Top centralized cryptocurrency exchanges, including Binance and Coinbase, witnessed a notable uptick in spot trading activities in January.

Industry experts suggested that the uptrend could be linked to the heightened anticipation of spot Bitcoin ETFs (exchange-traded funds).

Crypto Trading Volumes Soar

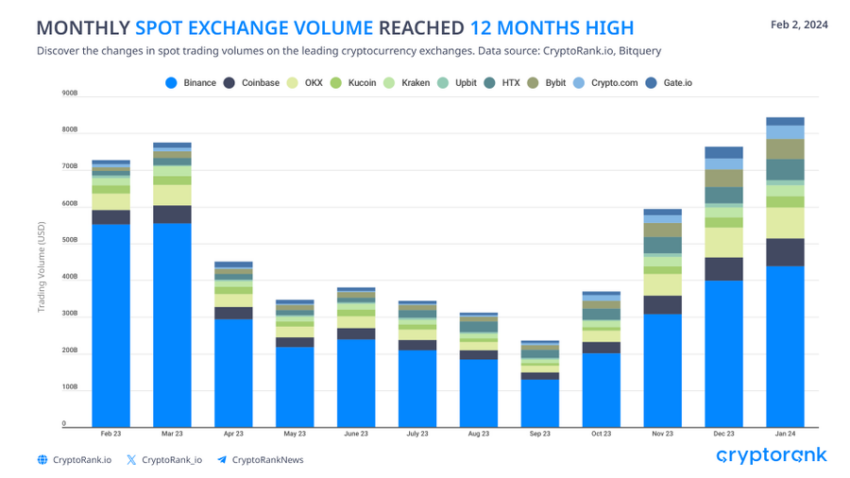

Analysts at blockchain analytics firm CryptoRank observed that trading volumes on centralized exchanges rose 10.4% since December 2023 to a 12-month high of more than $800 billion in January. Interestingly, Binance accounted for $400 billion as it appears to recover from the regulatory challenges it faced across several jurisdictions, including the U.S.

Despite the increasing regulatory scrutiny, Binance remains the dominant trading platform, commanding an impressive 52% of the market.

Read more: 14 Best No KYC Crypto Exchanges in 2024

Coinbase, the largest US-based crypto trading platform, also saw a 20% spike in trading volume, which can be attributed to its pivotal role in the newly launched spot Bitcoin ETFs.

Similarly, platforms like Upbit, Crypto.com, and Huobi demonstrated the most significant growth, rising 44.6%, 28.4%, and 23.8%, respectively. Bybit, Kraken, and OKX also experienced positive growth of 15.0%, 12.1%, and 5.9%, respectively, while KuCoin had the lowest growth rate at 3.3%.

In contrast, Gate.io was the only major CEX reporting a 34% decline in spot trading volume.

Why Is Trading Volume Rising?

The elevated trading activity observed in the previous month extends a positive trend noted since October 2023. Observers primarily linked the improved numbers to the heightened interest surrounding Bitcoin ETFs.

Renowned crypto analyst Al Bert emphasized the robust trading activity throughout January. He attributed this spike to increased user engagement and growth fueled by the SEC’s ETF approval. Al Bert also highlighted the overall improvement in macroeconomic conditions as a critical factor influencing the enhanced market volume.

“The general macro conditions are improving, with Fed likely to cut rates in the first half of 2024. China has already announced an easing, and the ECB will hopefully begin to cut rates soon as well after the strongest economy in the block, Germany, experienced a larger inflation drop than expected,” Al Bert explained.

![]()

PrimeXTB

Explore →

![]()

DeGate

Explore →

![]()

AlgosOne

Explore →

![]()

Wirex App

Explore →

![]()

KuCoin

Explore →

![]()

Margex

Explore →

Explore more

The post This Is Why Crypto Trading Volumes Reached a 12-Month High appeared first on BeInCrypto.