The likelihood of a spot Ethereum (ETH) Exchange-Traded Fund (ETF) getting the green light from regulators has dwindled to 36%. This sharp decrease in approval odds has tempered the enthusiasm within the cryptocurrency community.

It comes after the landmark approval of spot Bitcoin ETFs in January 2024, which initially sparked hope for similar advancements for Ethereum.

Ethereum Hits $4,000 Amidst Declining Chances of ETF Approval

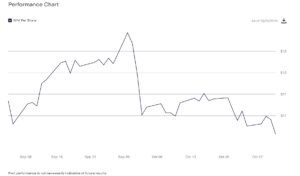

Interestingly, Ethereum’s market performance has been notable, breaching the $4,000 mark on March 11. The increase in Ethereum’s value is tied to anticipation around its upcoming Dencun upgrade and the speculative approval of its spot ETF by the United States Securities and Exchange Commission (SEC).

However, this optimism now faces a reality check. Prediction platform Polymarket shows a 36% chance of an Ethereum ETF approval. It is worth noting that earlier on March 11, the chances dropped to 24%.

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

Recent insights suggest a shift in the SEC’s stance, especially under Chairman Gary Gensler’s leadership. The SEC seems to show a different level of engagement in discussions about Ethereum ETFs compared to Bitcoin.

According to Fox Business journalist Eleanor Terrett, political influences, particularly from figures like Senator Elizabeth Warren, have introduced additional scrutiny. Terrett’s sources mentioned that Warren has been vocal about her concerns with the SEC’s approach to Bitcoin ETFs. This could influence the regulator’s caution towards Ethereum products.

“I’m told that Gary Gensler believes he already placated the industry with the approval of the Bitcoin spot ETFs. Also, influential anti-crypto politicians like Senator Warren are already angry at the SEC for approving the Bitcoin ETFs in the first place and are rallying against the same thing happening for Ethereum ETFs,” Terrett said.

Moreover, the SEC has delayed its decision on various Ethereum ETF proposals, including those from industry giants BlackRock and Fidelity. Such postponements contribute to the prevailing uncertainty despite being anticipated by some market analysts. These delays reflect the SEC’s skepticism, reminiscent of its initial hesitation with Bitcoin ETFs.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Finally, the crypto community eagerly awaits the deadline of May 23, which can be an inflection point for Ethereum’s adoption into mainstream finance.

The post Ethereum Breaks $4,000 Despite ETF Approval Odds Dropping to 36% appeared first on BeInCrypto.