Ripple’s (XRP) price fell from $0.63 to $0.52 earlier this week due to another regulatory battle with the US SEC. However, traders in the derivatives market seem to believe that this is a temporary setback rather than a long-term barrier, as they held positions predicting a bounce for the altcoin.

Whether it’s true or false, this analysis examines the reasons behind this sentiment and what could be next for XRP.

Ripple Bulls Expect Light at the End of the Tunnel

On Wednesday, the US SEC filed an appeal challenging XRP’s non-security status, which had been declared by the court in July 2023. Shortly after the announcement, XRP’s price dropped, wiping out a significant portion of its recent gains.

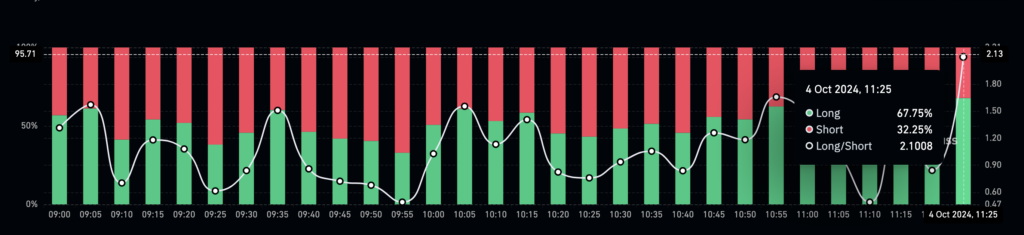

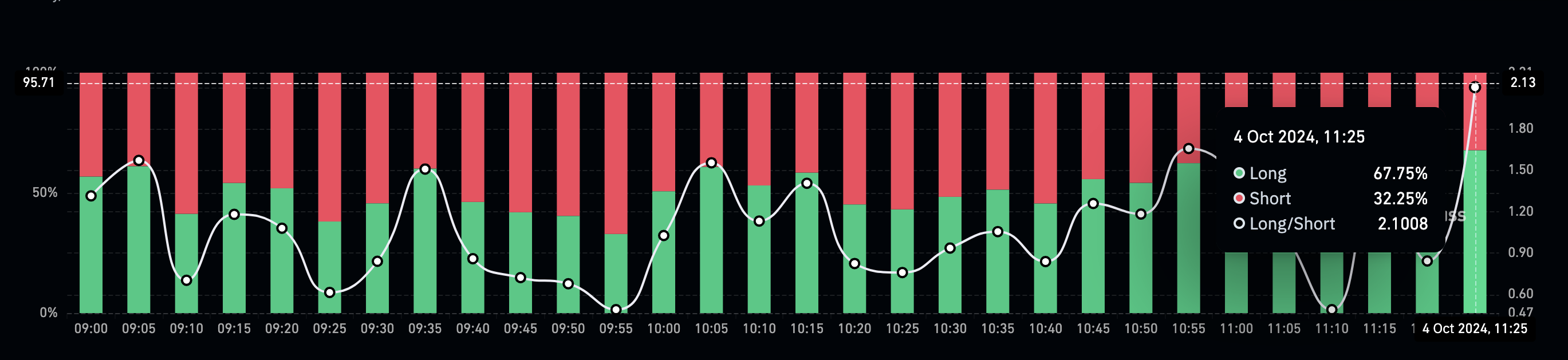

While traders initially panicked and opted to shorten the token, data from Coinglass shows that things have now changed. According to the derivatives information portal, XRP’s Long/Short Ratio had risen to 2.10.

This ratio shows whether more traders are holding long positions than shorts. When the reading is less than 1, it means more traders are opting to go short, suggesting a bearish sentiment. On the other hand, readings higher than 1 indicate a dominance of long positions.

Read more: XRP ETF Explained: What It Is and How It Works

In XRP’s case, 67.75% of traders are taking long positions, while 32.25% have opted for short positions. This suggests that a majority of traders anticipate a rise in XRP’s value once the discussions surrounding the SEC appeal subside.

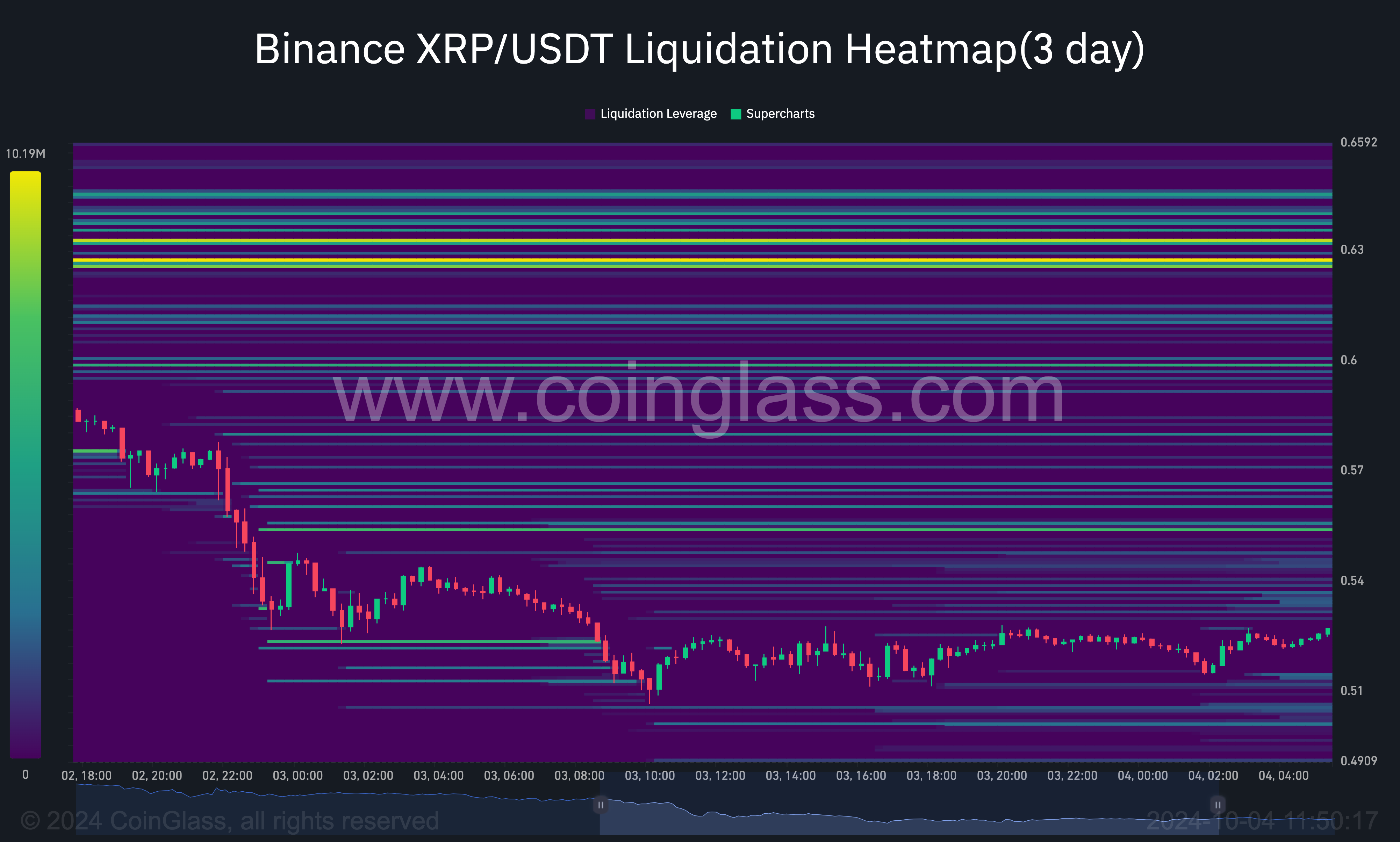

Furthermore, the liquidation heatmap, which identifies high areas of liquidity, seems to agree with bias. In short, the liquidation heatmap shows price levels where high-scale liquidations might occur.

It also helps traders to find the best liquidity positions. Specifically, if the color changes from purple to yellow, then there is a high concentration of liquidity at that point, and the price might move in that direction. For XRP, these regions are between $0.62 and $0.63. As such, the altcoin’s value might soon experience a bounce toward those levels.

XRP Price Prediction: Oversold and Ready to Bounce

A look at the Bollinger Bands (BB) on the daily chart shows heightened volatility around XRP as the bands expanded. But beyond highlighting the level of volatility, the BB also shows if a token is overbought or oversold.

When the upper band of the BB touches the price, it is overbought. On the other hand, if the lower band taps the price, it is oversold. As seen below, the lower band of the indicator has hit XRP’s price at $0.52.

This indicates that slight buying pressure could be significant in triggering a rebound. Additionally, the altcoin’s price is at the same position as the 38.2% Fibonacci retracement level. This ratio, also known as the support floor, could also be vital in helping XRP rebound.

Read more: How To Buy XRP and Everything You Need To Know

Thus, there is a high chance that XRP’s price will beat the $0.58 resistance. If that happens, the altcoin’s price might jump to $0.62. However, if the SEC appeal advances with Ripple on the back foot, this prediction could be invalidated. In that case, XRP’s price might decrease to $0.48.

The post XRP Traders See SEC Appeal as the Final Shakeout Before Recovery appeared first on BeInCrypto.