After a recent surge fueled by high demand and speculative trading, SUI price risks falling by double digits. This comes after a 124% 30-day price increase, which made the altcoin the best-performing crypto in the top 100.

While the broader market may hope for a higher high, data shows that a run toward $2 might not come easy. This on-chain analysis explains why investors should be cautious in the coming days.

Euphoria Is Not Good News for Sui

As of this writing, the altcoin’s price is $1.85, representing a 3% decline in the last 24 hours. Interestingly, the token’s performance aligns with BeInCrypto’s prediction, which suggested that SUI might not face intense headwinds after the token unlocks on Tuesday.

While Sui’s price drop has been minimal, its social dominance has been skyrocketing. According to Santiment, the project’s social dominance was 0.99 yesterday, October 2. But at press time, that ratio has increased to 1.53%.

Social dominance represents the ratio of discussions around a project compared to other assets in the top 100. Therefore, this hike indicates a high level of conversations related to SUI. However, the same condition suggests crowd euphoria and elements of Fear Of Missing Out (FOMO), especially as the token’s price has outperformed others.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

From a price perspective, the extreme reading and FOMO could signal a local top for SUI, possibly leading to a brief price decline. This is another indicator supporting the potential decline in Sui’s volume.

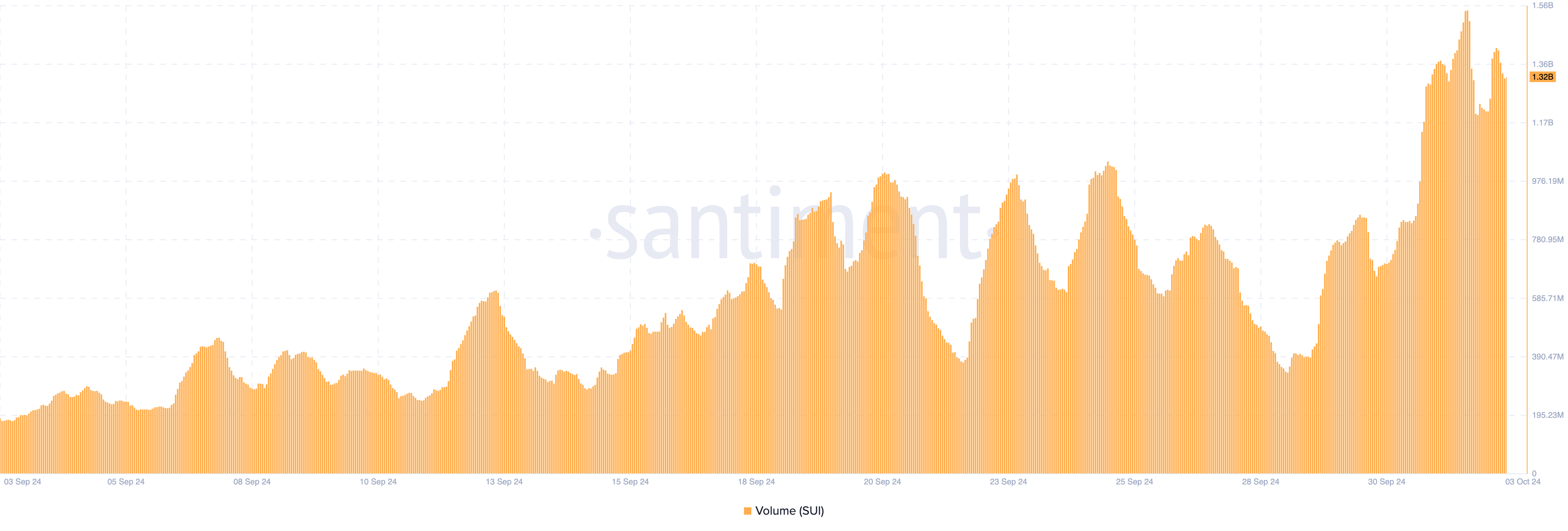

As an important metric, the volume shows the level of coins traded within a specific period. Whenever volume increases, it means there is a lot of buying and selling. However, a decrease indicates a drop in market activity and liquidity.

In Sui’s case, the volume has risen to $1.32 billion. But rising volume on declining price is rarely a bullish signal. Therefore, this increase indicates that SUI is experiencing higher selling pressure, which could accelerate the downturn.

SUI Price Prediction: $2 Target Delayed

From a technical point of view, the Relative Strength Index (RSI) shows that SUI is overbought, suggesting that the price could retrace. The RSI measures momentum and spots oversold and overbought points. When the reading is above 70.00, an asset is overbought.

On the other hand, a reading below 30.00 means it is oversold. With SUI’s price at $1.85, the RSI is 78.69, reinforcing the condition mentioned above. The Chaikin Money Flow (CMF) is another technical indicator predicting a price decrease.

Typically, the CMF measures the level of accumulation and distribution. When it increases, accumulation is higher than distribution. But a decrease implies otherwise. On the SUI/USD daily chart, the CMF has turned down, indicating that selling pressure has started to hit the token.

Read more: Which Are the Best Altcoins To Invest in October 2024?

Should this continue, SUI’s price could decline to $1.68 in the short term. Higher distribution might, however, send the token down to $1.42. On the flip side, the altcoin might resist downward pressure if the market condition improves. If that happens, SUI’s price might climb to the $2 mark.

The post SUI Price Faces Potential 10% Drop Due to Market FOMO appeared first on BeInCrypto.