On several occasions, Toncoin’s (TON) price has shown readiness to retest the $7 mark. But since late July, almost every time it inches close to the region, it pulls back, leaving investors worried about the cause.

Fortunately, BeInCrypto has identified a daunting sell wall that is hindering the Telegram-native cryptocurrency from maintaining a prolonged rally. This on-chain analysis reveals all the details and what TON needs to breach this point successfully

Pressing Issues for Toncoin’s Future

Currently, Toncoin’s price is $5.20, representing a 10% decline in the last seven days. This value also means that the token is 37% down from its all-time high, with about 75% of its holders out of the money.

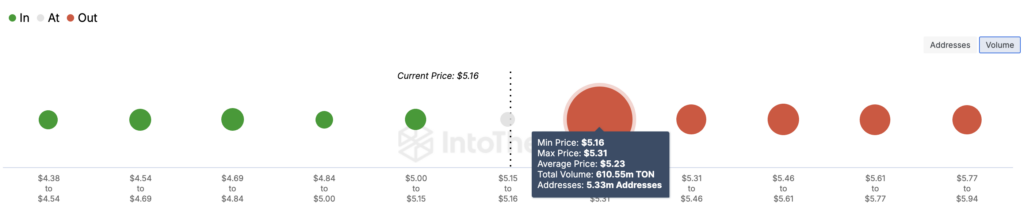

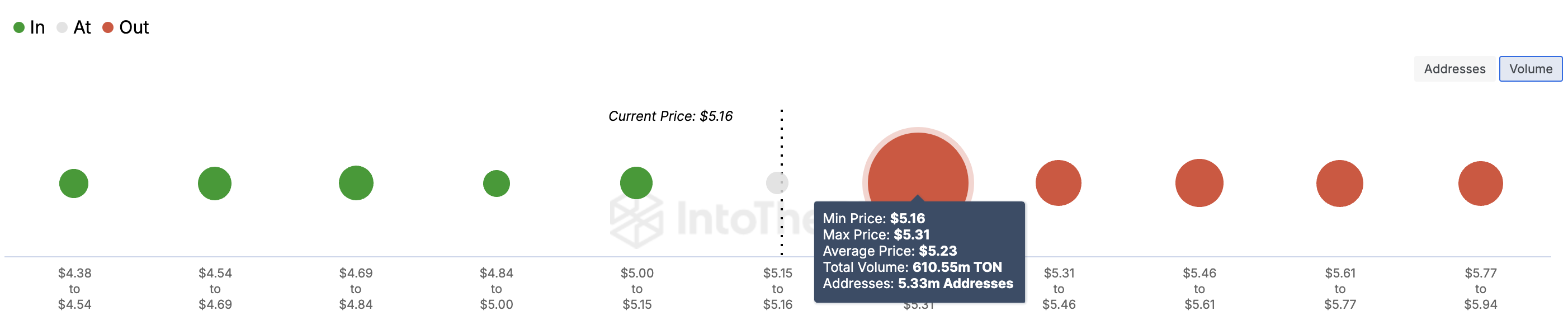

These TON holders are currently out of money because most accumulate it at a higher value than the current price. Interestingly, the In/Out of Money Around Price (IOMAP) reveals that Toncoin’s price might not move substantially higher unless some of these holders give way.

Specifically, the IOMAP provides an idea of support and resistance using the volume purchased at certain price ranges. The larger the volume or cluster, the larger the support or resistance. For Toncoin, about 5.33 million hold 610.55 million tokens and buy the token at an average price of $5.23.

Read more: 6 Best Toncoin (TON) Wallets in 2024

This volume is higher than that of those who purchased it, between $4.49 and $5.05. It is also a lot bigger than the volume bought by the 8,330 addresses currently at the break-even point. Considering this condition, TON is less likely to get support from these addresses.

Instead, the token might face huge challenges in surpassing $5.23 since that zone is a significant supply wall. Further, the Mean Dollar Invested Age (MDIA) is another factor hindering Toncoin’s price from breaking through to $7.

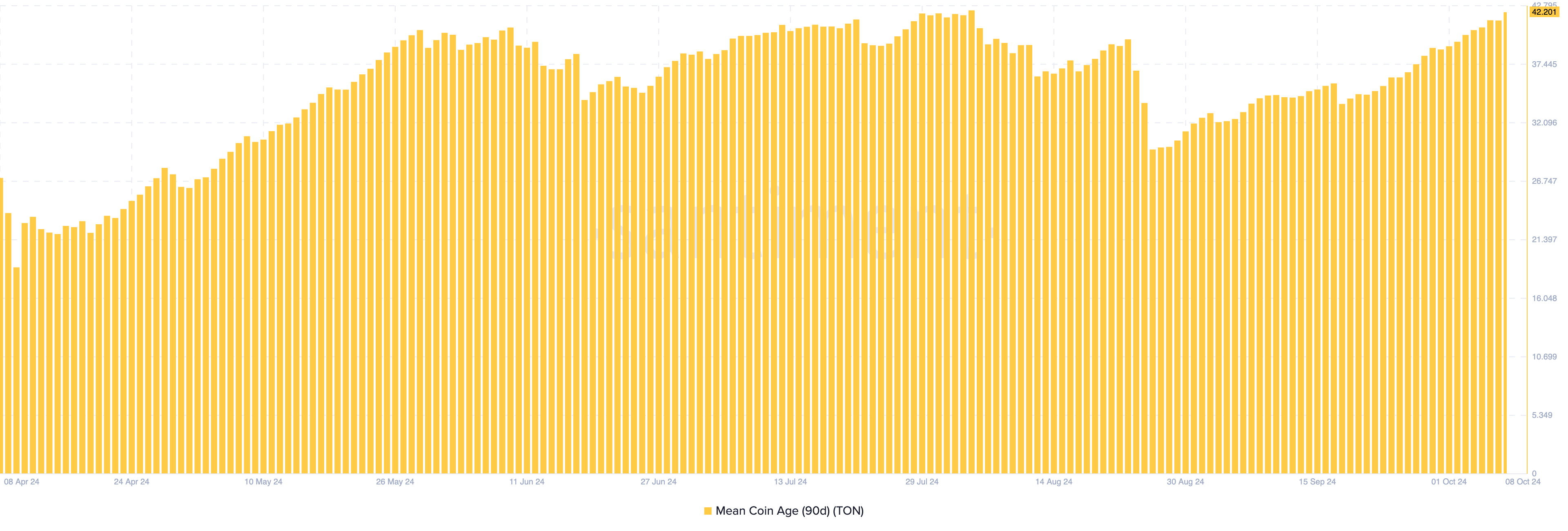

The MDIA is the average age of all tokens on a blockchain, weighted by the purchase price. When it rises, cryptos become increasingly dormant, making it challenging for prices to increase.

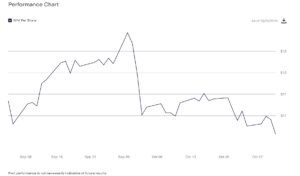

On the other hand, a falling MDIA indicates that tokens are beginning to wake up, thereby increasing the chances of near-future rally. As seen below, the MDIA for TON climbed, suggesting that the stagnancy of tokens could restrain the token from going higher.

TON Price Prediction: Bears Remain Dominant

As of this writing, Toncoin’s price is trading below two key moving averages: the 20-day Exponential Moving Average (EMA) and the 50-day EMA. Furthermore, the 50 EMA (yellow) has risen above the 20 EMA (blue), suggesting that sellers are dominant.

As it stands, bears might try to push TON’s price below the $5.12 support. If successful, the token’s value might sink to $4.89, making it challenging for Toncoin to hit $7 again.

Read more: 10 Best Altcoin Exchanges In 2024

On the flip side, if Toncoin climbs above the EMAs, bears might not be able to validate the expected decline. Instead, Toncoin’s price might breach the $5.67 resistance and increase toward $6.18.

The post Forget Toncoin (TON) $7 Target, This 610 Million Sell Wall Is the Real Barrier appeared first on BeInCrypto.