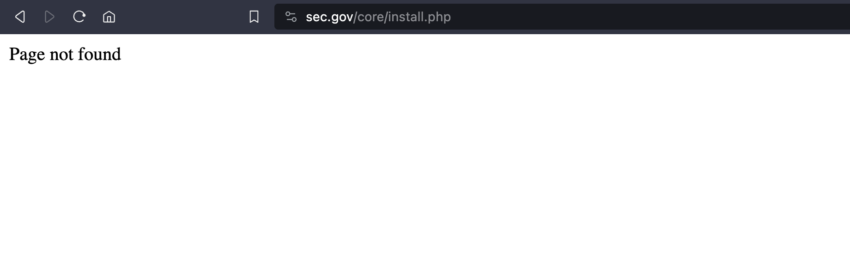

Meanwhile, the SEC’s website encountered troubles, notably a website outage. This sparked speculation about a cyber-attack, recalling the SEC’s prior security breaches. During press time, the official website shows, “Page not found.”

Read more: Crypto Project Security: A Guide to Early Threat Detection

In January 2024, the SEC suffered a SIM swap attack, compromising its X (Twitter) account. Consequently, this breach misled the public about a Bitcoin ETF approval, triggering market upheaval.

The incident revealed the SEC’s vulnerabilities, particularly the disabled multi-factor authentication on its X account.

The post SEC’s Website Goes Down While it Fights a Crypto Ponzi Scheme appeared first on BeInCrypto.