Digital asset management firm Bridgetower Capital has partnered with family office-backed Deus X Capital to launch an institutional-grade crypto platform in the United Arab Emirates (UAE). The new entity will serve institutional needs amid a growing crypto industry in the Middle East.

Bridgetower Capital and Deus X Capital have launched a joint digital asset business in the Abu Dhabi Global Markets District (ADGM).

Bridgetower Offers Crypto Staking & AI in the UAE

The new company, Bridgetower Middle East, will offer institutional crypto-staking with delegated assets. In addition to providing a customizable Web3 platform for digital brands exploring Web3, the new entity will offer Graphics Processing Unit (GPU)-driven artificial intelligence services over blockchain infrastructure.

Bridgetower will also invest venture capital to grow the digital asset industry in the United Arab Emirates and regions in the Gulf Cooperation Council, including Bahrain, Kuwait, Oman, Qatar, and Saudi Arabia. Following the business partnership, Bridgetower Middle East’s board is exploring a possible listing on the Abu Dhabi stock exchange.

Read more: Binance Review 2023: Is It the Right Crypto Exchange for You?

Governments in the UAE have welcomed digital asset firms, with the Dubai and ADGM regions tabling clear regulations. Dubai published a comprehensive blockchain strategy in 2016 and launched its Virtual Assets Regulatory Authority in 2022. The Financial Services Regulatory Authority of ADGM launched its framework in 2018.

Middle East Attracts Crypto Industry With Rules

Stable crypto regulation and a robust market draw the digital asset industry to regions, according to compliance firm Muinmos’ CEO, Remonda Kirketerp-Møller. For now, the Middle East seems to satisfy those criteria.

“Experience has shown that financial institutions seek two things – regulation they can work with, and a robust market – and it seems certain places in the Middle East can provide that,” she said.

Binance sought to move to Abu Dhabi before US authorities mandated a company restructuring to permit its operation. Under its new CEO, Richard Teng, the crypto exchange rescinded the application, saying the firm would explore other opportunities to expand its presence in the Middle East.

Companies that offer mining services are also drawn to the region. As of the middle of last year, Abu Dhabi housed 4% of all the computing power used to mine Bitcoin.

A recent survey by cybersecurity firm Kaspersky revealed that around 77% of Middle East respondents hold crypto. Around two-thirds said they knew how to use their crypto assets.

Read more: Is Crypto Mining Profitable in 2023?

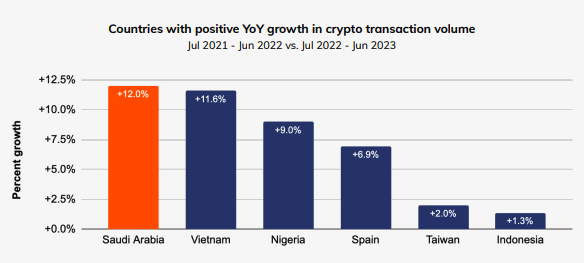

In September, Saudi Arabia ranked the highest in crypto transaction volume between July 2022 and June 2023. At 12% growth, the region’s increase surpassed Vietnam (11.6%), Nigeria (9%), and Spain (6.9%), according to Chainalysis. Moreover, the Middle East was the sixth-largest crypto economy in that period, worth $390 million.

![]()

AlgosOne

Explore →

![]()

Coinrule

Explore →

![]()

PrimeXTB

Explore →

![]()

BYDFi

Explore →

![]()

Сoinex

Explore →

The post Institutional Crypto Presence Expands in UAE With $250 Million Digital Asset Platform appeared first on BeInCrypto.