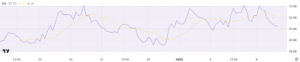

ETH

Ethereum lost over 5% this week as the Securities and Exchange Commission (SEC) delayed an exchange-traded fund (ETF) offering from Fidelity.

After approving eleven bitcoin ETFs in January, the SEC decided to delay a decision on Fidelity’s Ethereum ETF application until at least March.

According to a filing, the regulator wants more time to deliberate on the decision.

“The SEC finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein,” the SEC said.

The move was expected by many after asset manager Fidelity filed its application last November, a month after ETFs for ether futures were approved. The Boston-based firm was making a similar move as rival asset manager BlackRock which also filed a spot ether ETF application. Stuart Barton at Volatility Shares said:

The fact that they allowed listing of the futures-based ETFs is enough to say they are thinking about ether the same way they are thinking about bitcoin and you can infer from that they’re probably thinking it’s not a security and not going to regulate it that way.

Bitcoin ETFs went live earlier this month and have already gained $1 billion from investors. The price action in Bitcoin, which has fallen 4% over the last week, has disappointed many investors who were buying into Bitcoin expecting a surge after the ETF launch.

ETH starts the week looking for buyer support with the $2,200 level as a possible target.

XRP

Ripple’s XRP token had a rough week with losses of over 7.5% as court issues loom.

The SEC vs Ripple case continues to drag on and the regulator may have asked for post-complaint documents to argue a more punitive penalty for XRP sales to U.S. investors and entities. In July, Judge Analisa Torres ruled that Ripple breached Section 5 of the 1933 Securities Act when selling XRP tokens. If the Judge orders Ripple to provide the new documents, further breaches of Section 5 could hurt XRP.

Ripple Chief Legal Officer Stuart Alderoty posted more views about the hearing, saying,

“Last week (in Coinbase), the SEC told the Court that the question is “whether investors are “pooling [their] capital with the promoter’s efforts.” That’s wrong. Howey demands more than investing in efforts. You have to invest in a common enterprise. Revak (2d Cir. 1984).”

“I just want to bring it back to Howey compels us to look at the economic reality of whether investors are giving up their capital and pooling that capital with the promotor’s efforts. That’s exactly what’s being done here.”

The SEC case has been a headwind for the XRP price since it was announced in December 2021. After some recent price gains following the speculative moves of Bitcoin, XRP has given up its advance and now heads for the $0.50 price again.

RON

Ronin (RON) gained 35% this week after additional support was announced for crypto tokens.

Sky Mavis, the creator of the play-to-earn NFT game Axie Infinity, has announced an upgrade to the Ronin blockchain’s crypto wallet. The new features include multichain support, an in-app web browser, a new design, and support for multi-party computation (MPC).

The Ronin wallet now supports Ethereum, Polygon, and Binance’s BNB Chain. The latest upgrade allows users to manage and transfer assets across different blockchain networks from a single wallet. The new version of the Ronin wallet includes an in-app web browser that enables users to access decentralized applications (dApps) and interact with blockchain-based services directly from the wallet.

The wallet’s design has been updated to show more information on token activities and NFT information. The Ronin wallet now supports MPC, which requires two or more pieces of login information instead of a single private key. The wallet can also be used across different games such as Axie Infinity and Pixels without creating separate wallets for each game.

The Ronin wallet upgrade is a significant step forward for the Ronin ecosystem, providing users with a more versatile and secure platform for managing their digital assets. The addition of multichain support and other features is likely to attract new users and further drive the adoption of the Ronin blockchain.

RON trades at $2.35 and has jumped into the top 100 coins at number 90.

SOL

Solana was one of the big losers in the top ten cryptos with a drop of over 7% for the week.

The project’s BONK meme token also suffered with a 6.70% loss over the last seven days. Solana is still ranked at number five in the list of crypto tokens with a valuation of over $48 billion.

CoinShares stated in its weekly crypto report that there were outflows of $21 million in cryptocurrency products last week. The majority of the outflows were said to be in Bitcoin and likely due to profit-taking.

BTC experienced an outflow of $24.7 million last week, while Ethereum also saw an outflow of $13.6 million. The Bitcoin Short fund saw an inflow of $12.7 million this week. In the altcoin space, Litecoin experienced an outflow of $ 1.5 million, while Solana experienced an outflow of $ 8.5 million.

“Cryptocurrency investment products saw small outflows last week, totaling $21 million, but this top-line figure masks very high trading volumes in Bitcoin last week, which totaled $11.8 billion, 7 times the usual weekly trading volume in 2023, the report said.

SOL trades at $89 and needs to hold that support level or a swift move to the $60-70 range could happen.