Coinbase, the renowned crypto exchange, has surpassed Wall Street expectations, reporting a stellar fourth-quarter revenue that left analysts’ predictions in the dust.

The crypto market rally in the fourth quarter has positively impacted the company’s revenue reports.

Coinbase Turns Profitable

Coinbase’s net revenue soared by 45.2%, hitting $905 million in the last quarter and surpassing the expected $825 million. Notably, Q4 2023 marked a significant turnaround. The crypto company reported a net income of $273 million, moving away from a $2 million loss in the previous quarter. This marks the first profitable quarter since Q4 2021.

Transactional activity is at the heart of Coinbase’s success. Consumer crypto trading alone brought in $493 million, almost doubling from the previous quarter. Institutional transaction revenue also saw significant growth, doubling to $36.7 million. The crypto exchange processed over $29 billion in consumer trading volume, a 164% increase from the previous quarter.

Subscriptions and services contributed significantly to the revenues, bringing in $375.4 million. A notable portion came from stablecoin and blockchain rewards, totaling $171.6 million and $95.1 million, respectively.

Coinbase CEO Brian Armstrong pointed out the positive impact of ETFs on the industry, stating they have been “additive for Coinbase.” Furthermore, Armstrong discussed the increasing adoption of cryptocurrencies by large financial institutions. He believes the financial system is officially adopting crypto, with Coinbase leading as the most trusted partner.

“We’ve been named as the custodian in 5 of the 8 [Ethereum] ETF applications,” Armstrong said.

Read more: Gemini vs. Coinbase: Everything You Need To Know

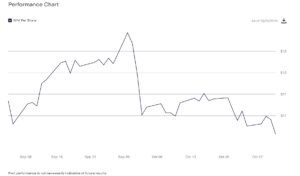

The crypto company’s stock performance reflects investor confidence, with shares up approximately 160% in four months. After the earnings announcement, the stock is trading at $185.45 pre-market. This surge in stock price underscores the market’s positive reaction to Coinbase’s strategic direction and financial health.

Despite Coinbase’s strong performance, an interesting development occurred with ARK Invest CEO Cathie Wood’s decision to sell Coinbase shares. This move came shortly after the company announced its impressive fourth-quarter earnings.

Read more: Who Is Brian Armstrong? A Deep Dive Into the Coinbase Founder

ARK Invest divested 162,762 shares, worth $26.7 million, from its flagship ARK Innovation ETF and ARK Genomic Revolution ETF. This decision sparks curiosity about ARK Invest’s broader investment strategy and its perspective on Coinbase’s future.

![]()

FXGT.com

Explore →

![]()

Bitrue

Explore →

![]()

Coinrule

Explore →

![]()

BYDFi

Explore →

![]()

KuCoin

Explore →

![]()

Kraken

Explore →

The post Soaring Profits: This Crypto Company Outperformed Analysts’ Expectations appeared first on BeInCrypto.