Base has breached the $2 billion threshold in total value locked (TVL) for the first time since its launch, as the Coinbase low-cost Layer-2 (L2) continues to record a significant rise in activity.

The L2 scaling solution, built on the Ethereum blockchain, could make Coinbase a decentralized finance (DeFi) powerhouse.

Base Breaks $2 Billion TVL Mark

With upwards of $156 million in deposits over the last 24 hours, Base TVL has gone past the $2 billion threshold to reach $2.131 billion as of this writing. A rise in TVL indicates more assets are being locked into smart contracts within the ecosystem, which is a measure of the platform’s success and stability.

It points to growth in Base’s user base and overall adoption of the L2 scaling solution within the DeFi space amid increased investor interest and confidence. Indeed, this interest is reflected in the TVL growth, a climb of almost 400% year-to-date. Since the mainnet launch in July, the TVL is up by $849 million.

Read More: What is Base Chain? Everything You Need to Know

Noteworthy, Base ascended the ranks rather quickly, dethroning OP Mainnet, according to data on L2Beat, to become the largest network on Superchain. It is also worth mentioning that Base is closing in on Arbitrum Layer-2, which has a TVL of $2.59 billion as of this writing.

The surge in Base’s Total Value Locked (TVL) is primarily driven by the ecosystem’s expansion. In addition to rising revenue and an increasing number of active addresses, Base continues to see a spike in transactions. On September 18, for instance, it set a new record with over 4.5 million transactions, largely due to the growing popularity of the Basenames domain name service.

Moreover, the protocols within Base’s ecosystem play a critical role in its growth, particularly the Aerodrome decentralized exchange (DEX), which has been a key factor in its upward trajectory.

Aerodrome Helps Drive Base TVL Growth

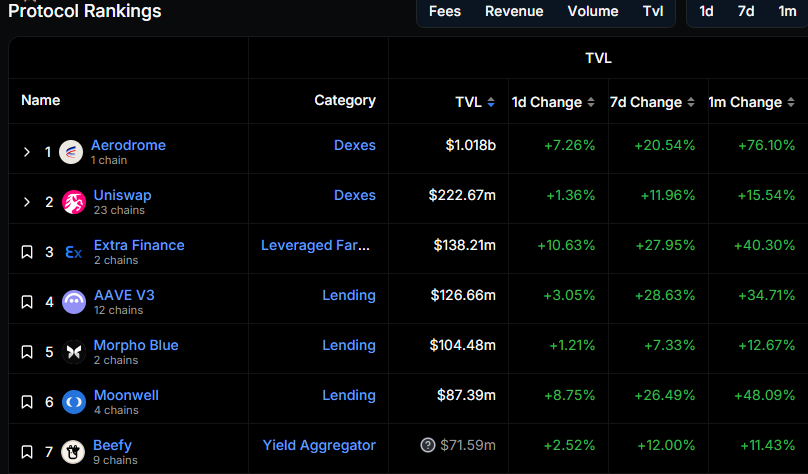

Aerodrome is the leading protocol on Base L2, boasting a $1.018 billion TVL, which is up by 76% in the last month. Other protocols on Base include Uniswap and Aave V3, which could soon integrate Coinbase’s Bitcoin Wrapper, cbBTC.

Aerodrome accounts for nearly half of Base’s TVL, achieved as the DEX progressively launches liquidity pools for meme coins such as PEPE and WIF. These have attracted investors and could continue to do so as meme coins ride the new wave of market optimism towards Q4 2024.

Beyond that, Aerodrome’s Flight School program is also an enabler for growth because of its rewards. Specifically, for every veAERO a user deposits, they get up to 0.67 veAERO, which creates a great incentive to pump in more capital into the protocol.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

Looking ahead, products such as cbBTC could continue to drive momentum for Base. Others include Coinbase’s collaboration with Morpho to launch a lending model with real-world assets (RWA).

Specifically, Morpho will leverage Coinbase’s authentication mechanism to establish two asset lending Vaults atop the Base L2 platform.

The post Base TVL Crosses $2 Billion, Challenging Arbitrum’s Market Position appeared first on BeInCrypto.

:max_bytes(150000):strip_icc()/Bitcoin-7c580bcd389d4aef8f5a7bdb42cd26bb.jpg)