This week’s roundup highlights regulatory tightening and innovations in the crypto sector across Asia and MENA. Dubai’s regulator implements new crypto marketing rules, which will be effective as of October 1, 2024. Meanwhile, in South Korea, Worldcoin was fined $830,000 for breaching data privacy laws, particularly by collecting sensitive biometric data.

With regulatory authorities stepping up oversight across the region, the crypto industry is experiencing a period of transformation that is reshaping its future.

Dubai Introduces Stricter Guidelines for Crypto Promotions and Marketing Activities

As of October 1, 2024, companies promoting virtual assets in Dubai must comply with new marketing regulations introduced by the Virtual Asset Regulatory Authority (VARA). Under these guidelines, crypto advertisements must include a prominent disclaimer highlighting the risks of crypto investments. The disclaimer must clearly state that virtual assets can lose value in full or in part and are subject to significant volatility.

In addition to the new disclaimer requirements, VARA has introduced penalties for non-compliance. Firms violating these marketing guidelines could face fines of up to AED 10 million (approximately $2.7 million).

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

The size of the fine will depend on the severity of the infraction. If the company repeatedly violates the regulations, it may also face increased fines.

Additionally, virtual asset service providers (VASPs) offering incentives related to virtual assets must now obtain compliance approval from VARA. This ensures that promotional materials do not obscure the risks investors may face when entering the highly volatile crypto market.

This regulatory update is part of Dubai’s ongoing efforts to balance crypto innovation with consumer protection. With the region positioning itself as a global hub for blockchain and digital assets, the new rules aim to safeguard retail and institutional investors from misleading promotional content.

Worldcoin and TFH Hit with $800,000 Fine for Data Breaches in South Korea

South Korea’s Personal Information Protection Commission (PIPC) has fined Worldcoin and its development company, Tools for Humanity (TFH), 1.14 billion Korean won ($830,000). This penalty was for violating the country’s data protection laws.

The fine stems from Worldcoin’s unauthorized collection of sensitive biometric information, including iris scans, from Korean users without proper consent. Moreover, the data was transferred abroad to Germany without notifying users. This action further breaches South Korean data privacy laws.

The PIPC ordered Worldcoin to implement corrective measures, including obtaining explicit user consent for sensitive data collection. The agency also demanded improvements in data storage and use transparency. Furthermore, the firm must introduce an effective data deletion mechanism for users who wish to opt out of the Worldcoin service.

Hong Kong’s Project e-HKD+ Explores Tokenized Assets and Digital Money

Hong Kong’s Monetary Authority (HKMA) recently launched the second phase of its digital currency project, now rebranded as Project e-HKD+. This phase aims to explore more advanced use cases for digital money, including tokenized deposits, as well as broader applications in both retail and corporate settings.

Project e-HKD+ brings together 11 firms that will conduct real-world trials on the settlement of tokenized assets, programmable payments, and offline transactions. These pilot programs are crucial for evaluating the feasibility and benefits of implementing digital currencies within the broader economy.

The outcome of Phase 2 will help shape the future design and regulatory framework for digital currencies in Hong Kong. Authorities will share key learnings with the public by the end of 2025.

Eddie Yue, Chief Executive of the HKMA, emphasized that the initiative is essential for positioning Hong Kong at the forefront of financial technology.

“The e-HKD Pilot Programme has provided a valuable opportunity for the HKMA to explore with the industry how new forms of digital money can add unique value to the general public. The HKMA will continue to adopt a use-case-driven approach in its exploration of digital money. We look forward to working closely with industry participants in Phase 2 to co-create various innovative use cases,” Yue stated.

The authority also plans to establish the e-HKD Industry Forum. This forum will be a collaborative platform where industry leaders can discuss the broader adoption of digital currencies.

Indonesia’s Largest Bank Launches Blockchain-Based Pilot Project

Indonesia’s largest state-owned bank, Bank Rakyat Indonesia (BRI), is launching a blockchain-based pilot project to improve transparency and security in financial transactions. Announced during the Indonesia Blockchain Conference (IBC), the project is designed to streamline supply chains and secure business transactions for BRI’s extensive customer base of 82 million.

Nitia Rahmi, Head of BRI’s Digital Banking Development Department, highlighted that this initiative is part of the bank’s broader commitment to embracing Web3 technologies. Rahmi explained that the project would improve BRI’s digital infrastructure and position the bank as a leader in blockchain adoption within the Indonesian financial sector.

As blockchain technology gains momentum in Southeast Asia, BRI’s move aligns with a growing regional trend of integrating decentralized technologies into traditional banking systems. The bank’s adoption of blockchain is expected to set a precedent for other institutions looking to innovate and improve financial processes.

WazirX Secures Court Moratorium to Restructure After $230 Million Hack

On September 26, Singapore’s High Court granted a four-month moratorium to Zettai Pte Ltd, the parent company of the Indian crypto exchange WazirX. This decision follows the platform’s $230 million exploit in July.

This moratorium allows WazirX to restructure its liabilities and address users’ outstanding cryptocurrency balances. Initially, the exchange requested a six-month moratorium. However, the court decided on a four-month moratorium, factoring in the automatic 30-day moratorium that started with the initial filing.

Nischal Shetty, Director of Zettai and Founder of WazirX, expressed gratitude for the court’s decision. He described it as a critical step toward recovery and resolution. Shetty also emphasized that this breathing space is necessary for developing a fair, creditor-approved restructuring plan that maximizes recovery potential for affected users.

As part of the court’s conditions, WazirX has committed to full transparency. The exchange will make its wallet addresses public, release financial data, and address user concerns raised during the legal proceedings. Additionally, future voting on restructuring plans will be supervised by independent parties to ensure impartiality.

Read more: Crypto Project Security: A Guide to Early Threat Detection

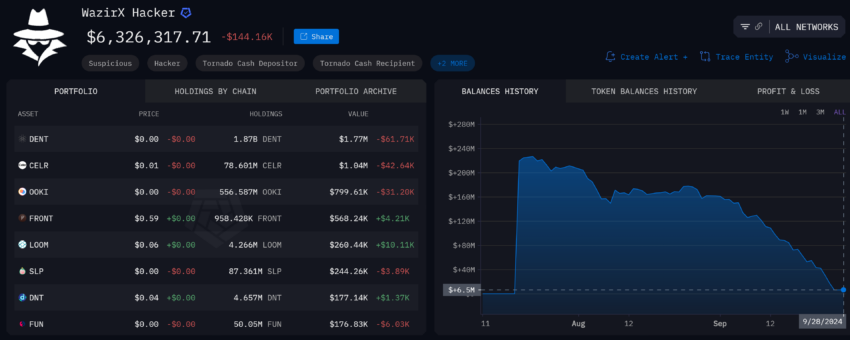

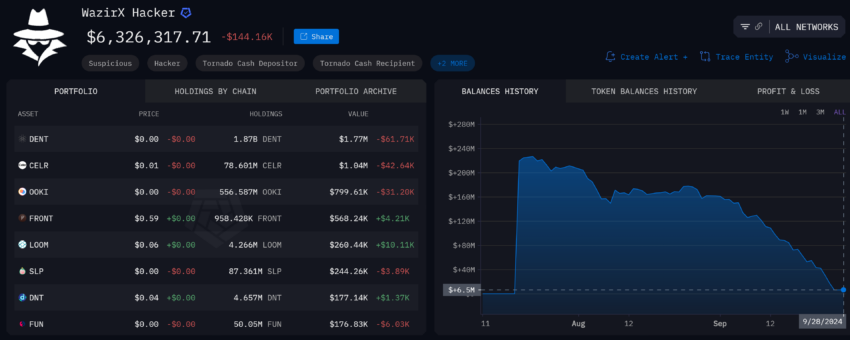

In parallel with these legal proceedings, blockchain data from Arkham Intelligence revealed that the hacker responsible for the exploit has almost entirely laundered the stolen assets. Of the $230 million, only $6 million of cryptocurrencies remains unlaundered. The hacker funneled the majority of the funds through the crypto mixer Tornado Cash.

The post Asia & MENA Crypto Roundup: Dubai’s New Ads Rule, Worldcoin Fined $800,000 in Korea, and More appeared first on BeInCrypto.

:max_bytes(150000):strip_icc()/Bitcoin-7c580bcd389d4aef8f5a7bdb42cd26bb.jpg)