Frax Finance is considering a pivotal shift in its revenue-sharing strategy. The project disclosed the potential for stakers of its native token, FXS, to enjoy a share of protocol fees.

This approach mirrors the successful model adopted by the leading decentralized exchange (DEX), Uniswap, which has significantly engaged its community.

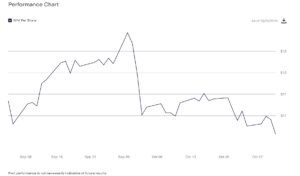

FXS Token Surges 16% in Anticipation of Revenue Sharing Model

The decentralized finance (DeFi) protocol, Frax Finance, uses the FXS token for governance and utility within its ecosystem. When users lock FXS, they receive veFXS tokens. These tokens retain their utility and grant governance rights.

Notably, the protocol allows the staking of veFXS tokens on the Ethereum mainnet and Frax Finance’s dedicated Layer 2, Fraxtal. The project’s proposal aims to incentivize veFXS stakers by sharing protocol revenue, which could redefine stakeholder engagement within the platform.

“Should veFXS holders vote to distribute Frax Protocol revenue back to veFXS stakers again? Frax Finance makes 8 figures of annual revenue and growing, mostly being conserved in the treasury now. Time to turn it back on?,” Frax Finance wrote.

The reaction to the announcement was immediate. The value of FXS surged by over 16% within hours, underscoring the market’s enthusiasm for revenue-sharing models. Although there was a subsequent 5% drop from its peak, the initial surge highlighted the community’s positive reception.

“I would fully support this. It’s one thing to be defensive in a bear and use funds to increase the Collateral Ratio. It’s another thing when it’s a bull. High APR, more people lock and stake, more demand for FXS, and repeat. This is on top of FXTL points, making FXS even more attractive,” Frax Finance’s Core Advocate, DeFi Dave said.

Read more: APR vs. APY in Crypto: What Are the Major Differences?

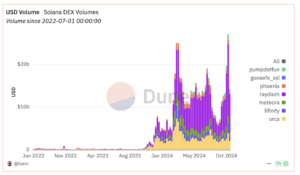

Last week, Uniswap floated a similar idea, proposing that holders of its UNI token who stake and delegate their tokens should receive a portion of the DEX’s fee earnings. The proposal propelled UNI’s value by an impressive 60%. Moreover, this ripple effect was felt across the broader sector, with other DeFi tokens surging in value.

Uniswap’s new governance framework is designed to encourage active participation by rewarding UNI token holders for their engagement. This initiative is critical to ensuring the protocol’s sustainability and growth.

The post This DeFi Protocol Wants to Share Revenue With Stakers Like Uniswap appeared first on BeInCrypto.