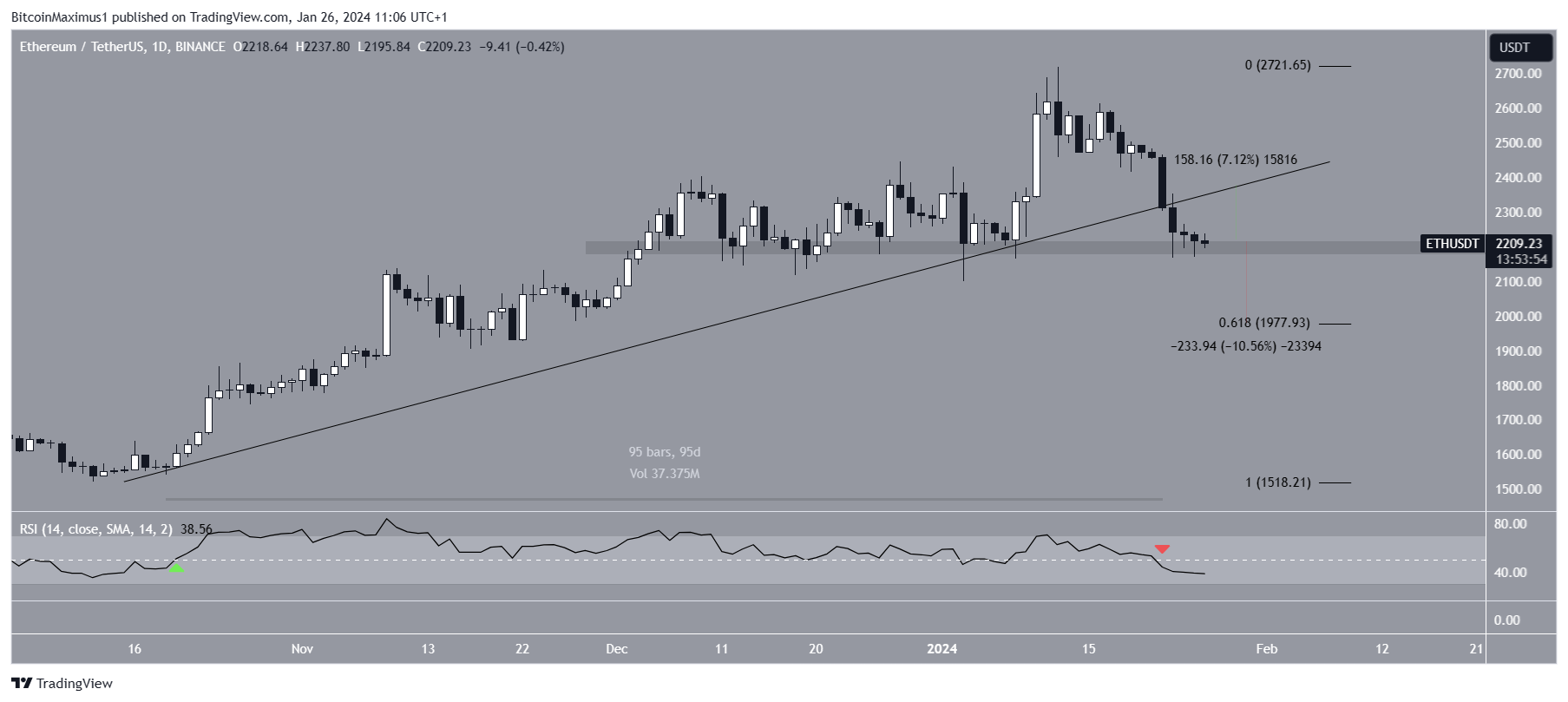

The Ethereum (ETH) price started 2024 with a sharp increase, reaching levels not seen since May 2022. However, ETH has fallen since January 12.

The ETH price trades inside a minor horizontal support area that has been in place for over a month.

Ethereum Loses Footing

The weekly time frame technical analysis shows that the ETH price has increased alongside an ascending support trend line since July. More recently, the price bounced at the trend line in October 2023 (green icon), accelerating its rate of increase.

The ensuing upward movement caused a breakout from a horizontal area in November. Except for a deviation in April (red circle), the area had intermittently acted as support and resistance for nearly 1,000 days.

After the breakout, the ETH price reached a high of $2,717 on January 11, 2024. However, it has fallen since and is creating a bearish candlestick in the weekly time frame.

The weekly Relative Strength Index (RSI) gives a bearish reading. When evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

The indicator generated a bearish divergence (green line) and is falling. This happens when a momentum decrease accompanies a price increase, often leading to trend reversals.

Read More: What Is Wrapped Ethereum (WETH)?

What Are Analysts Saying?

Cryptocurrency analysts and traders on X are uncertain about the future trend. InmortalCrypto stated that the ETH price will fall in the short term but will then increase significantly.

CryptoMichNL suggests that the ETH price will appreciate against Bitcoin (BTC). He tweeted:

The momentum towards $ETH is probably going to come in the next few weeks. Arguments: – #Bitcoin bottoming out is a trigger for altcoins to make a new run. – Ethereum Spot ETF hype. – Ethereum launching new upgrades to reduce 90% of the costs.

However, CredibleCrypto believes that the ETH/BTC pair has not reached its bottom yet and will continue falling.

Read More: How To Buy Ethereum (ETH)

ETH Price Prediction: Will the Support Hold?

The technical analysis of the daily time frame gives a bearish outlook because of the price action and the RSI.

On January 23, ETH broke down from an ascending support trend line that had been in place for 95 days. The daily RSI legitimizes this breakdown since it fell below 50 (red icon) simultaneously with the price breakdown.

The RSI increased above 50 (green icon) when the ascending support trend line was created.

Currently, ETH trades inside the $2,200 horizontal support area. If it breaks down, it can decrease nearly 11% to the 0.618 Fib retracement support level at $1,980.

Despite this bearish ETH price prediction, a strong bounce at the $2,200 support area can trigger a 7% increase to the ascending support trend line at $2,400.

For BeInCrypto‘s latest crypto market analysis, click here.

![]()

Prime XTB

Explore →

![]()

DeGate

Explore →

![]()

Wirex App

Explore →

![]()

KuCoin

Explore →

![]()

Margex

Explore →

Explore more

The post Ethereum (ETH) Faces Crucial Test to Hold $2,200 Support Level appeared first on BeInCrypto.