Recently, the value of Bitcoin fell below $39,000 for the first time since December 3, 2023. This significant drop to below $39,000 is mainly due to the Grayscale Bitcoin Trust (GBTC) selling off its holdings. Despite this, two key factors indicate that the correction phase of Bitcoin might be ending.

The Bitcoin market is showing signs of stability after a prolonged downturn.

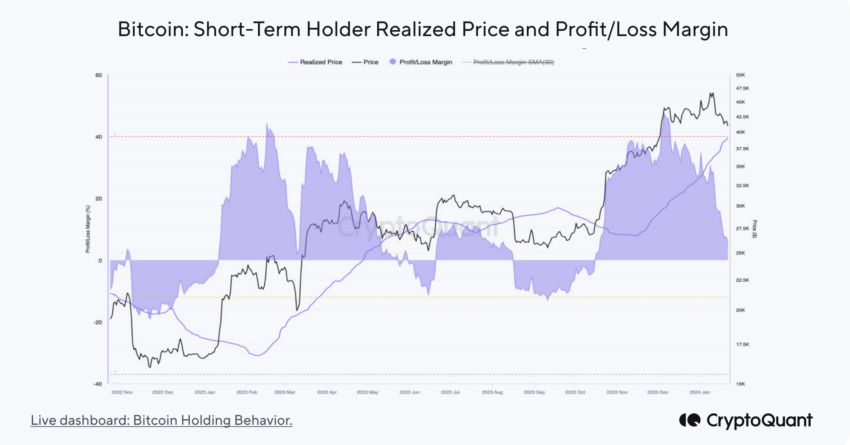

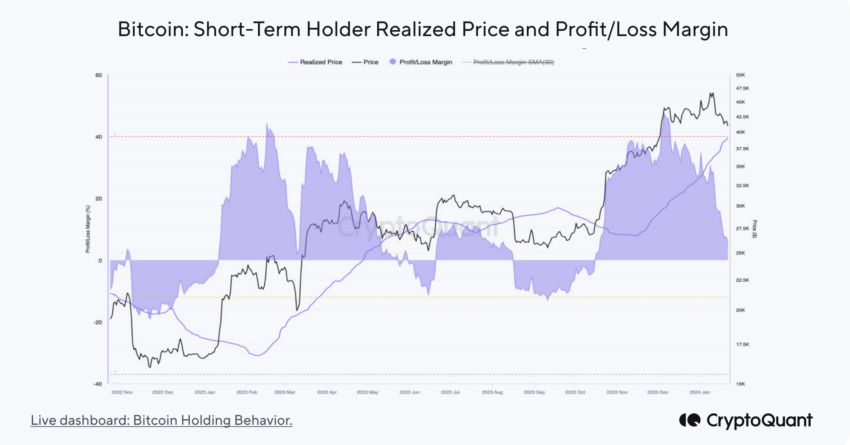

Bitcoin Short-Term Holder Unrealized Profit Margins Approach Zero

Firstly, the behavior of short-term holders is a vital sign. Their unrealized profit margins are nearing zero. However, a confirmed market bottom is typically indicated when these margins reach -10%. According to CryptoQuant, currently, price support is between $39,000 and $37,000. This data suggests potential market stabilization soon.

Read more: Bitcoin Price Prediction 2024/2025/2030

Grayscale’s Selling Pressure Continues to Decline

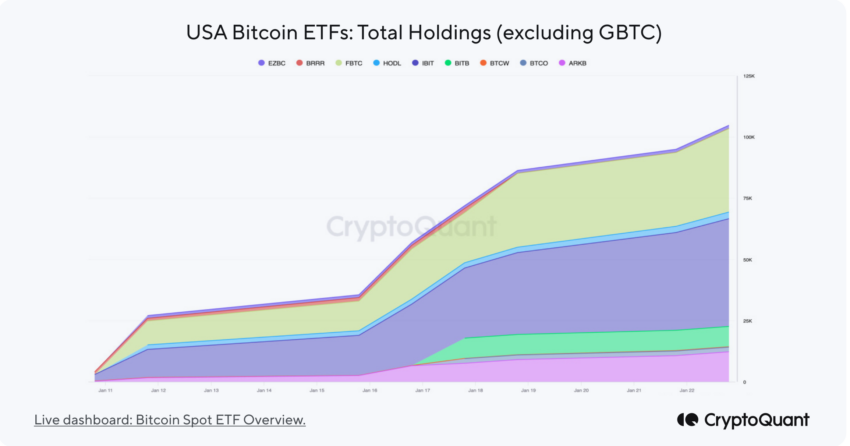

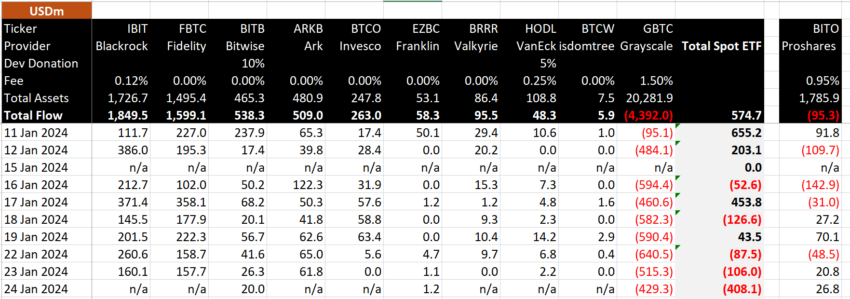

Moreover, there’s growth in the total Bitcoin holdings in US spot exchange-traded funds (ETFs). Despite GBTC’s outflows, other ETFs now hold about 104,000 Bitcoins.

Since launching on January 11, total holdings in US ETFs have reached 641,000 Bitcoins. This includes GBTC’s 537,000 Bitcoins, down from 619,000 at the ETFs’ inception.

Read more: What Is a Bitcoin ETF?

GBTC’s total holdings have decreased to 537,000 Bitcoins, a drop of 82,000. This reduction has influenced the market’s current price pressures.

Finally, GBTC’s selling pressure has been slowing down. BitMEX Research data shows a decline in GBTC outflows. On January 23, outflows were around 19% down from the previous day, totaling $515.3 million. The next day, the decline continued, with a further 16% drop in outflows to $429.3 million.

“GBTC outflows today were ‘only’ $425 million, lowest bleed since day one and seemingly trending down. That said it’s still a pretty large number,” said Bloomberg analyst Eric Balchunas.

This reduction in selling pressure is a crucial indicator for market analysts and investors, which could signal a market reversal. In summary, despite Bitcoin’s volatile nature and various external pressures, these two factors point to a possible end of its correction phase.

![]()

GT Protocol

Explore →

![]()

DeGate

Explore →

![]()

KuCoin

Explore →

![]()

DeepCoin

Explore →

![]()

Wirex App

Explore →

Explore more

The post These 2 Factors Suggest Signs of a Market Correction Phase Ending appeared first on BeInCrypto.