Saifedean Ammous, author of The Bitcoin Standard, informed his 319,200 followers on X (formerly Twitter) that a family member brought up the point that Bitcoin outperforms the investments the financial advisor suggests, prompting the advisor to admit that he merely sells strategies.

However, the financial advisor confessed that he personally prefers investing in Bitcoin.

Bitcoin Standard Author Questions Financial Advisor Bitcoin Reluctance

In a recent X post, Ammous recounted the response the financial advisor gave to his cousin when questioned about traditional financial investment strategies, asserting that Bitcoin surpasses them all and “doesn’t necessitate any fees or active management.”

“Financial advisor: Good point. To be honest, that’s what I do with my own money, but it’s my job to sell these strategies.”

Multiple replies flooded the post, including one X user who confessed to being expelled from several financial advisory Facebook groups merely for mentioning Bitcoin.

Read more: Bitcoin Price Prediction 2024/2025/2030

Another X user revealed that this was the primary reason for their departure from the financial advising profession. They expressed their reluctance to recommend products they knew were not as high-performing as Bitcoin, citing a desire to maintain ethical integrity.

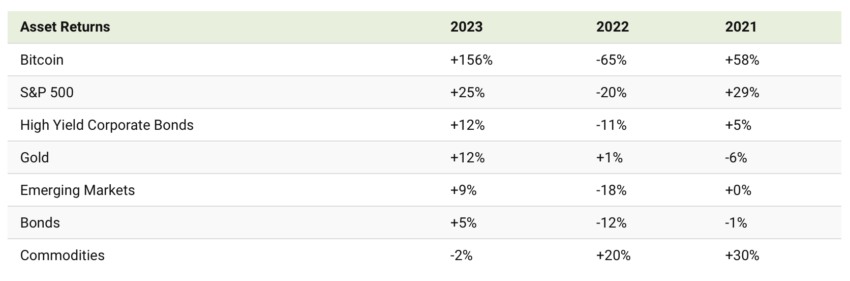

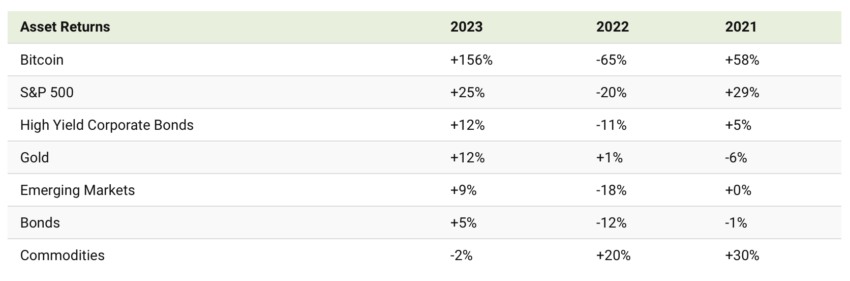

BeInCrypto recently reported Bitcoin’s outperforming results compared to other world assets. On an annual basis, in bullish years, BTC generated profits ranging from 37% (2015) to as much as 5516% (2013).

Despite experiencing a significant downturn in 2022, one of the worst bear markets for the crypto industry, Bitcoin continues to outperform with its average annual returns.

Experts Forecast Continued Growth in Bitcoin Returns

Crypto analysts foresee no signs of Bitcoin slowing down in terms of its returns anytime soon.

On February 22, BeInCrypto reported that Bitcoin expert Max Keiser predicts a surge in Bitcoin value beyond $500,000.

Read more: What Is A Bitcoin ETF?

This comes as he foresees a US stock market crash of unprecedented scale reminiscent of the late 1980s.

According to Keiser, the market is overripe for a correction. He cited data from The Kobeissi Letter, showing a worrying concentration in top stocks not seen since the Great Depression. This signals a market teetering on the edge.

![]()

Coinbase

Explore →

![]()

PrimeXTB

Explore →

![]()

AlgosOne

Explore →

![]()

UpHold

Explore →

![]()

iTrustCapital

Explore →

Explore more

The post Bitcoin Standard Author Exposes Financial Advisor’s Hypocrisy Toward BTC appeared first on BeInCrypto.