BlackRock’s executive Rick Rieder shares insights on the Federal Reserve’s interest rate plans. Rieder suggests a cautious Fed approach, possibly delaying rate cuts beyond March.

Amidst swirling economic forecasts, BlackRock’s Global Chief Investment Officer of Fixed Income offers a nuanced perspective on the Federal Reserve’s upcoming decisions.

BlackRock CIO Suggests Fed Will Keep Interest Rates Unchanged in March

Rieder believes a March rate cut is premature despite a shift towards a neutral monetary policy. “I still think March is early,” Rieder stated, pointing to the current condition of the US economy. The economy shows significant strength, with a 3.3% growth rate in the fourth quarter of 2023.

“For the Fed to go in March, I think we need some data to show some more tangible slippage in the economy than we’re seeing currently,” said Rieder.

The economic landscape, buoyed by robust employment figures and retail sales, suggests a stronger-than-anticipated underpinning. Despite a retreat from the inflation highs of 2022, Rieder believes the Fed will likely await further data. This is to ensure that inflation is on a sustained downward trajectory.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

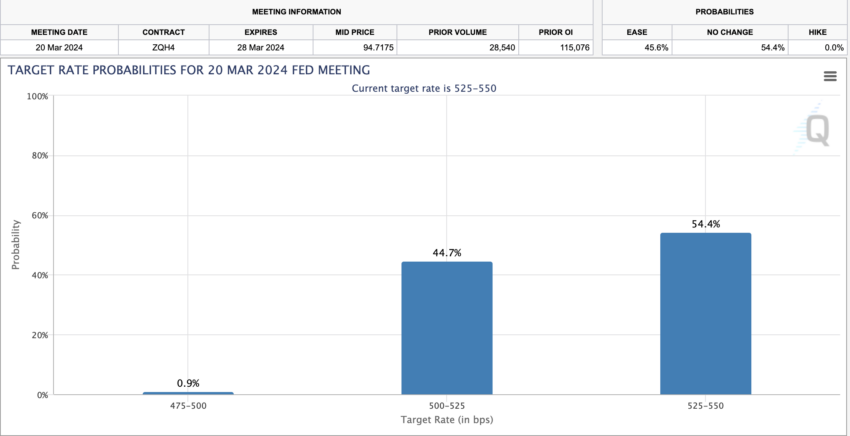

Rieder’s analysis suggests strategic patience on the Fed’s part, with a preference for initiating rate cuts in May, potentially adjusting by 25 basis points bi-monthly. Aligning with Rieder’s thoughts, the screenshot below from CME Group shows a 54.4% probability of the Fed keeping the interest rates unchanged in March.

Contrasting Rieder’s view, Goldman Sachs Group’s economist David Mericle anticipates an earlier start to rate reductions, projecting a March initiation based on sufficient inflation progress. Mericle’s forecast, detailed in a January 29 research note, envisions a total of five rate cuts through 2024.

Read more: Top 12 Crypto Companies to Watch in 2024

“We expect a March cut mainly because progress on inflation is already sufficient. If Fed officials see even modest downside risks to economic activity and the labor market or to inflation, that could also strengthen the case for cutting sooner rather than later,” Mericle said.

Rieder’s insights highlight the Fed’s cautious path amid complex economic dynamics. The next months will be crucial for the direction of US monetary policy and its impact on stocks and crypto markets.

![]()

PrimeXTB

Explore →

![]()

DeGate

Explore →

![]()

AlgosOne

Explore →

![]()

Wirex App

Explore →

![]()

KuCoin

Explore →

![]()

Margex

Explore →

Explore more

The post Will the Fed Keep Interest Rates Unchanged in March? BlackRock Executive Weighs In appeared first on BeInCrypto.