Market observers anticipate some volatility ahead for Bitcoin (BTC) price. Among the reasons behind it is a spike in on-chain activity and the impact of an impending spot Bitcoin ETF (exchange-traded fund) approval by the US Securities and Exchange Commission (SEC).

BlackRock expects favorable news from the financial regulator regarding its spot Bitcoin ETF application by January 10. Interestingly, this date coincides with the SEC’s deadline to approve or reject the ARK 21 Shares spot Bitcoin ETF application.

Bitcoin ETF Decision Looms

Bloomberg senior ETF analyst Eric Balchunas explained SEC Chair Gary Gensler’s probable non-opposition to a Bitcoin ETF launch. He highlighted Gensler’s lack of substantive grounds for refusal and noted his proactive direction to the SEC staff to engage with the Bitcoin ETF applicants.

“[Gensler] is literally the one who directed the staff to put in thousands of man-hours to work with 11 issuers on 5-10 rounds of comments, and most recently telling them they want these lined up for 1/11 launch,” Balchunas added.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

This insight follows a series of discussions and meetings the SEC had with Bitcoin ETF applicants resulting in multiple amendments. Notably, BlackRock was among the many applicants who submitted a 19b-4 amendment on January 5 to the SEC.

Satoshi Nakamoto Wakes Up

Meanwhile, an intriguing occurrence unfolded when an unidentified individual transferred more than $1 million worth of BTC into Satoshi Nakamoto’s wallet.

The individual acquired the assets from Binance and transferred them into Nakamoto’s wallet, sparking curiosity and speculation within the crypto community. This transaction led to varied conjectures, ranging from the potential resurgence of Nakamoto to an unconventional marketing strategy related to the imminent Bitcoin ETF.

“Either Satoshi woke up, bought 27 bitcoin from Binance, and deposited into their wallet, or someone just burned a million dollars,” Conor Grogan, a director at Coinbase, said.

Moreover, heightened activities among Bitcoin whales, including this enigmatic transaction, suggest an imminent spike market volatility. Blockchain security firm Santiment noted that whale transactions have hit their highest level since June 2022.

According to the firm, increased whale activity fuels expectations of forthcoming market fluctuations and uncertainty.

“There may be some volatility ahead with whale transactions hitting their highest level since June 12, 2022. When whale activity spikes, prices often foreshadow a breaking cycle,” Santiment said.

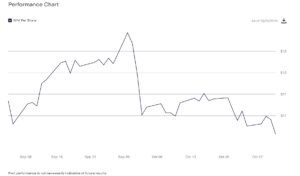

Bitcoin’s price has been mostly muted during this weekend. BTC briefly exceeded $44,000 in the last 24 hours before retracing to $43,986.

Best crypto platforms in Europe | January 2024

![]()

Coinbase

Explore →

![]()

KuCoin

Explore →

![]()

Metamask Portfolio

Explore →

![]()

Wirex App

Explore →

![]()

YouHodler

Explore →

![]()

Margex

Explore →

Explore more

The post Two Reasons Why Analysts Expect a Spike in Bitcoin Price Volatility This Week appeared first on BeInCrypto.