The popular meme coin Pepe (PEPE) reached an all-time high of $0.000025 on November 14 but has since dropped 20% due to increased profit-taking.

Currently trading at $0.000020, price chart indicators suggest a potential for further decline. This analysis identifies key price levels that token holders should monitor.

Pepe Bears Establish Dominance

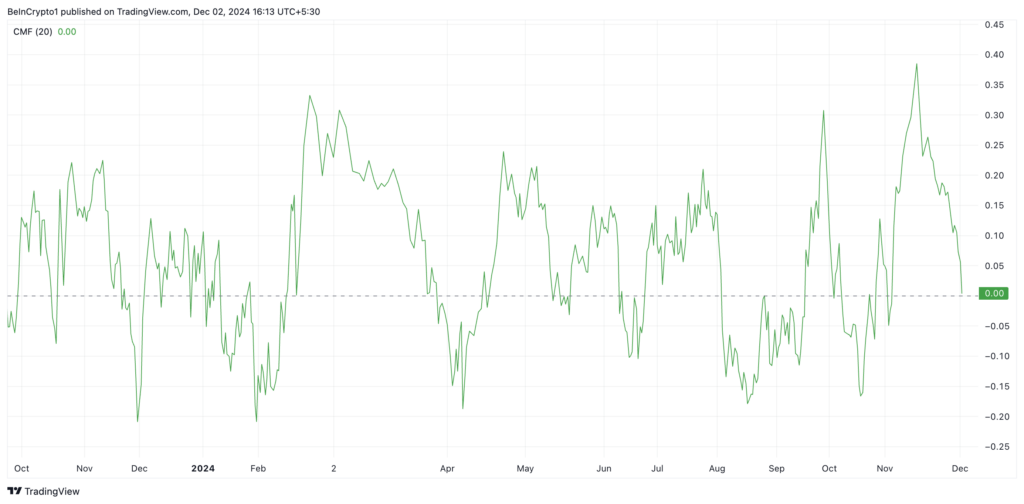

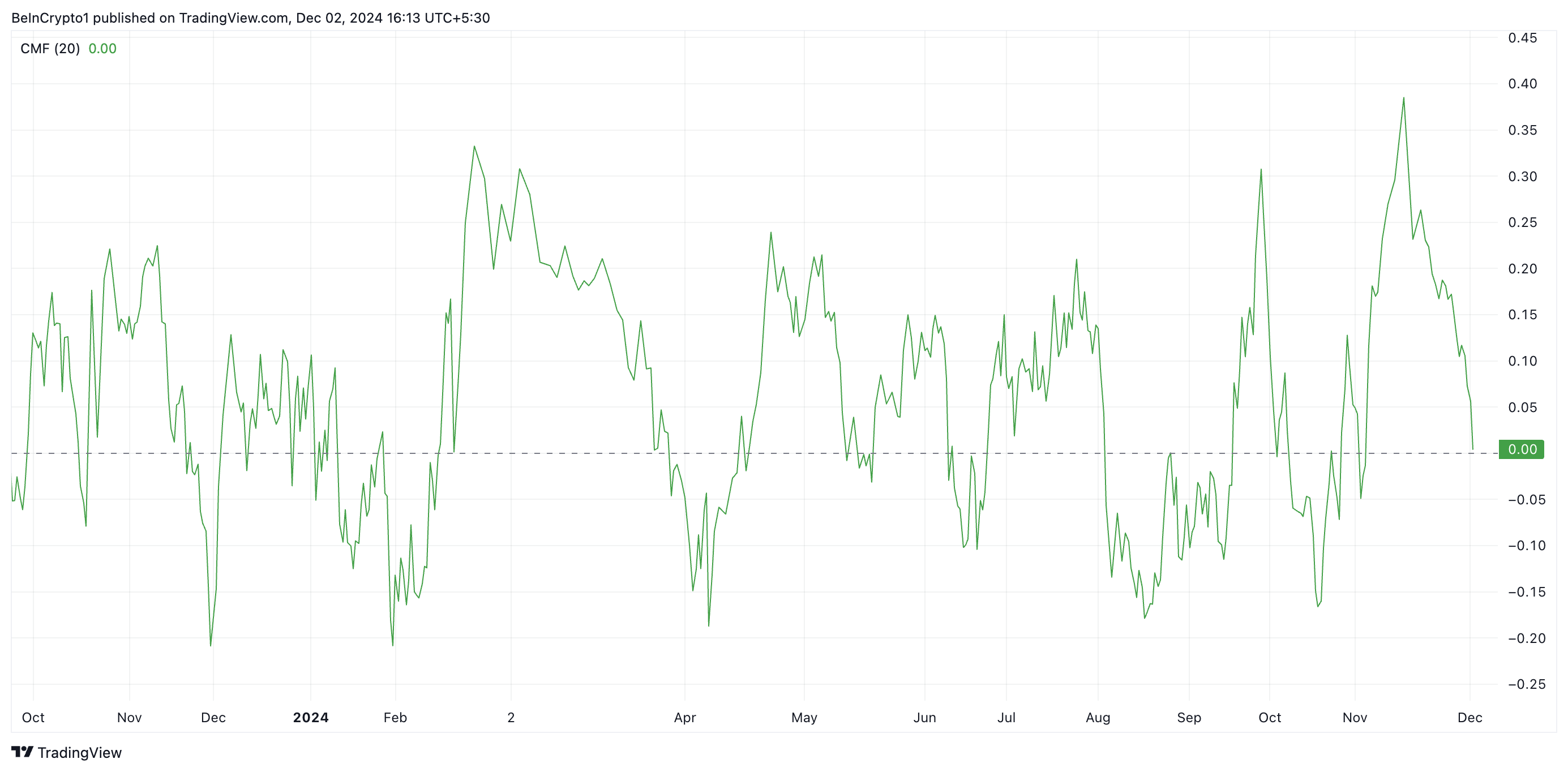

On the PEPE/USD one-day chart, the altcoin’s Chaikin Money Flow is poised to breach the zero line. As of this writing, this momentum indicator sits on the center line.

The CMF is an indicator that measures an asset’s accumulation and distribution by comparing the price movement with volume over a specified period. When it declines, it signals that there is more distribution (selling pressure) than accumulation (buying pressure), suggesting weakening bullish momentum.

The eventual decline in PEPE’s CMF below the zero line would confirm the trend reversal and signal the resurgence of bearish momentum, putting additional downward pressure on its price.

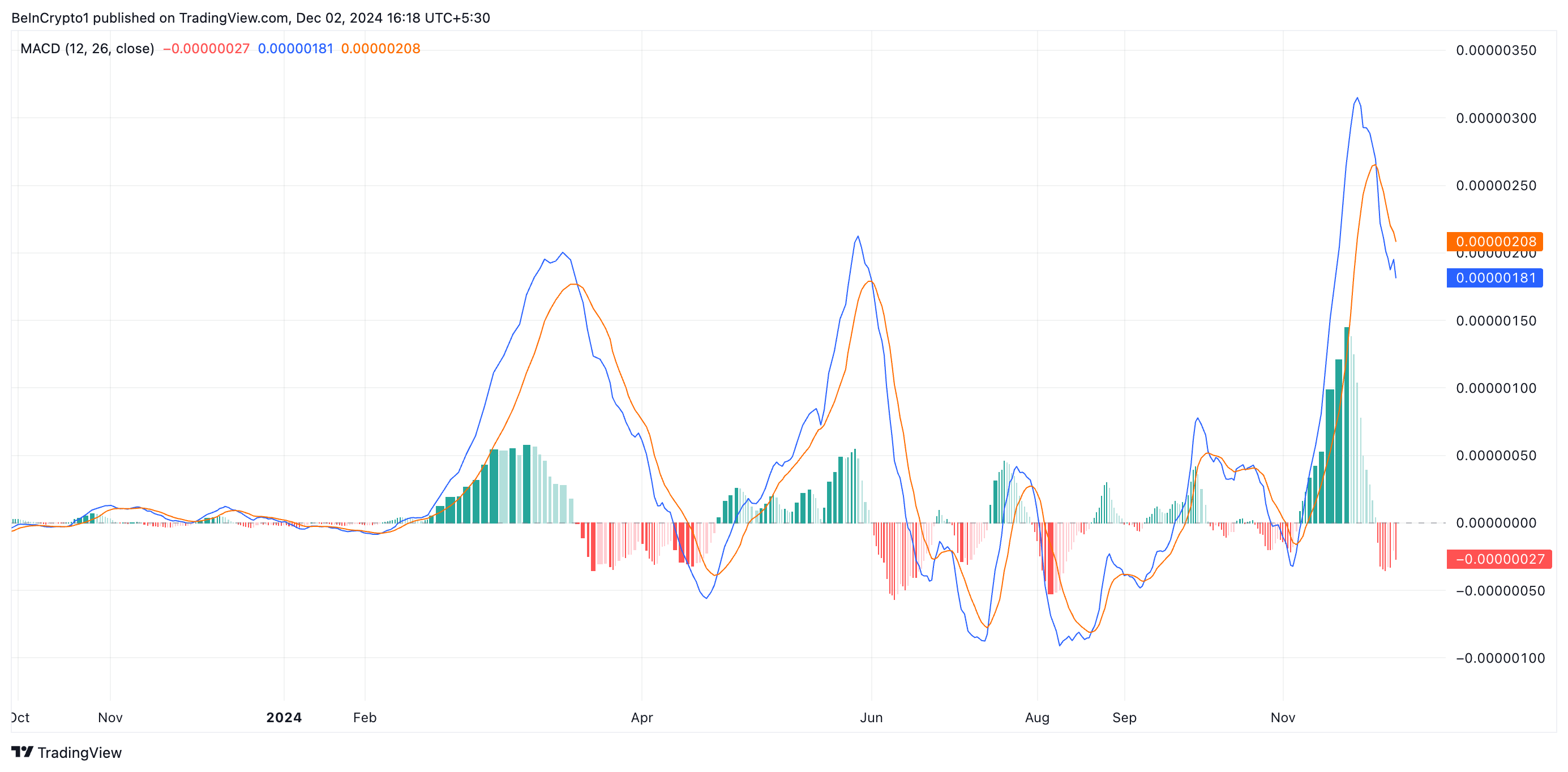

Additionally, the setup of PEPE’s Moving Average Convergence Divergence (MACD) confirms this bearish bias. As of this writing, the token’s MACD line (blue) rests below the signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies potential reversal points. As in PEPE’s case, when the MACD line is below the signal line, the asset’s price is experiencing downward momentum, signaling a selling opportunity for most traders.

PEPE Price Prediction: A Decline To $0.000015 Or Rally To All-Time High?

At press time, the PEPE token price is just above the critical support level of $0.0000018. Heightened selling pressure could push the meme coin below this threshold, potentially dropping its value to $0.000015.

Conversely, a surge in new demand could trigger a rebound toward $0.000021, and a decisive break above this level would set the PEPE token price on a trajectory to reclaim its all-time high of $0.000025.

The post PEPE Drops 20% From Record High, Signaling End of Rally appeared first on BeInCrypto.