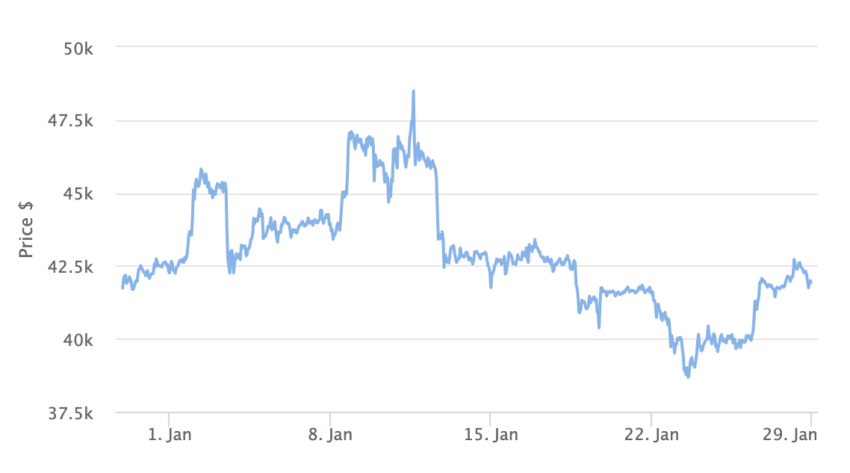

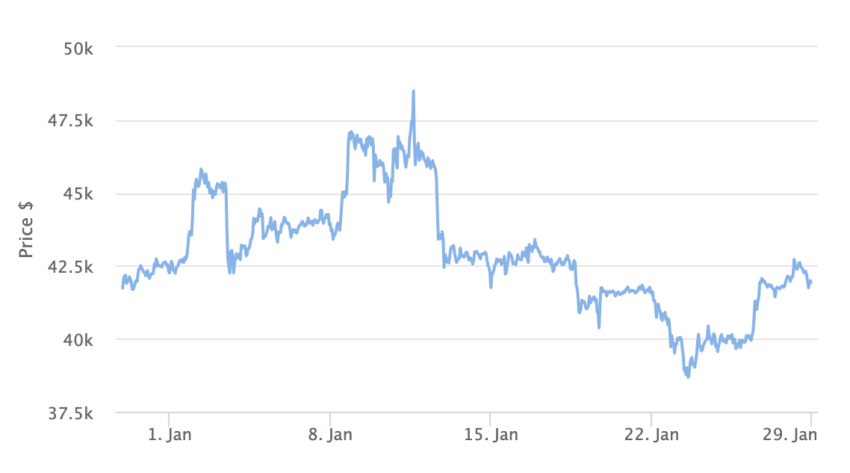

Prominent crypto trader Arthur Hayes looks at the falling price of Bitcoin (BTC) following the launch of the Bitcoin exchange-traded fund (ETF) only two weeks ago, as a “cautionary sign.”

He highlights the correlation between Bitcoin reaching its recent peak and the 2-year US treasury hitting a local low of 4.14% this month, which is currently showing a gradual increase.

Arthur Hayes Short-Term Prediction of Bitcoin Price

In a recent blog post, Hayes refutes the common argument that the reason for Bitcoin’s recent price slump is due to the outflows of the Grayscale Bitcoin Trust (GBTC).

“That argument is bogus because when you net the outflows from GBTC against the inflows into the newly listed spot Bitcoin ETFs, the result is, as of January 22nd, a net inflow of $820 million.”

Meanwhile, BeInCrypto recently reported that since the approval of spot Bitcoin ETFs, Grayscale has seen more than $3.3 billion in outflows.

However, he points to the potential for the Bank Term Funding Program (BTFP) not being renewed as a possible reason for this sentiment from investors.

The BFTP is an initiative created by the US government. It is to ensure that banks have enough liquidity to meet the requirements of businesses and households.

The BTFP renewal decision is set for March 12. Hayes expects Bitcoin’s price to keep decreasing until the decision is disclosed.

However, he foresees a reversal in the trend after the expected decision, anticipating a rise in Bitcoin’s price post-announcement.

“As the SPX and NDX dump due to a mini financial crisis in March, Bitcoin will rise as it will front-run the eventual conversion of rate cuts and money printing talk on behalf of the Fed into the action of pressing that Brrrr button.”

At the time of publication, Bitcoin’s price is $41,921. Bitcoin price short term.

Read more: Bitcoin Price Prediction 2024/2025/2030

Arthur Hayes Long-Term Outlook

Hayes confidently provides specific and optimistic projections when discussing Bitcoin.

In July 2023, BeInCrypto reported that Hayes predicts the decreasing interest rate, crypto halving event, and the launch of spot Bitcoin ETFs would push Bitcoin to $70,000 by the end of 2024. Hayes said:

“That’s when the real fun starts. That’s when the real bull market starts.”

Yet, his optimism extends further to 2026, where he envisions the Bitcoin price reaching a range between $750,000 to $1 million.

Read more: What Is A Bitcoin ETF?

He is not the only one to throw out six-figure price predictions in recent times.

Analytics firm Messari predicted that Bitcoin will reach $600,000 by the end of the year, meanwhile, VanEck predicts $275,000 and ETC Group expects $100,000.

![]()

Prime XTB

Explore →

![]()

DeGate

Explore →

![]()

iTrustCapital

Explore →

![]()

Coinbase

Explore →

![]()

UpHold

Explore →

Explore more

The post Arthur Hayes Forecasts a 30% Short-Term Decline in Bitcoin’s Price appeared first on BeInCrypto.