USD Coin (USDC) and Binance USD (BUSD) have contrasting fortunes. USDC has experienced a notable upward trend, rebounding from the aftermath of the US banking crisis, while BUSD is grappling with a critical shortage in its supply.

This divergence underscores a shift within the stablecoin market, notably influenced by regulatory challenges encountered over the past year.

USDC Market Cap Soars

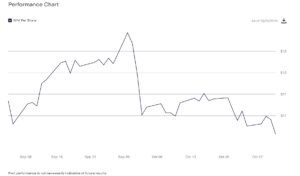

USDC has experienced a remarkable surge in market capitalization at the onset of the new year, riding the wave of favorable market conditions. Recent data from BeInCrypto indicates an impressive uptick of over $1.6 billion. This marks a 6.6% increase and brings the total market capitalization to $26.15 billion.

Corroborating this positive trend, crypto analytical platform CCData reported a consecutive second-month surge in USDC’s market capitalization. This follows a series of eleven consecutive monthly declines, with the stablecoin briefly surpassing the $25 billion market cap milestone in January.

Read more: A Guide to the Best Stablecoins in 2024

Several factors contribute to this upward trajectory. Notably, Circle announced its intention to go public in a recent filing with the US Securities and Exchange Commission (SEC). This disclosure has played a role in bolstering USDC’s market standing.

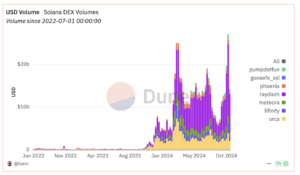

Additionally, USDC has experienced a notable surge in transfer volume, particularly on the Solana blockchain. Data from Artemis reveals that Solana-based USDC is instrumental in driving stablecoins to their highest transfer volume levels in over a year.

Despite these positive developments, USDC’s current supply remains significantly below its all-time high of $45 billion.

BUSD Falls Under $100M

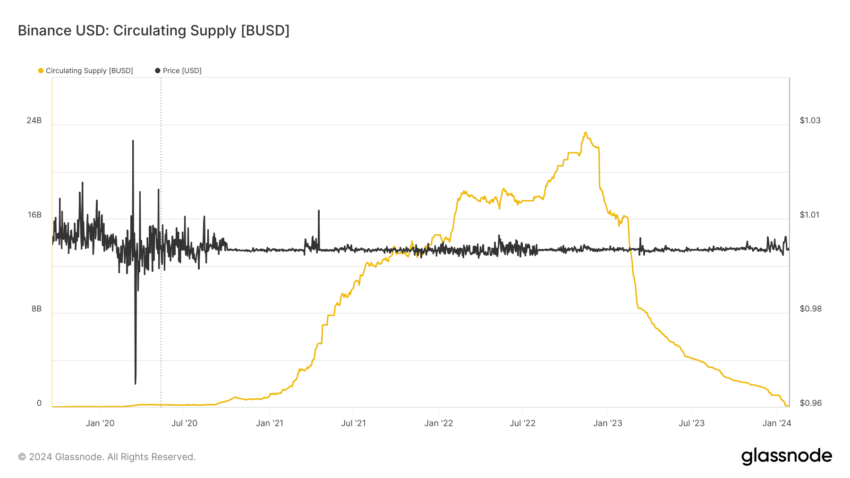

In contrast, the Binance-backed stablecoin, Binance USD (BUSD), has experienced a significant decline in its supply, reaching an unprecedented low of less than $100 million.

The challenges for this stablecoin emerged last year when the SEC issued a Wells Notice to Paxos, the issuer of BUSD, leading to a halt in the creation of additional units of the digital asset. The situation escalated when the federal agency classified the stablecoin as security during its legal action against Binance.

Read more: 7 Best Crypto Platforms To Buy PayPal Stablecoin (PYUSD)

In response to these regulatory developments, Binance initiated a strategic shift, encouraging its users to transition from BUSD to alternative stablecoins such as FDUSD. Also, it discontinued several services associated with BUSD, leading to the total supply to dwindle from a peak of over $20 billion to less than $100 million within just one year.

![]()

Prime XTB

Explore →

![]()

DeGate

Explore →

![]()

iTrustCapital

Explore →

![]()

Coinbase

Explore →

![]()

UpHold

Explore →

Explore more

The post As Regulatory Challenges Diminish BUSD, This Stablecoin Ascends in Dominance appeared first on BeInCrypto.