Cardano’s price has witnessed a notable rally over the past few days. As ADA’s realized profits steadily rise, many large holders, or “whales,” have been prompted to sell off their coins to lock in gains.

This puts Cardano at risk of shedding some of its gains over the next few days. this analysis details why.

Cardano Whales Take Profit

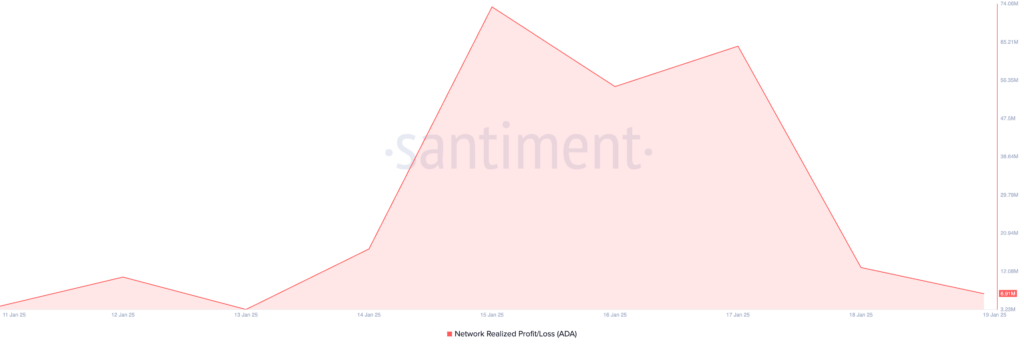

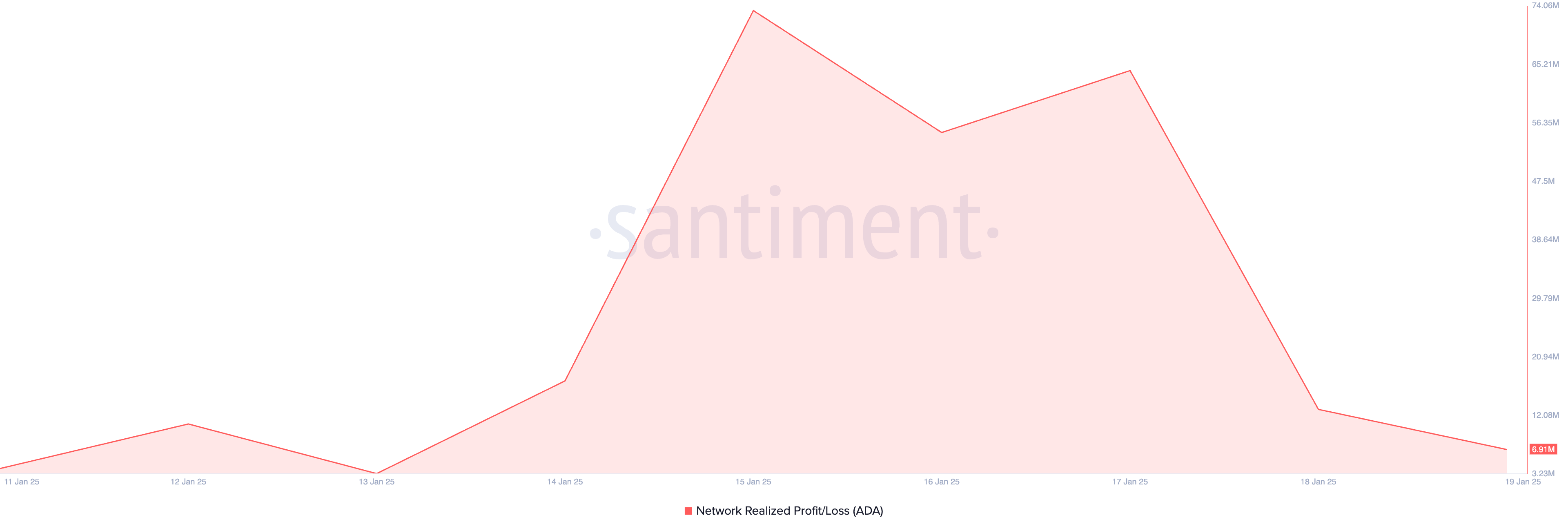

Cardano’s price rally in the past few days has led to a surge in realized profits among its holders. For context, realized profits rose to a weekly high of $73.33 million on January 15 as ADA’s price climbed toward $1.15.

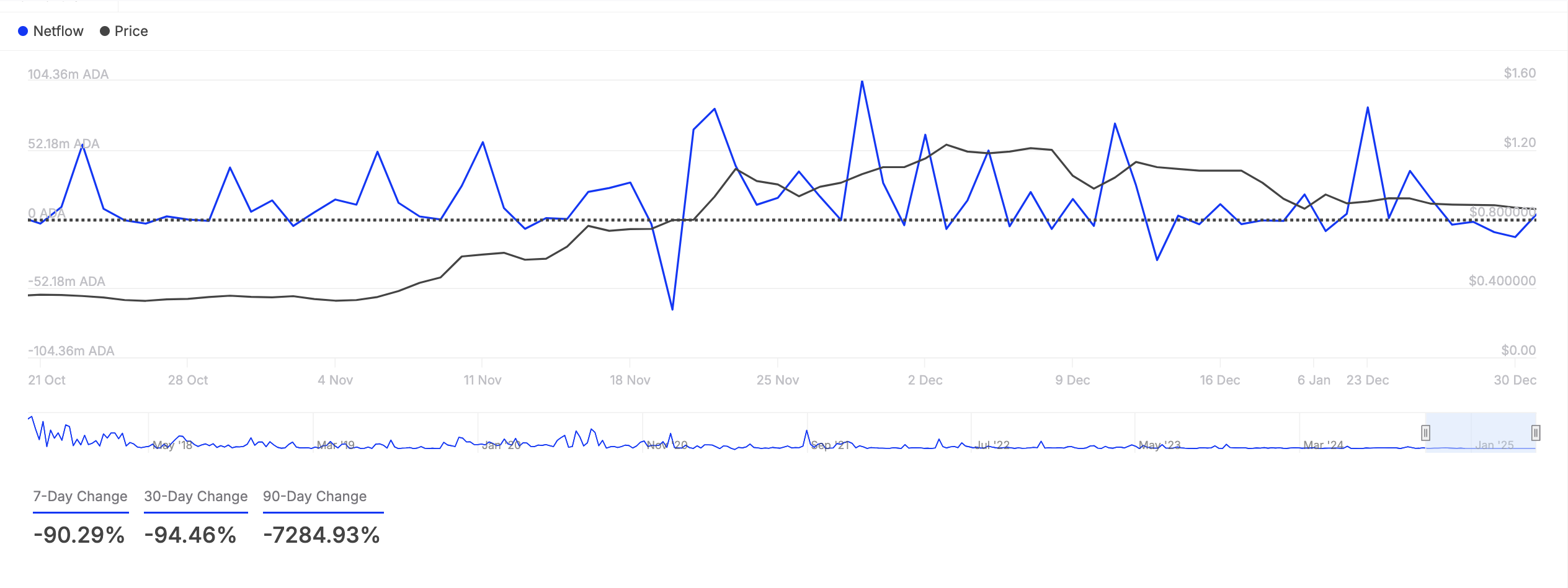

This spike in realized profits has triggered a wave of coin distribution among ADA whales, reflected by its declining large holders’ netflow. According to IntoTheBlock, this has plummeted by 90% during the week in review.

Large holders are whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the amount they sell and buy over a specific period.

A spike in an asset’s large holder netflow indicates that significant amounts of the asset are moving into whale wallets, suggesting accumulation. As with ADA, a drop in netflow, on the other hand, shows that large holders are selling off their holdings. This signals a potential decrease in the asset’s price or a shift in market sentiment.

ADA Price Prediction: Breakout Retest Fails, Reversal Likely

An assessment of the ADA/USD one-day chart reveals a failed attempt to retest ADA’s breakout line. The coin now trades within the symmetrical triangle pattern, which it recently broke out of.

When a breakout retest attempt fails, the asset’s price has not been able to sustain the breakout level, indicating weak support. This confirms the reversal in ADA’s uptrend. If the decline continues, ADA’s price will fall to $0.94.

On the other hand, if market sentiment improves, it could push ADA’s price above the upper line of the symmetrical triangle, which forms resistance at $1.03.

The post Cardano’s Rising Profits Push ADA Whales to Sell appeared first on BeInCrypto.